The Reserve Bank of Australia’s surprise decision earlier this month to only increase the official cash rate (OCR) by 25 basis points is, as expected, starting to manifest itself with a weakening Aussie dollar (AUD).

Most economists had expected a 50 basis point rise. At 2.60 percent, the OCR sits at the bottom of the RBA’s neutral band of 2.5 to 3 percent. The RBA believes this neutral band is where the OCR neither stimulates or contracts from economic growth. With the monthly headline inflation indicator sitting at 6.8 percent, most believe the RBA still has quiet some work to do, hence the surprise.

As the local currency falls, imported goods become more expensive, only adding to the challenge the central bank faces in controlling inflation.

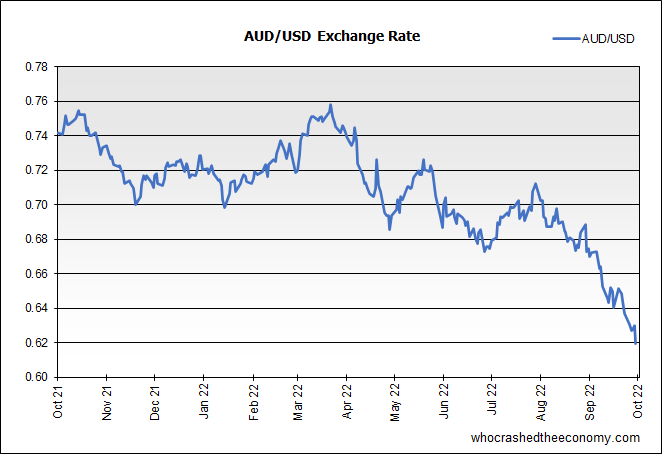

Prior to the RBA meeting on the 4th October, the average exchange rate for the year was hovering just over 71 cents.

Today, the Australian dollar closed at 61.96 cents, down 4.9 percent from the RBA meeting and down almost 15 percent from the average of the 71 cent average.

The result means imported goods will be 4.9 percent more expensive since the RBA meeting. This will have an immediate effect on the consumer who is directly importing their own goods (at the time of payment), but may take a longer time to work through for goods sold by Australian retailers (such as washing machines and refrigerators) as local inventory is depleted and new stock ordered.

It will also effect the cost of imported fuels such as unleaded and diesel fuels, although the prices of these commodities are, in itself volatile and will also influence the price paid at the pump.

U.S. Inflation

Thursday night (Australian time) the U.S. Bureau of Labor Statistics released the September CPI print showing consumer prices in the United States rose 0.4 percent in September to bring annual headline inflation to 8.2 percent, down slightly from 8.3 percent recorded in August.

However, the real concern rests with hot core inflation which rose 0.6 percent for the month to an annual pace of 6.6 percent, the highest level since August 1982. Core inflation strips out volatile food and energy prices and is the metric more commonly used by central banks. It is showing inflation is becoming more entrenched in everyday goods and services and will hence be harder to contain.

The undesirable result gives more support for the Federal Reserve to hike rates by another 75 basis points at its next meeting in early November and has resulted in the Australian dollar losing 1.62 percent on Friday alone.

RBA Melbourne Cup Day Meeting

If the RBA decides on Melbourne Cup day to only raise rates by 25 basis points as now widely expected, then we can expect a further deterioration in the Australian dollar and more imported inflation in the year ahead. Already, the bond market is predicting rates might not peak now until 2024 – effectively rates will be higher for longer as the RBA takes a slow but steady approach.

This month’s moment in exchange rates demonstrates the narrow path ahead for the Reserve Bank in controlling inflation and engineering a soft landing.