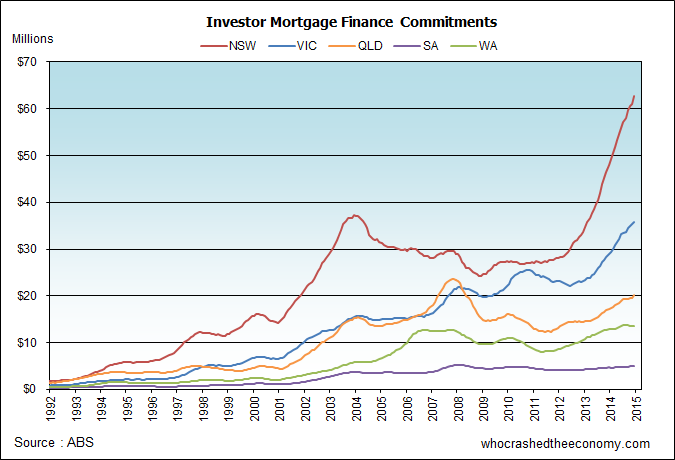

‘Crazy’ value agnostic investors continue to leverage up in an environment of poor rental growth, according to investor mortgage finance commitments released by the Australian Bureau of Statistics on Friday.

In the year to April, NSW property investors have borrowed $64.2 billion to spurge on the residential property market, another all time record.

This comes as CoreLogic RP Data also released data on Friday showing rents are now rising at their slowest annual growth on record, caused by the surge in property investment. According to the ABC, “Bureau of Statistics figures show it is 20 years since rental growth has been this low nationally.”

» 5671.0 – Lending Finance, Australia, Apr 2015 – Australian Bureau of Statistics, Friday 12th June 2015.

» Rental growth slowest on record says CoreLogic RP Data – The ABC, Friday 12th June 2015.

Words, and all level of explanation, fail me.

I never thought something as stupid as the tulip bubble could occur in a modern country, given the ease of access to information.

This is truly sickening.

I’ve got some advice for Joe: I really, really, really don’t want you to use my tax dollars (which lets face it, are stolen from me) to bail out banks that have lent to the greediest specimen alive: The Aussie, negatively geared specufestor.

@Matty – I’m dumbfounded too by the extent of bubble mania.

Who is still lending? Why are they still lending? If I was a bank, I would have a maximum LVR for a Sydney and Melbourne Property Investor set at 50 to 60%.

I guess it is the point of no return. If they stop lending now, the bubble will collapse.

Bank raises home loan deposits in mine towns

ANZ has dropped the maximum LVR for mining towns to 70%. You should hear the whining – have a read of the above article:

“One broker, who spoke on condition of anonymity because he did not want to jeopardise his business relationship with ANZ, said the “crazy” policy would “price ANZ completely out of the market”

Well isn’t that the idea, to reduce risk for ANZ!

Matty, I understand your concern, but the reason the bubble is getting so big IS because of the government guarantee for the big 4 which will re-float them along with Bail-Ins. In a perverse way the banks want the market to implode so they can take over real assets which cost them nothing. Then they on sell the properties to their hedge fund mates who become the nations landlords. This is exactly what happened in the US after 2008. Welcome to Neo-Serfdom.

I would set LVR to 105% and let the taxpayers wear the risk…it’s been tried and tested on the rest of the world population and nobody did a thing! a silent whimper at most….

@3: Max D

Absolutely, fractional reserve lending banks are insolvent. I have to report yearly my companies can pay their creditors if and when the become due:

If everyone withdraws from a bank: It’s out of cash, well before the line of depositors ends…..

It’s the same with super: The funds buy things in their name, ride the up, onsell to the customers near the top, then the public takes the fall..and guess who buys it back for pennies on the pound?????

The whole system is stuffed. Just make sure you aren’t a lemming caught in the trap.

@ Max D,

spot on. the cost to fund a loan on a promise to pay on currency that doesn’t exist is only a few hours work for a clerk, to check your LEGAL FICTION NAME credentials and if that foreign estate trust is credit worthy.

@ Matty an Pete,

you are talking about the deflation part of the scenario I believe is coming large, contracting the currency supply. a quote we have used often.

Quotation: Thomas Jefferson, Born April 13, 1743, Died July 4, 1826,”If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…I believe that banking institutions are more dangerous to our liberties than standing armies… The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

Matty,

i thought tax was optional. hasn’t there been 3 high court cases determined out tax collection agency is not an aussie entity.

prepper

Finally, a party to vote for.

http://news.domain.com.au/domain/real-estate-news/house-price-debate-gives-rise-to-the-the-affordable-housing-party-20150615-ghoaqk.html

@2 that article is so amusing. All of those RE industry people crying foul but also use the old “Won’t someone please think of the first home buyers” defence.

The ANZ bank has every right to adjust who and how much they lend to people. They were probably sick of dumb people buying investment properties in those towns and then defaulting and leaving the bank with a worthless property. The investor then goes bankrupt and is unlikely to ever repay such a huge loan in their lifetime.

So apparently housing is more affordable than 26 yrs ago on account of a lower % of houseold income going towards the mortgage.

http://news.domain.com.au/domain/real-estate-news/new-research-shows-sydney-property-more-affordable-than-26-years-ago-20150617-ghoxqb.html

How can this be?

@ 9 it’s called spruiking – a fancy word for lying.

http://www.sbs.com.au/comedy/article/2015/06/15/piss-stained-cardboard-box-sydney-sells-590000

@8, that would be the fibro(?) house bought for 1.3million a couple of years ago passed in at auction for 300k not too long ago in a mining area.

Old house requiring some TLC, probably mortgaged to the hilt and now valued at less than 25% of the price paid.

Searched for the article to link but google failed me.

Even if the market only drops by 25-30% many will hurt, let alone 50% plus.

@12 Port Hedland house passed in at auction in million-dollar dive, sign mining boom over – The ABC, 9th February 2015.

http://www.dailytelegraph.com.au/newslocal/news/sydney-property-investment-guru-stephanie-brennan-has-23-million-portfolio-aged-24/story-fngr8gwi-1227402551502

At 20, she was advising federal politicians…. Well, that explains even more why the world is so borked.

If she had any brains she’d exit everything and park the money off shore in something that actually pays a return…

Oh hang on…she’s brainwashed, she thinks this is the new normal..

I’m not on FB, but ‘friend’ her, and report back when she’s 30 and retired… LOL, retired at thirty off of property: I bet less than 1% of all current RE investors could retire in 5 years, they are so far down the chute they can’t see the forest for the trees.

This is going to end sooooo bad for the entire country.

@14 – Over in whirlpool, they are discussing her CV

https://au.linkedin.com/pub/stephanie-brennan/76/aa0/771

Apparently in 2005 (when she was just 13) she was Assistant Coordinator at the Glenaeon Retirement Village….

Nah she’ll be fine. If you read further down she admits she comes from a wealthy family.

Stephanie is probably not to different to this woman. I love the look on here face when Kochie tells her she has 4 million dollars debt.

Kochie is a cheerleader for the economy but I like this one.

https://au.tv.yahoo.com/sunrise/video/watch/22316914/property-mogul-mum/

The loan is the bait to take everything the people own.

my mate believes housing IS still affordable, yes while interest rates are low sure!

@ 19 XL debt

yeah and the loan is over >30 years. LOL, working 1 or 2 or 3 days a week for 30+ years just to have a roof over your head you can call your own (but it’s not really yours at all on many levels) is just crazy.

Affordable?

People confuse the definition of affordable with achievable:

Oh well, I’ve been telling the truth for years……. It’ll catch up to most, very few real will make it out being in front.

Love your work, Mr Peacock.

Don’t Buy Now!

@ Steve

The Lindas of investing with $4 million in debt will provide the incredible buys of the century for those who are cashed up and waiting. Even a 10% downward swing in the markets will wipe her out and bring the banks in howling for margin calls. It would be interesting to do the same interview same time next year.

Finally saw Kochie do a good interview,

Loved watching her eyes rolling around as if to say “the guy said so”. Her face from 2 minutes in speaks volumes…”Kochie’s giving me heat- is there a chance I’m in deep shit? $4M worth of it”

Also his attempted piss take on Sydney before corrected…it’s, its..

Central Coast, Port Macquarie. Gimme a break.

@Matty, sorry mate. Haven’t got around to YouTubeing all the signs. But in Syd, theyre everywhere. It’s going off. For sale/lease/sold/leased. Can’t blame people for selling at the top but where are they going? And who’s buying?

Yep, ok

https://youtu.be/DvOiF5XxsL8

Getting some cracker articles around. One from the Domain:

10 steps to beating the Sydney property bubble

Yes, you guessed it. Rent where you want to live and invest into the Bubble! Sure fire way to beating the bubble.

@ 25

Do they know how stupid they sound? So they say renting is cheaper, then in the next sentence, that you can get 4-5% rental return on an investment property…… Which is it? One or the other, you can’t have it both ways…..

Except in RE investor land, you THINK you can have your cake and eat it too!…..

The only ones doing the real eating are, of course, the banks…. Nice, juicy profits, quarter in, quarter out….. Until you need a bail out, bail in or nationalization… It don’t matter, the rich will just get richer….

Make sure you align how you live, invest and think to be like the rich.

Yesterday, i went to see an auction for nice 4 bed, 10-12 years old house & suburb in west of Sydney, 650sqm block, quality built. Nicely groomed & suited vultures started auction at 900k. Guess what? Out of 10-12 family bidders, only two bids. As a result, auction withdrawn 920k. Seller wants 1.2 million. Another auction, a 600-700k house though, people overbidding each other to death. Feels like trapped between the greedy & the sheeple.

average_bloke:

Oh

lordgullible fools, won’t you buy mea Mercedes Benzmy first investment property?Won’t someone think of the children?

Interest rates are on the increase overseas due to increasing sovereign risk and the start of inflation as a result of massive money printing. Imagine the effect when it reaches the Oz housing markets where most investors are only just breaking even. They will realise you can negative gear yourself into bankruptcy when their deductions overtake their income. I remember in 1987 when the stock market crashed 20% in a day and the next day RE markets froze. Nobody knew what anything was worth. The same could happen in Sydney, probably before the end of 2015.

Now is the time to put cash under the mattress. Assets like stocks and real estate keep increasing in price because of record low interest rates and money printing. The rest of the economy is slowing down and if interest rates are increased everything crashes. Basically there is no way out. When main street media announce this from reputable fund managers I think it is time to take action.

http://www.telegraph.co.uk/finance/personalfinance/investing/11686199/Its-time-to-hold-physical-cash-says-one-of-Britains-most-senior-fund-managers.html

@ 27

Maybe the passed-in house had one of the unlucky Chinese numbers and the one that sold had a lucky number.

Not racist, just stating facts.

@ Max D. Leverage,

better to be early to the coming adjustment than late…i think we will see another 1 or 2 cuts…

your cash might be devalued in the process…

prepper

@Paul

Yes cash could devalue depending on what is happening in the rest of the world but it would be king during periods of capital control. My guess is we will tip into deflation first,(Goodbye overpriced housing) followed by massive money printing and runaway inflation. The essential for financial survival is to have liquid assets outside the banking system.

THOMAS JEFFERSON: “When the government and the bankers fear the people,there is liberty and prosperity! When the people fear the government and the bankers,there is tyranny and debt!”

@ 32 Paul

I agree, but I’m not 100% sure. Unlike USA, which is it’s own unique currency, we have to balance foreign debt against expanding/growing/printing our currency system.

Throw in the fact that our banks have borrowed uber dollars from USA FED, and I’m not sure where this goes.

One theory says we can just print, lower our dollar and drop rates further, but the other theory says USA banks and the FED don’t want dropping AU$….. So maybe we can’t just print and be merry.

I expect we have a couple of cuts yet, but beyond that I really can’t predict anymore: It’s too distorted.

Housing market ‘bloodbath’ is looming:

http://www.news.com.au/finance/real-estate/economists-claim-australia-in-midst-of-largest-housing-bubble-on-record/story-fncq3era-1227410053643

Now we just need some follow up articles where someone from Toop & Toop, LJ Hooker or REI can tell them they’re just economists what would they know?!

Interview on SBS Tuesday night with economist Lindsay David predicting a 50% deflation in major housing markets. He states there are 1.2 million negatively geared investors in Victoria alone and we could have a real estate bloodbath as in Spain, Ireland and USA. The housing industry economist called it scaremongering.

http://www.sbs.com.au/news/article/2015/06/23/housing-bubble-or-scaremongering

The guy from Housing Industry Association could stand to pipe down.

as he says:

“there is certainly no indication out that there that we’ve got some kind of impending crash coming upon us in the housing market.”

umm what!!

We have everyone from RBA, bank CEO’s, economists etc.. all warning about price rises and the risk that it indicates but vested interests from the housing and real estate industry are saying “move along people nothing to see here” oh what you mean that graph with a line going upwards towards the moon which represents debt taken on by investors who over 70% of are negative geared and thus banking on prices to continue the same trajectory. Nah that is no indication that something might be headed for a crash.

Wait till all those negatively geared investors wake up and smell the ashes and that their dreams of being the next clowns on the front cover of property infestor magazine come crashing down and turn into their worst ever nightmare. They will still blame the people who warned of the bubble and say it was their scaremongering that caused it all.

As much as we are in a massive property bubble (Sydney and Melbourne), I don’t see it bursting anytime soon, as both sides of politics will do everything within their power to inflate it even more and more.

Here in NSW, the state government has boasted about how it’s collecting billions of dollars in stamp duty revenue (mostly from the out of control Sydney market), so the NSW government definitely does not want to kill “the goose that lays the golden eggs”. The obvious thing here is, is that the NSW government has placed all its eggs in one basket, and what if there was a downturn in property, then what? Obviously payroll tax receipts are down, because of increasing unemployment (which is chronically under reported by the ABS), and what other industries are there in NSW that are booming at the moment? (apart from property speculation).

When the NSW state government has to rely on this massive property Ponzi scheme for its main source of revenue, you know something is seriously wring with the economy.

@39 Just watching and listening to those clowns in state parliament over the last couple of days has truly made me want to sick up my breakfast. There was an older Liberal moron who shouted “the only people who don’t want house prices to keep going up are the Labor mob”, or words to that effect – and I literally shouted at the radio while driving to work.

There is a pervasive smugness and narcissism now among property investors, real estate agents and politicians that is actually quite disturbing. It makes me very sad indeed.