As widely expected, the Reserve Bank of Australia (RBA) has today increased the official cash rate (OCR) by 50 basis points to 2.35 percent. This is the fifth consecutive rate hike this year as the RBA continues to normalise interest rates in preparation for what is shaping up to be a challenging inflation fight, one not seen since the 1970s.

| Date | Change | Target Cash Rate |

| 6th September 2022 (Today) | +0.50 | 2.35 |

| 3rd August 2022 | +0.50 | 1.85 |

| 6th July 2022 | +0.50 | 1.35 |

| 8th June 2022 | +0.50 | 0.85 |

| 4th May 2022 | +0.25 | 0.35 |

The global COVID pandemic triggered Australia’s central bank to temporary drop the official cash rate to almost zero, to help support the economy through what was forecast to be a difficult time.

But as the worse case scenario didn’t eventuate, it became clear too much stimulus, both monetary and fiscal was sloshing around the economy, causing increased demand for goods and services while supply was crippled by COVID related supply chain issues.

To make matters worse, on the 24th of February 2022, Russia invaded Ukraine sending energy and food prices souring higher.

Neutral OCR Setting

In a speech to the Australian Strategic Business Forum on the 20th of July, the Reserve Bank governor, Philip Lowe talked about the concept of a neutral real interest rate. This had been much the topic of discussion during RBA board meetings.

This is where the interest rate is neither stimulatory nor contractionary. He explained, this rate cannot be observed or measured directly, but must be inferred from other information.

Based on work done by the RBA, the bank believes the neutral nominal cash rate to be at least 2 and a half percent. At 2 and a half percent, the central bank believes interest rates won’t stimulate nor contract from economic growth. The RBA’s target inflation rate is 2-3 per cent.

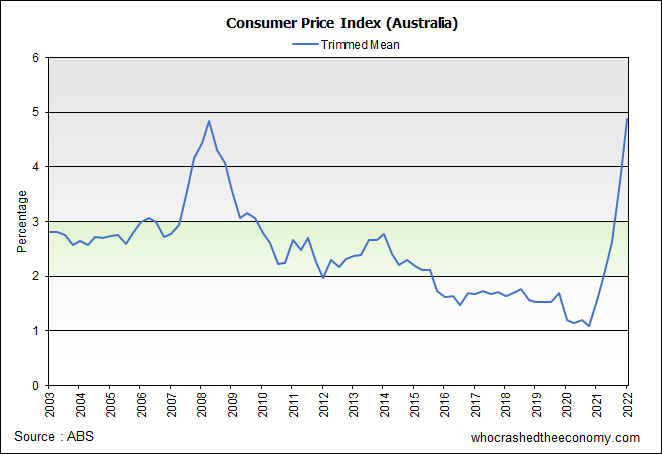

The Reserve Bank’s preferred measure of inflation is the trimmed mean. It removes volatile changes and currently sits at 4.9 percent, well outside its target band of 2-3 percent. Hence, it should be expected that the RBA will continue to hike to and beyond 2.5 percent.

Most economists expect a further 50 basis point hike in October, taking the OCR to 2.85. At this point the OCR is close to what is considered the neutral real rate.

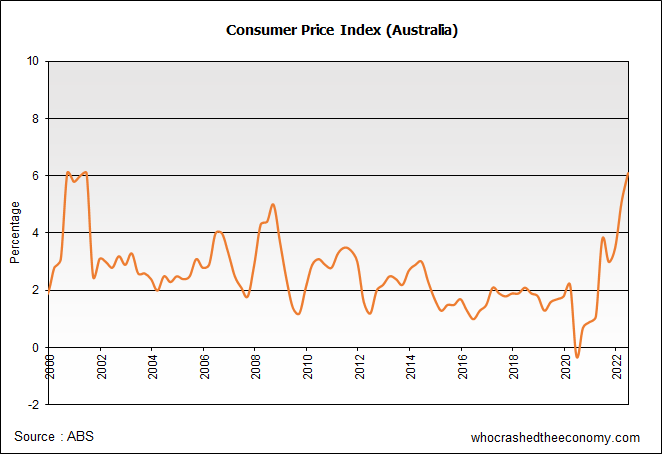

Headline inflation, measured by the Australia Bureau of Statistic’s (ABS) Consumer Price Index (CPI) has hit 6.1% for the June 2022 quarter, the highest rate since the introduction of the GST caused a spike.

Resilient Economy

So far, higher interest rates are having little measurable effect on the economy. Retail sales for July rose 1.3 percent for the month and a surprising 16.5 percent for the year. While this metric is not adjusted for inflation and some of the growth would be contributed to inflation, it does demonstrate considerable demand for goods.

Unemployment is also very low. For July, the unemployment rate fell to 3.4% (from 3.5% in July).

The Challenge Ahead

Getting inflation under control without overshooting will be a challenge. The full effects of an interest rate rise is not likely to be fully seen until after at least 12 months or more. However, if the RBA acts too slowly, then inflation is likely to become entrenched or ‘sticky’ and the cash rate will have to pushed even higher that before to rein in inflation. This will also result in higher inflation for longer.

There is already some evidence of inflation becoming entrenched. Businesses are putting up prices to compensate for increased input costs – plus some more either with the expectation of more inflation to come, or to enhance profitability.

No one really knows what threshold the cash rate will have to reach to get inflation under control. During the last inflation crisis in the 1970s, it was found the cash rate needed to be higher than the inflation rate to bring inflation down.

Today however, household debt levels are multiples times more than during the 1970s – in many cases unprecedented. One would expect debt would act as a multiplier, with the result that interest rates do not necessarily have to increase as much to obtain the same pull back in spending than during the 1970s.

We also measure inflation differently to that of the late 1970s. The CPI is a product of a basket of goods with different weights. Some items have been removed (e.g. house asset prices), and most of the weights are now different. For example, if United States CPI was calculated today using the same 1980 methodology, the result would be 17 percent, almost twice today’s official measure of 8.5%. With all other factors being equal (i.e household debt), this could that mean the cash rate now has to exceed the inflation by double.

Inflation is the number One Priority

While predicting the future of inflation and interest rate movements are murky, one thing is clear. The RBA, like most central banks, is committed to getting inflation under control.

“The RBA is committed to ensuring that the current period of higher inflation is only temporary and it will do what is necessary to bring inflation back to target.” remarked Philip Lowe during his address to the Australian Strategic Business Forum 2022.

Late last month, United States Federal Reserve Chair Jerome Powell delivered a short and direct speech at Jackson Hole. “Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone.”

Today’s statement on the momentary policy decision borrows the Fed’s reference to price stability, “Price stability is a prerequisite for a strong economy and a sustained period of full employment.”

For over two decades, leveraged markets and the heavily indebted has come to expect and depend upon a pivot in monetary policy (or Fed Put) as soon as markets show some sign of softening. In most of these cases, central banks were trying to generate some inflation to get back within target bands. The difference today is we have too much inflation.

First get the middle class as leveraged as possible. Then tighten credit conditions, next get cash flowing into the banking system chasing higher deposit rates, then bail in the banks.

Mission acomplished, no more middle class!