The Christmas and New Year period is traditionally a time to sit back and reflect on the year. Generally a quiet news period, the newspapers will run finance articles on the best and worse performing stocks for the year and have bold and radical predictions for the next year.

Unfortunately there is unlikely to be much cheer this Christmas holidays. This year’s rapid wealth destruction has seen in excess of 40% of the value of Australian shares evaporate and the worst return on super funds since the introduction of compulsory super in 1992.

For other investors, they may start to become more bitter with realisation they have just fallen victim to the scam of the century. There is nothing worse than falling victim to a scam, no matter what size. It’s the thought, how can I be so naive. Why didn’t I see this coming?

This scam didn’t stem from Nigeria, but its reach was global. It caught out people in most OECD countries and had spread to China and other developing economies. The list of people involved included not only Mums & Dads, naive Investors, and the orchestrators, but in many countries even embroiled Governments and Central Banks.

The fallout from this scam is on a scale so large, it has the real potential to plunge the global economy into depression. Even Bernard Madoff’s recently discovered $50 billion Ponzi scheme pales in comparison.

The dictionary has the definition of a scam as :

1. a confidence game or other fraudulent scheme, esp. for making a quick profit; swindle.

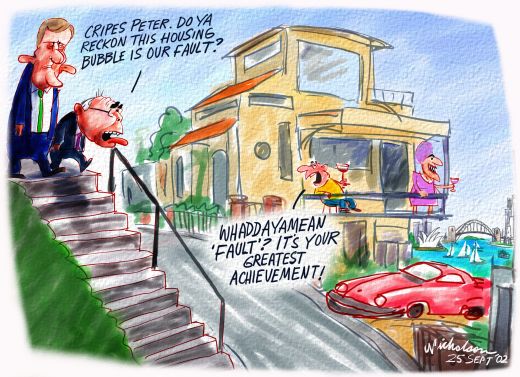

And what a confidence game it was. The orchestrators of this scam had all a range of confidence building quotes – “House prices double every 7 to 10 years”, “Better buy now or miss out for ever”, “Buy now, worth more tomorrow” and in times of falling share markets, “Safe as houses”.

As the US economy took a dive and along with it house prices, sayings such as “It’s different here”, “There is a shortage of houses” and “High Immigration is putting a floor under prices” sprung up. Now that our house prices are following suit, “It’s never a better time to buy” and “housing is a long term investment”.

That’s right, this scam was the great property bubble aka property swindle.

The aim for investors in this fraudulent scheme was simple – making a quick profit. As house prices only went up in value, all you needed was an interest only mortgage to cash in on the capital gains. Rental yields? What yields?

The property lobby groups had the interests of their members at heart. The higher the price of property, the bigger commissions real estate agents make on their sale. As buyer confidence increases, so does the turn over.

The mortgage brokers only cared about writing loans. They didn’t keep them, so it didn’t really matter if the mortgagor could afford it or not. That would be someone else’s problem – to package the loans into special purpose vehicles or collateralized debt obligations (CDOs) and flog them off to unsuspecting parties. When too many of these CDOs cause concern for credit worthiness or the possibility of default, just take out a credit default swap (CDS) contract.

3rd August 2004 | Greed even engulfed governments far and abroad as they stepped up for a piece of the action. It was in their best interest to keep the bubble from bursting, for a housing bubble crash would instantly vaporise the huge capital gains flooding in. Through a phenomenon called the wealth effect, if consumers feel wealthy such is the case when the value of their house rises, they spend more despite the fact that it is an unrealised capital gain. This coined the term, “using your house as an ATM”. As consumers continued to spend more than they earned, 10% of this made its way into government coffers by the means of the GST. Also at a state level, any reduction in housing turnover (sales) coupled with falling prices would seriously erode easy income from rising stamp duty. You only have to look at the NSW mini budget this year to see the effects governments so feared. In five months, the NSW government went from forecasting a $268 million surplus to forecasting a $917 million deficit. A $1 billion collapse in stamp duty revenues from a slowing NSW housing market, and a $450 million write-down of anticipated GST revenue thanks to consumers cutting back on spending contributed to the drastic downturn. |

The media was also in on it. In today’s ever more commercial world the objective now is to write articles that attract readers, thus sells papers, web ‘hits’ or advertising clicks. The days of accurate reporting had gone and for heavens sake don’t think about doing any investigation or research – that costs money! As soon as the faxed press release came in from the industry lobby groups, the headline was tweaked and it hit the presses.

|

No one wanted to read about spiraling household debt, unsustainable spending habits, and negative savings ratios. After all, (former) Prime Minister Howard said working families were never better off during our 16 years of economic overdrive and according to John Howard, “since the gold rushes of the 19th century”. Household debt was hidden and the then government talked up the strides it was making paying down government debt.

TV media was in on it too. Current Affairs programs ran endless stories of “investors” buying 10 or so houses on 100% LVR or interest only loans. As houses only ever went up in value, it was a sure bet – anyone could do it. House flippers never missed the Nine Network’s weekly reality TV show, The Block.

But that was the good old days before the house of cards started tumbling from the sheer size of the bubble. As they say, what goes up must come down.

House prices double every 7 to 10 years

The graph above, showing “Real” house prices – that is house prices corrected for inflation really drives home the size and severity of the scam. While the scam had been plotting for years, it really fell into gear towards the end of the 1990s.

The US real house price data (in blue) is more of a textbook example. You will observe that real house prices really don’t deviate far from the index over one hundred years. That is, houses only go up in value in line with inflation.

This is what one would expect. If house asset prices did go up faster than the owner’s capacity to finance them, then they would become unaffordable and demand for housing would falter as fewer owners can afford their own home.

While this shouldn’t be of any surprise to anyone, for many whom where naive to believe that house prices actually do double every 7 to 10 years, this is a very hard concept to stomach.

It was Albert Einstein who said never to underestimate the power of compound interest. If houses did in fact appreciate faster than household income, then the gap between income/wages and the house price would deviate larger and larger as time passes.

ABS data shows the average wage growth over the past 25 years has averaged about 4.55% pa. If prices double every 10 years, then house prices will increase in value by 7.2% pa. On the other hand, if houses double every 7 years, then house prices will increase by 10.4% pa.

In June this year, the mediam Sydney house price was $562,496. The yearly ordinary full time adult earnings was $59,456 which means the mediam house is 9.5 times average wages – Historically this is very high, it should be around 3 times.

Now let’s jump forward 100 years to 2108. At 4.55% per year, the average Adult earnings in 2108 should be around $5 million. If houses double every 10 years, then the medium Sydney house price will be $588 million or 115 times wages. (Sure hope life expectancy increases.) However, if houses double at a faster rate of every 7 years then the average medium house will be $11.1 billion dollars or 2190 times wages! – try paying that off with interest in your lifetime.

What happens if we go back 100 years? In 1908 and assuming wages grew by 4.55% from 1908 to present, the average wage would have been $694.70 in decimal equivalent. If houses double every 10 years, then the medium house price would have been $537. My great grandparents could have brought a house every 9 months. If houses doubled every 7 years, then the average house price would have been $28. My great grand parents could have brought 24 houses a year!

There are minor arguments about the simplicity of above examples – it assumes the household income is derived from one wage earner. Socially, the world has changed a lot since my parents purchased their first home. It is now common to have two wage earners contributing to the mortgage.

This social change is more commonly known as the two income trap. Where does the trap come into it? When the first dual income households came along, the idea was to de-risk the household by diversifying the income steams. If one member of the household lost his or her job, the other member would still be able to fund the mortgage repayments.

However this didn’t quite work out as planned. As more and more two income households came into the picture, all this did was push house prices up. Today, prices are so high that in the majority of cases two incomes are a mandatory requirement to service the mortgage. If one member of the household loses his or her job, then it’s more than likely than not, they will default on the mortgage.

This means the household is now riskier. The probability of either one person out of the two losing their job is higher, than one person losing their job. The increase in unemployment has never been tested on this model. It also means there must be more jobs to go around.

Another valid argument about the number of wage years to buy a house is that it is not really wages that determine the ability to service the mortgage but the household income. Extra household income could be derived from investments such as stocks and shares.

It has been quite rightly reported that household income has increased in recent years thanks due to stellar returns on the stock market and other investments. However, it appears the days of unsustainable double digit rises have passed. The 40 year commodities super cycle ran out of puff only a year or two into the cycle. Recent ABS data suggests the average Australian household is now 25% less wealthy than a year ago.

Better buy now or miss out for ever

One of the other key concepts to come from the real house price data is that a boom is always followed by a bust. Every boom always corrects.

Dutch economist, Piet Eichholtz created a Herengracht Real Location Value Index for houses on Amsterdam’s Herengracht Canal dating back 350 years. It also has the same outcomes. Prices do not rise much faster than inflation (if at all) and while the Herengracht Canal has seen some bubbles in the past 350 years, they have all corrected back to norm.

Safe as houses

The idea that house prices only go up is quickly coming to an end. In the US house prices started correcting two years ago and the falls are still accelerating.

In California the median price has dropped 41.8% in the 12 months to November. The term “Safe as houses” was used by many property investors who would never touch shares as you can suddenly lose the lot. Yet a diversified share portfolio is probably tracking better than Californian bricks and mortar.

Buy now, worth more tomorrow

Falling house prices have now spread to most OECD countries and even to so called economic super power houses like China. If you buy now, it’s more than likely it is worth less tomorrow.

It is different here™.

In October, the Deputy Governor of the Reserve Bank of Australia, Ric Battellino tried to calm Australians with an update on household finances during the 7th ITSA Bankruptcy Congress. He told the conference that the Australian housing market is actually leading the US by three years and that our correction occurred in 2003. This he mentioned, along with the shortage of houses in Australia means the “Australian housing market will not follow the US market to the same degree”.

Yet, days after this speech official RBA housing data showed Australia was experiencing the biggest housing falls in 30 years.

From the graph above, it is hard to see where we lead the US. Rather it suggests the US housing bubble popped in 2006 and our bubble popped in early 2008, some two years after the US.

Shortage of Houses and High Immigration will keep a floor under prices

Australia’s shortage of houses and high immigration also make up the It’s different here argument. It would be a good justification for keeping a “floor” under house prices, if only it was true. Now that the U.S. and U.K. housing is in a mess, we must distance ourselves from the reality that our housing asset bubble was bigger and with a bigger bubble comes more household debt.

But just as Americans and Brits were told there was a shortage of houses and subsequently found out it was complete and utter nonsense, so is true for Australia.

A quick look at the ABS data from the 2006 census suggests there is no shortage of houses. But a more thoroughly researched report has to go to EarthSharing Australia who earlier this month released a report titled “I want to live here – Vacancies in Melbourne Report”.

It reported between January and June 2008 there were 2,317 vacant properties indentified in the inner suburbs of Melbourne, representing a genuine vacancy rate of 7%. “Between the 2001 and 2006 census, Melbourne’s unoccupied dwellings increased by 18.14%. Dwelling construction outpaced population growth by 1.81%. This identification of the surplus was available to the Australian public in 2007.”

What is unique about this report is the sources of data. Not only did they use official ABS data, but also backed it up with secondary data such as household water consumption data from City West Water. Water consumption of zero or under a certain threshold indicated the premises were vacant. They also did a walk around of the local area to identify vacant premises.

Prior to this unprecedented speculative bubble, housing was an investment for yield. This required tenants to live in the properties (or at least pay rent) to get a return. When this changed to a capital gains fueled frenzy earlier this decade, investors didn’t care about yield. As long as the property appreciated in value in double digit figures, life was great. Who needed tenants – they only wreck the place. Retail yields were so low, it didn’t really matter.

The same was said for many developers. They built new apartments and townhouses, but when they couldn’t attract buyers at the prices they commanded, they didn’t worry. All they needed to do was keep the property on the books, as property only goes up. Someone will eventually come along, fall in love with it and snap it up at the crazy prices they wanted.

Now the speculative bubble has popped, everyone is heading for the exit. In my area alone, there are apartments built in 2003 which no one has ever lived in. The developers could never obtain the prices they wanted. Now it’s panic to offload the lot, flooding the market with “the shortage” of houses.

It’s never a better time to buy – housing is a long term investment.

As the Reserve Bank of Australia fights to keep households spending more than they earn from home ATMs that have ran dry of money, they are lowering interest rates at alarming paces. Many real estate agents are now spruiking that it is never a better time to buy. Cheaper Interest Rates, Lower Petrol Prices, Increased First Home Owners Grants – The Global Economic Crisis is Averted!

The trouble is when have you heard a real estate agent say that it isn’t a good time to buy?

It’s almost inevitable our housing will follow the likes of US and UK housing down. There are just no real “fundamentals” to explain why a unprecedented bubble of this proportion is sustainable.

On the 14th of October the Rudd Government announced increases to the First Home Owners Grant [Australian Government announces increased grants to encourage people to take on more excessive debt]. The existing $7 thousand dollar grant was increased to $14 thousand for the purchase of existing dwellings and to $21 thousand for the purchase of new homes.

While this sounds like a great incentive to go out a buy a home, figures from Perth showed the medium house price had fallen 10% since December last year. At those rates, your extra $7k grant will disappear in 1 and a half months.

But as they say, housing IS a long term investment. Paying too much for a house now on a 25 or 30 year mortgage means you will be paying for it for the best part of your life. Just think of fellow home owners in the US.

This bubble is so big, even with inflation it could take decades for housing to reach the giddy heights peaked in 2007/08. Figures from New Zealand show falling house prices now mean 1 in 5 mortgage holders actually have negative equity – i.e. they owe the bank more than what the house is worth. The bank is not going to turn around and say, your house is now worth less than what you paid for it, so you only have to pay back what it is worth. No, once you buy an over inflated asset, you are locked into paying down that price for the rest of the loan.

The housing lobby groups are also suggesting renters will start entering the property now that rates are the lowest they have been in years. Renters will be able to save money with mortgage repayments being cheaper than rent. However renters must not underestimate loses from falling property prices. If you are paying $400 a week in rent or $20,800 a year, this could look extremely cheap considering your newly purchased property could easily fall more. For example the medium house price in Perth has fallen $46,000 from December 2007 ($472,000) to October 2008 ($426,000).

Dare I say the last laugh will be at the housing lobby groups. For years they have been telling renters to brace for huge rent increases, yet renters will probably have the last laugh when rapidly falling property prices take hold.

2009 is going to be an interesting year for both the economy and the housing bubble. For Australians it will be the year of de-leveraging. To think the mother of all booms is just around the corner is just as naive. The current boom had nothing to do with fundamentals and everything to do with speculation.

This year, we have now climbed to the top of the roller coaster and are past the point of no return. 2009 will see us heading down the first incline ready for the first bend. This crisis has only just started. How well we sail through 2009 and into 2010 will depend on one thing – jobs.

What would your advice be for first home buyers? Keep renting?

great read, well done.

One aspect not considered in this article is the continuous expansion of cities in Australia. Compared to the US and UK we are 1) a very young country with a small population and 2) have very small cities with large amounts of land available to be utilised.

These conditions help raise land prices for a variety of reasons – mainly due to the ever increasing value of older suburbs becoming the next better suburbs (and the suburbs before them becoming even more valuable etc). This expanding ring of value can continue to happen in Australia (whilst there is demand to expand and grow).

Now this won’t impact the “avg” real house price, as long as new cheap housing comes online at the edges, to fuel the desire to keep affordable housing available. The real risk (outlined in the article) is when no further housing is available, and then the forces of maxium affordablity for housing will start to take effect – things like better transport and better communication (100 years ago there would be no possible way to live on the Gold Coast and still work in Brisbane) have allowed housing to continue to expand. I’m guessing in another 100 years, I could live 300 klms west and still have some of the benefits (medical, education and entertainment) that I enjoy close to the CBD (but cleary it would be more expensive to live inside the 100Klm radius – why, cause its recognised as being the better location to live – just like the better suburbs near all cities are).

As such, I think some of the “sky is falling” claims made are not as likely as described – eg in Australia we don’t have the same walk-away home loans that allow USA residents to just walk from their debt when they default, thus allowing prices to crash badly… so in Australia, it is more likely that I’ll stick it out, and pay off the loan rather than declare bankruptcy. As such, I’m less likely to sell and carry the debt for ever… I’ll keep the price up (by not selling) and continue to hold onto the home instead. This creates a different outcome that this article isn’t addressing at all.

My advice to readers – don’t believe everything you read on the Internet.

Great article, I enjoyed reading it.

As for Grant’s comment above about mortgagees in Australia “more likely (to)… stick it out, and pay off the loan rather than declare bankruptcy”. Sure, this will happen but only if they can stick it out. If people are reliant on two incomes and they suddenly have only one, I don’t think they can ‘stick it out’.

Grant, in Japan a lot of people did hang onto their houses. Japanese people don’t like declaring bankruptcy, and Japanese banks don’t like to force their customers to lose face. Can you imagine Australian banks going easy on customers, just because they didn’t want to be impolite? Tokyo still fell 70%.

I will certainly agree that their is an “expanding ring of value”. Good places can be bought in bad suburbs that are in an otherwise good location. Uni students will replace the unemployed renters, crime rates will drop, then young professionals will start to move in. However the bubble bursting will sink a lot of property – even the ones that will increase in value compared to other suburbs.

@Juiced – The bank will still require full loan repayment, and if selling your house at 30% less means I still owe $120,000 and I still have repayments to make, and after all that – I still need to find a place to live – OMG! …and the funniest part is that I guess that’s going to be renting. Continuing this crazed scenario, renting demand will most likely rise, increasing the price of renting – so it could even be possible that the net outcome is very similar in terms of the weekly pay check impact – a more realistic outcome is that few people will feel that it is worthwhile selling up, and most will curb their spending on Plasma TVs and new cars… and start to just pay off the debt instead.

More to the point… every personal situation will be different of course, but I think it would be safe to assume only a minority would be in a scenario whereby selling up significantly below your debt would be the best move to make.

@Pete – I’m not so sure. Do you really think Japan is enough like Australia that we can safely assume what happened in that country will be mirrored in Australia – we are very different culturally, ecconomically and geographically. I appreciate your point regarding their culture re “saving face”, but so many other aspects are so drastically different.

For example, Japan was going through a cultural change (young people breaking mould and doing whatever they wanted – like our young already do here) and another is the geographic differences ie the large amounts of developable land (in Australia) vs the mostly appartment living (in Japan) – is the value in cookie-cutter 1 bed appartments the same as a 5 bed 600m2 block in a nice leafy suburb?

The desire for someone to “poney up” large cash for an item is based on demand for something of value.

If there is no demand (due to unemployment) or there is no value (cause its a cookie cutter appartment and there are 100 of them for sale) then the price MUST go down.

Inner city appartments in Australia are set for a price adjustment (downwards) and this is mainly due to a oversupply and lack of value. There is no logical reason for under supplied good quality land in the city suburb-belts to crash – there is strong demand (due to location and value) and lack of supply (due to mainly home owners and minimal developers).

The model in Japan was very, very different – in fact I think its highly unintelligent to just assume that everything is the same, and therefore we should base our thinking purely on history.

Grant I would like to point out with your ever expanding ring of value theory, that cities cuch as Phoneix, Salt Lake City, Las Vegas are growing much faster than any city in Australia. (Las Vegas population increased almost one million 1995 to 2005) yet property prices there have collapsed more than any other US city. This price decrease has nothing to do with fundamentals (like population increase, like wages, like shortages) and everything to do with speculation exactly like the stock markets. With the entire world economy slowing dramatically there will be job losses or under employment on a huge scale and if this occurs it does not matter whether you want to hold on or not you may have no option but to go bankrupt, infact it will be worse for Australia than America because we can’t just hand in the keys and transfer the loss to the bank. The borrowing spree that we used to buy everything (I am just as guilty as everyone else) will come to a screaming halt, because the banks won’t lend to us anymore. I would also keep an eye on the Australian banks as the full impact of this has not yet hit them, however I can tell you as a banker there is not much lending happening and management is starting to panic.

I would like to see an article on Post-Housing Bubble Bust-Australia? – I cannot seem to get my head around the flow-on effect of a major correction in House prices in AU? – It’s not just the price of the dwelling on the land; but also the revaluation of the land > by the relevent State Gov Dept’s – that flow on to the Local Gov Rating (Taxing) agencies? In my shire rates are calculated on the Qld Gov Valurer Generals estimate on the land area, which supposedly fund infrastructure, amenities etc?…has anyone zoomed out for the big picture?

Given that my parents (postwar, I am a “baby boomer” I despise that term, however) paid 350.00 Auspounds for their first house 1949-50>I +(husband) paid $9000.00 for our first hse (outskirts of Brisbane)1972> but my daughter will have to pay in excess of $350,000.00 for her first house? (which she is not going to do)- If her generation forgo homeownership for a life of rental properties how is this going to effect the dynamics of all other interconnected business> every RE office works hand in hand with Legal Officers; having worked in Qld Title office back in ’94 it is their bread and butter… etc etc…? Can some one attempt this task albiet hypothetical, and post it maybe on this site?

I found the partial answer to my Q. but not the big picture?

This paper examines the depth and duration of the slump that invariably follows severe financial crises, which tend to be protracted affairs. We find that asset market collapses are deep and prolonged. On a peak-to-trough basis, real housing price declines average 35 percent stretched out over six years, while equity price collapses average 55 percent over a downturn of about three and a half years. Not surprisingly, banking crises are associated with profound declines in output and employment. The unemployment rate rises an average of 7 percentage points over the down phase of the cycle, which lasts on average over four years. Output falls an average of over 9 percent, although the duration of the downturn is considerably shorter than for unemployment. The real value of government debt tends to explode, rising an average of 86 percent in the major post-World War II episodes. The main cause of debt explosions is usually not the widely cited costs of bailing out and recapitalizing the banking system. The collapse in tax revenues in the wake of deep and prolonged economic contractions is a critical factor in explaining the large budget deficits and increases in debt that follow the crisis. Our estimates of the rise in government debt are likely to be conservative, as these do not include increases in government guarantees, which also expand briskly during these episodes.

http://papers.nber.org/papers/w14656