I never thought I would see the day. In fact, in 2008 I joked with some Journalists on who was going to be the first to get Australia’s Real Home Price Index into a mainstream paper. None of us thought it could ever happen.

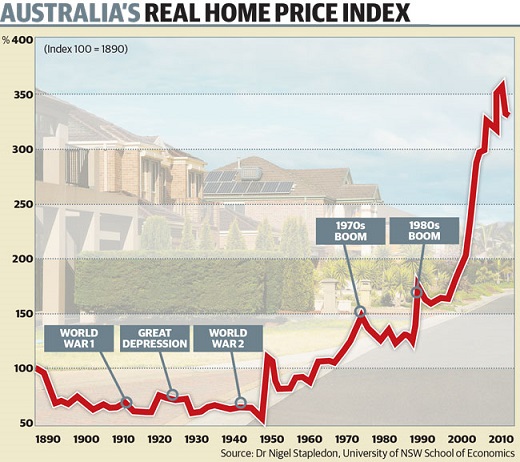

So you still need to pinch me today when I stumbled across News Limited’s Tabloids and The Australian publishing this graphic:

In the original article published in the Australian Conservative, it was called “The most important graph in Australia’s history.”

Bob Day AO, Managing Director of Homestead Homes and Federal Chairman of Family First writes for News Limited:

FOR more than 100 years the average Australian family was able to buy its first home on one wage. The median house price was around three times the median income, allowing young homebuyers easy entry into the housing market. As can be seen from the accompanying graph, the median house price is now – in real terms that is – relative to income, more than nine times what it was between 1900 and 2000.

It’s a story we have told for many years.

That’s $600,000 they are not able to spend on other things – clothes, cars, furniture, appliances, travel, movies, restaurants, the theatre, children’s education, charities and many other discretionary purchase options.

The economic consequences of this change have been devastating. The capital structure of our economy has been distorted to the tune of hundreds of billions of dollars, and for those on middle and

low incomes the prospect of ever becoming homeowners has now all but vanished.

And,

And while the slump in business conditions over the past years have been blamed on everything from the GFC to the high Australian dollar, the real culprit has been the massive redirection of capital into high mortgages.

Oh shit, is this for real.

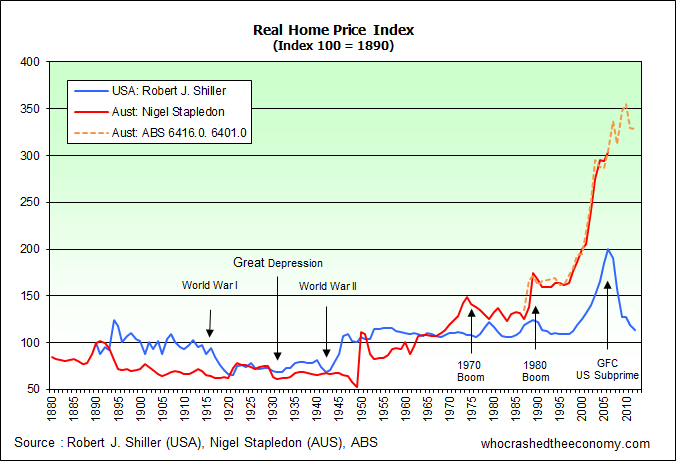

It did stop short of a comparison with United States subprime bubble, so readers could easily comprehend the scale – but it’s a fantastic start.

Meanwhile, in other news, The Australian Financial Review reports today the International Monetary Fund will investigate Australia’s Housing Bubble and the risks it poses when it sends a team to Australia later this year. The AFR writes :

News of the visit comes after the IMF this month urged regulators around the world to consider using so-called macroprudential tools, such as limits on loan-to-valuation ratios or increased bank capital requirements, to prevent banks fuelling house price bubbles.

It will be interesting if the visit puts more pressure on Australian regulators to step up to the plate and act.

» Bob Day: Current Australian house prices more than nine times median household income – The Advertiser, 23rd September 2013.

» Bob Day: Current Australian house prices more than nine times median household income – The Australian, 23rd September 2013.

» Massive supply-demand imbalance puts home prices out of reach of many – Australian Conservative, 19th August 2013.

» IMF turns spotlight on Australia’s housing market – The Australian Financial Review, 24th September 2013.

Bob Day for PM!

What? A wealthy housing director admitting that the economy is shagged because of expensive housing?

Well, I damned…Where are all the tradies sprouting that if not for the housing support they couldn’t have kept the car, boat and motorcycle dealerships in business.

……Again, it’s the debt stupid

Ah, forgot to ask, does Bob Day’s real economy spending reduction include interest on the capital borrowed? I still can’t believe people believe their house cost (example) $350k…no it didn’t…how longs your mortgage? At what rate? There’s your cost of the house… Interest is a real cost, and it has to be paid somehow….

Funny how people are all too aware of interest repayments when paying the loan, but forget all about the interest requirements when bidding or making offers…

You’re right Matty, our bubble is sucking a lot more out of the economy that what the article portrays. But don’t make the bubble sound too big, otherwise people dismiss it as it can’t be happening. Small steps first!

I think he has done a wonderful job exposing all this.

http://www.bobday.com.au/

We was National President of the housing association, and you know what they are like – they are lobbing the government for more first home buyers grants to keep the ponzi scheme going.

Looks like he was elected to the Senate for Family First.

Might post this graph on a billboard in Martin Place opposite the RBA head office.

We could play a game called ‘Spot the Bubble’.

If you have being paying attention over the last week or two most of the usual suspects have been shouting from the rooftops ‘There is no HOUSING BUBBLE’, almost to the point where the spin has become relentless.

Can anyone say ‘Nation in DENIAL’

And the plebs, the greedy, the vested interests, the spruikers, the speculators etc, etc, etc all suck it up like mothers milk, while smacking their lips and asking for more.

Even in the face of indisputable evidence to the contrary, such as the above Real Home Price Index, the rent-seekers continue to deny reality because it does not fit with their rather warped view of the world.

Let it run, fast and hard, head on into a brick wall of reality. The resulting mess will not be fit for adult viewing, however, once it is eventually cleaned up and those over-leveraged souls are made to suffer for their largesse, we will be able to take heart as first home buyers and current and future generations will REJOICE.

Seems fair – what do you think ?

I do not see any positive changes coming out of a corrupt and incompetent political system. Change will only come from the average Australian’s commitment to not buying into the housing market and that will only happen when unemployment will rise

@ Pete

I hope they throw more FHB money at this entity.

That will make it really interesting!

Like that old saying goes, if they’re buying, it’s cheap enough, if they don’t then it’s too expensive. Maybe we’re just a bunch of poor bastards. Or maybe there are just too many people who have plenty of money. If you wanna see how big a gap can get, with no end in sight, there are plenty of places.

Plenty of money in SMSF that investors want to put on the line:

Self managed funds blamed for driving up house prices

Investors in aggregate can trade titles back & forth at ever increasing prices however investors in aggregate cannot extract in cash, anything more than, the net rent minus costs & interest.

According to the ATO, there were 1,811,174 property investors in Australia in 2010-11, up from 1,751,679 in 2009-10

Their net loss was $7.862 billion

By ALL economic measures, at a 6% risk free AAA yield rate of return this indicates that investors in their aggregate are $131 billion deficient in economic equity.

Presently, aggregate investor loans are $422 Billion and economic equity deficiency is roughly $131 billion.

i.e. The aggregate economic value of all residential rental property is $291 billion.

Interestingly, that number closely approximates the Stapledon graph.

Sounds like in near future there’s going to be some extremely rich people and the rest of the sheep in absolute poverty hmmmm…Goodbye to the happy go lucky Aussie middle class.

The faster house prices go up, the faster first home buyers demand will drop of.

The next question is, how high do they go before investor demand drops off, even the Chinese will reach a point where they have to start questioning the purchase (especially when the are a lot better options available around the world).

Well it looks like game over folks.

http://www.macrobusiness.com.au/2013/09/coalition-backs-rising-house-prices-ducks-reform/

No tax reform or MP tools to be implemented by the Coalition. So it’s house prices to the moon and damn the consequences.

Who is the official Housing Bubble minister btw?

Don’t know if that’s such a bad thing, Average Bloke.

What we don’t want is something that draws out and delays the inevitable for years. I would rather see one big bubble, and then a sudden crash rather than years of reform trying to moderate and keep a floor under the bubble.

I think it will crash in Abbott’s term.

I pretty much have the same view as Pete, though I’m not as optimistic about a crash occurring on Abbott’s watch. Surely there’s got to be an end to this craze sooner or later though!

I read Abbott supports rising house prices. What more proof all politicians are only elected by special interest groups and not the voter. This is a person people voted for the better? Sometimes I do not know who poses a bigger danger to Australia’s economic welfare-corrupt politicians or the voter? I believe the latter-Maybe we deserve a strong recession for all of us to come to our senses.

Theo, don’t blame the voter. What choice did we have – either a party who supports a bubble or a party who supports a bubble.

We do have a choice the minor party as about 10% voted that way and each election more people are voting that way.most of voters would be gen y. The ALPand Libs fear the shift way from them.

We didn’t have much of a choice. I voted below the line for the Senate, knowing my vote wouldn’t make a huge difference. And realistically, we know that it was either going to be ALP or Coalition who would get into power. And both are committed to a bubble.

If there was a third major party who had policies to pop the bubble it would have been a different matter. But there wasn’t.

Hi Admin – On the 21st August I made a post about my mate selling his McMansion here in ADL due to marriage breakdown and you asked whether it would sell in ‘jiffy’ or not and to let you know. As a reminder to other readers it was bought in 2010 for $750K and advertised now for $680K-$745. He informed me yesterday that he was about to accept an offer for $710K. Some extra information I received was the house across the road first advertised for $720K 18 months ago then pulled has now been placed again for a price range of $660K-$690K. Thus this price rise speak at least here in ADL is all hot air !