The new Australian Bureau of Statistics (ABS) Monthly CPI Indicator has shown headline Inflation in Australia had hit 7.0 percent in the year to July, and 6.8 percent in the year to August.

Prices for food and non-alcoholic beverages have risen at 9.3 percent per year, helped by fruit and vegetables up 18.6%.

Price increases on automotive fuels have slowed in August, but still up 15 percent for the year. With the fuel excise returned to 44 cents a litre on Thursday (up from 22 cents), we are expected to see a rise next month.

Residential rents are starting to trend up and is expected to be a key driver of inflation next year, along with household energy bills – both electricity and gas in New South Wales, Victoria, Queensland, South Australia and Tasmania.

Prior to this monthly CPI indicator, Australia was one of few countries that only measured inflation on a quarterly basis. However, with inflation now rampant, the Reserve Bank of Australia (RBA) needed a monthly indicator to help set the direction of monetary policy.

RBA to increase rates next Tuesday

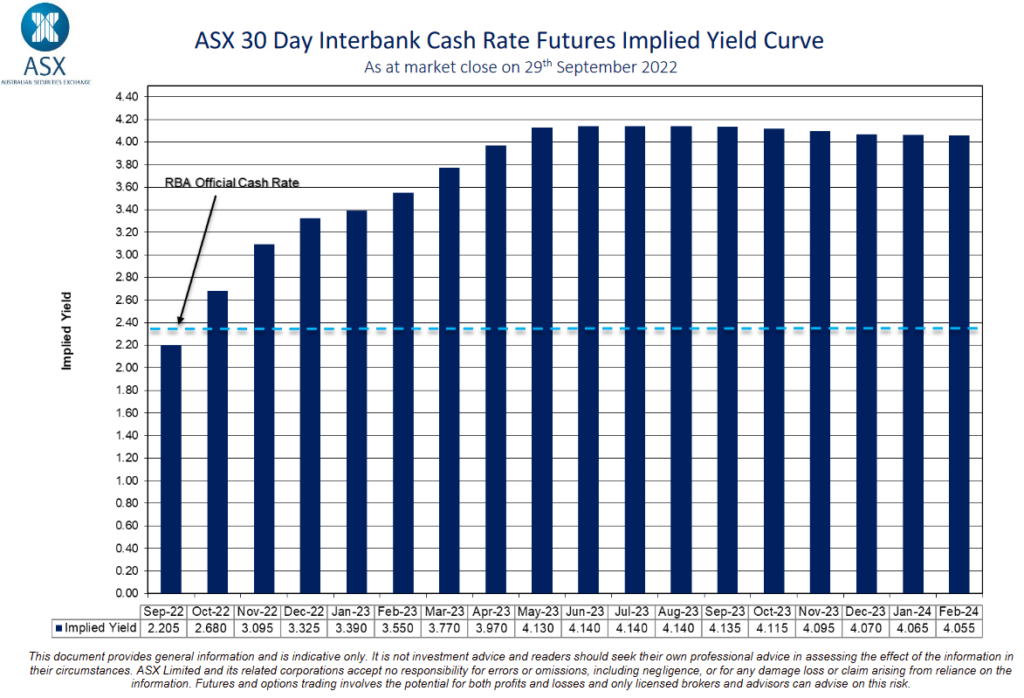

The Reserve Bank is expected to increase the official cash rate (OCR) to 2.85 per cent when it meets next Tuesday, 4th October. This will put the OCR is what the RBA considers a neutral setting, where interest rates are neither stimulatory nor contractionary.

Markets are now expecting the OCR to be over 4 percent in the middle of next year. Hence, mortgage lending rates would be expected to be around 6 to 7 percent.