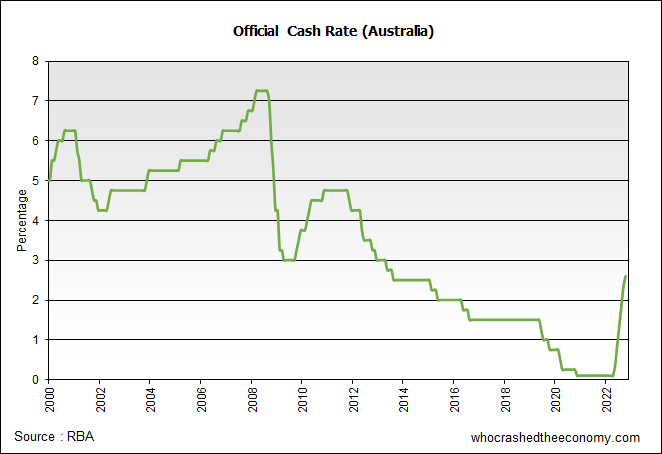

The Reserve Bank of Australia (RBA) has today increased the official cash rate by 25 basis points to 2.60 percent. Most of the market was expecting a 50 basis point rise. This is the sixth consecutive rate hike this year as the RBA continues to normalise interest rates and start to put a lid on rampant inflation.

| Date | Change | Target Cash Rate |

| 4th October 2022 | +0.25 | 2.60 |

| 6th September 2022 | +0.50 | 2.35 |

| 3rd August 2022 | +0.50 | 1.85 |

| 6th July 2022 | +0.50 | 1.35 |

| 8th June 2022 | +0.50 | 0.85 |

| 4th May 2022 | +0.25 | 0.35 |

The most recent monthly inflation indicator from the Australian Bureau of Statistics (ABS) shows headline inflation was 6.8 percent in the year to August, down slightly from 7.0 percent in July. However, when volatile items are removed, core inflation is still trending upwards and shows no sign of abating.

The next quarterly CPI index is due later this month, on the 26th, and will feed into RBA decision making for the November 1st meeting. The Reserve Bank’s preferred measure of inflation, the trimmed mean, currently sits at 4.9 percent for the year to June, well outside of the RBA’s target band of 2-3 percent.

Today’s hike brings the official cash rate back to levels last seen in July 2013.

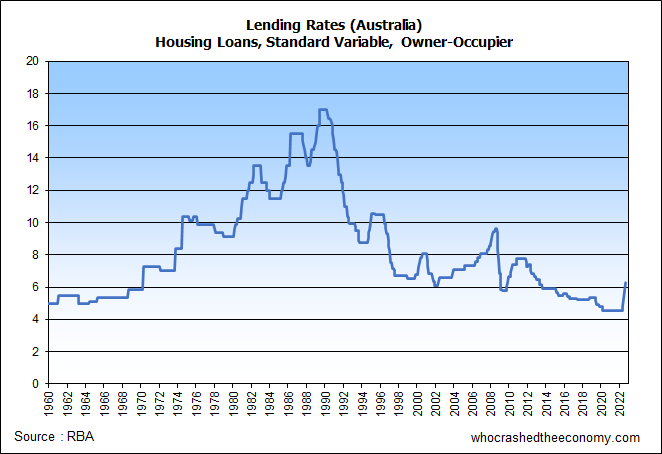

Mortgage rates are still low by historical standards. Over the past 60 years to August 2022, the average standard variable mortgage rate for owner-occupiers has been 8.4 percent. Over the past 20 years, it was 6.4 percent.

The standard variable mortgage rate normally sits around 2 percent higher than the OCR, hence the 2.60 percent OCR should translate into a standard variable mortgage rate today of around the 4.65 percent mark.

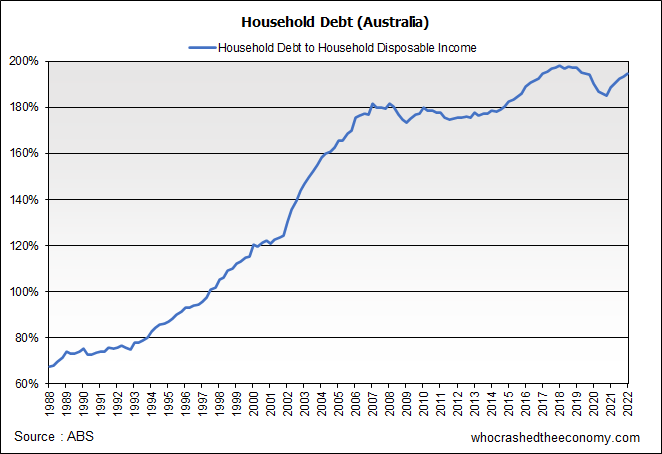

The reason why so many Australians could start to struggle is not primary due to ‘high’ interest rates, but rather excessive household debt levels in Australia, fueled by an obsession for real estate.

Household Debt

The Bank for International Settlements (BIS) recently updated household debt to GDP figures on the 19th September for Quarter 1, 2022.

Australia once again comes in at second place for household debt. It is conceivable rising interest rates will impact Swiss household’s the most, followed by Australian.

| Rank | Country | Q1 2022 Household Debt to GDP (percent) |

| 1 | Switzerland | 128.5 |

| 2 | Australia | 118.4 |

| 3 | Canada | 105.9 |

| 7 | New Zealand | 98.1 |

| 12 | United Kingdom | 84.9 |

| 13 | United States | 77.2 |

US Federal Reserve

Two weeks ago, on the 21st September, the US Federal Reserve hiked the federal funds rate 75 basis points to a target range of 3 to 3.25 percent. The Fed meets less regularly than the RBA and hence generally needs to make larger rate hikes to achieve the same rate of increase over time.

The RBA also has to juggle the currency exchange rate. If the interest rate differential becomes too large, i.e. Australia’s official cash rate falls behind the U.S. federal funds rate, we can expect the Australian dollar to fall and given most of our goods are purchased from overseas, will only further fuel inflation. (Most products purchased from China is priced/traded in United States Dollars). To a certain extent, the RBA may have no choice but to follow the Fed’s direction on rates. Today, the Aussie is buying 0.65 down from 0.71 in early August.

However, there are differences to household balance sheets and how the mortgage market operates in those two countries. Australia has significantly more household debt than in the United States and are normally exposed to floating rate mortgages. Where rates are fixed, they are only fixed for a couple of years. In the United States, it is more common to have a fixed-rate mortgage which has a specific interest rate for the entire term of the loan (generally 15 or 30 years) and hence interest and principal payments remain the same each month.

It is possible the large Australian housing asset bubble may have to become collateral damage in the inflation fight. To what degree is uncertain at this stage as we don’t yet know where inflation will peak – or what will break. Housing asset price declines, through the wealth effect, may help to control domestic inflation and may limit longer term falls.