Sydney and Melbourne residential property markets could already be in a bubble according to the chief of Australia’s Investment and Securities regulator. Talking to the Australian Financial Review this week, ASIC Chairman Greg Medcraft said “History shows that people don’t know when they are in a bubble until it’s over” warning, in particular, that many Self-Managed Super Funds (SMSFs) could be exposed to a conceivable correction.

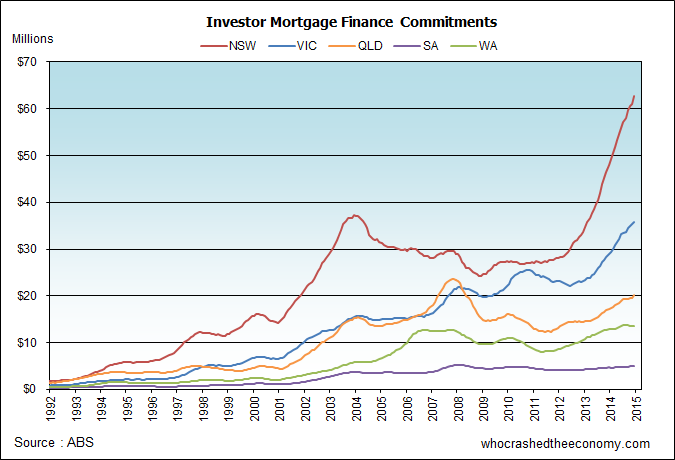

For most economists examining housing finance figures, this comes as no surprise. Recent data from the Australian Bureau of Statistics (ABS) show value agnostic investors have been piling into the Sydney and Melbourne market like no tomorrow, and as rents continue to fall.

Medcraft’s warning for SMSFs won’t come as a surprise to the National Australia Bank (NAB) either. The NAB quietly exited lending to self-managed superannuation funds early this month. With limited recourse borrowing, the risks were just too great. According to a report in the Australian, a NAB spokesperson declined to comment, outside of a statement saying the bank is “constantly assessing its product offering through our risk appetite and the broader regulatory environment.”

ANZ has indicated it has no exposure to SMSFs.

Activity below the radar

Fears of a housing correction impacting the stability of Australia’s banking system has forced the banking regulator to secretly act. As we reported in March (‘APRA to keep banking crackdown secret‘) the chairman of the Australian Prudential Regulation Authority, Mr Wayne Byres said the regulator was unlikely to ever disclose what capital controls it will impose on individual banks who do not exercise prudence. He told the house economic’s committee:

Prudential regulators are traditionally the people who try to operate behind the scenes—below the surface, below the radar. Financial institutions survive and thrive because they have confidence and the community has confidence in them, and you are happy to put your money into the bank, you are happy to take out your insurance policy and you are happy to invest your superannuation money because you have confidence that, when the time comes, you will get your deposit back, your policy will be paid and your super money will be there.

Unfortunately no institution is perfect, and sometimes issues arise. Prudential regulators tend to try to operate behind the scenes to get issues fixed and to avoid them becoming a source of concern to the community. If we can do that well and head off problems before they become serious problems, that is actually reinforcing of financial stability, because it is preserving the confidence that exists in the system.

The Reserve Bank of Australia (chair of the council of financial regulators) had been waiting on the many proposed macro-prudential controls to be implemented before it further slashed the cash rate, at the risk of fuelling the credit fuelled asset bubbles. On the eve of the rate cut this month, Westpac announced conformance with APRA requests. The bank said it would apply stricter loan serviceability tests to new property investor loans and tighten lending to foreign investors.

While the industry is tight lipped and potentially overwhelmed about all the new lending restrictions, brokers have indicated the National Bank, Commonwealth and Westpac have all removed package discounts to investors and tightened serviceability requirements. Negative gearing tax flows have been removed from serviceability requirements. Assumptions on rental incomes have been slashed.

Brokers also report two of the major banks have slashed maximum loan value ratios (LVR) for loans to non-residents from 80 to 70 per cent.

Bank recapitalisation begins in earnest

We reported last year (‘Have the Big 4 just flunked APRA’s stress test?‘) and (‘Australian banks not the safest in the world – far from it.‘) that there has been growing concern about the lack of loss absorbing capital our big 4 “advanced” banks hold.

Two weeks ago, NAB went to the market, cap in hand, to raise $5.5 billion, one of the largest capital raising in history. $3.4 billion will be sunk into the troubled Clydesale Bank in the United Kingdom, leaving a spare $1.5 billion left over to bolster the balance sheet back home.

Westpac on the other hand has announced plans to raise an additional $2 billion capital through a dividend reinvestment scheme.

CLSA’s bank analyst Brian Johnson has suggested the big four require an injection of more than $41 billion in additional capital over the next coming years. According to his estimates, CBA will need $13 billion, ANZ $11.9 billion, Westpac $11 billion and NAB $5.1 billion.

Banking stocks officially in correction

News that our banks will need extra capital injections, and with the outlook of further super profits diminishing among a challenging regulatory environment and potential property bubble, has caused a plunge in the bank’s share prices.

Since the peak only weeks ago, ANZ’s share price is now down 14.1 per cent, CBA down 14.3 per cent, WBC down 19.4 per cent and NAB down 14.0 percent.

» NAB exits property loans for SMSFs – The Australia, 6th May 2015.

» Investor home loans tighten as regulator APRA clamps down – The ABC, 18th May 2015.

» Big four banks hit iceberg after APRA’s Wayne Byres talks mortgage risk weights – The AFR, 1st May 2015.

» Westpac dividend reinvestment to boost tier 1 capital ratio – The Sydney Morning Herald, 4th May 2015.

This is why the G20 in Brisbane approved BAIL-INS for re-floating banks. It’s time to get your funds out of the big 4 internationally controlled and owned banks. Now that the bubble has been identified, the smart money will be heading for the doors. My guess is after September the fire sales will begin as lenders start sending out margin calls on all the over leveraged, over priced properties.

News of increasing vacancies are not a good sign for a bubble.

http://www.afr.com/real-estate/residential/residential-vacancies-rise-in-sign-of-market-slowdown-sqm-research-says-20150518-gh4a2r

I can see the knock on effects. Higher vacancies lead to a renter’s market, which then leads to a lower rents, lower returns on investment property, which increases losses on negative gearing which increases loss deductions on taxes, which reduces government income tax takings, which reduces the government budget, which cuts government spending, which starves the economy even further!

“Negative gearing tax flows have been removed from serviceability requirements. ”

Is this precaution a move to factor in a higher unemployment figure (loss of income = loss of tax deductions) or could this signal the government/Treasury is not committed to preserving negative gearing?

The writings on the wall… looks like its the Mums and Dads who will be wearing this correction.

Too big to fail, although the Real Estate market will meet its demise, Tax payers will no doubt bail them out. Not to mention our great country will be the first to impose tax on savings and let’s not forget that bail in legislation is sealed. Next on the list we can eat emu meat so the kangaroos don’t feel discriminated against. Oi oi oi.

I wish I could edit my previous comments…

http://www.afr.com/real-estate/inner-brisbane-apartments-10pc-unoccupied-no-price-growth-20150520-gh5kh1

Oversupply is here already.

The housing market is a croc of shite.

We are wanting to buy a place in Hobart, but even there, you pay 600k for a very shoddy box in a very average hood. We WILL NOT buy, even if we have the money.

With enough shit thrown, soon or later the straw man will fall. IMO things tend to hold together with the odd shock hitting from time to time. However, for any system to break down, requires more than a few shocks all hitting at the same time.

We have a dumb government, a disinterested general public, a reserve bank with their hands in lolly jar, growing debt, a minning downturn, a slowing China, a European Union showing signs of falling apart, Russia and the USA at each others throut, not to mentions the grossly externalized costs of energy and environment.

I have no idea how this will play out, but sooner or later, with enough weight behind us, we will slip off the edge. Who knows, maybe we are aleady in freefall and just don’t know it?

Maybe, with the budget, we have time for one last round of suckers?

“Collapse Now and beat the Crowd” JMG

Lenno

A house market apocalypse is coming. I think there will be a general downturn globally.

What is happening with IO loans? I heard unconfirmed reports the banks have cracked down on IO as well. Makes sense considering they represented over 50% of investor loans and pose greater risk to bank capital when the market starts to collapse.

An Australian bank has finally made the first move to clamp down on housing investors

Maximum Investor (Foreign or local) LVR for CBA’s Bankwest customers now 80 percent.

Late last year I went to a bank and tried to see the highest mortgage they can lend me. I already have a house and plan to sell it and move somewhere else so I wanted to see my ceiling according to the bank.

The banker said 750K AUD.

I chuckled and he asked me why, I told him who in their right mind would pay for a 750K house on my income. He said, plenty apparently even with lower income than I. Which made me shake my head, I told him I dont plan to be in debt long term and always target 10-15 years as my ideal time frame in paying off a house. He tried to tell me 25 years is pretty common, and I stopped listening and just ended the inquiry short after.

Basically… Australia is indeed in trouble if there are a lot of people with mortgages that cost a lot higher than their house worth and income affordability. Not to mention the investors who are paying top dollar for peak price housing benefiting from tax breaks… they’ll be in a rude shock when they find out their “hard work” and struggles net them losses when they try to sell.

And the property madness in the Sydney continues on. Tonight on Sydney talk back radio station 2GB, Ross Greenwood reported of a house in West Ryde that rose in price from $940,000 to $1.7 million within the space of 12 months.

When will this insanity end?

@ admin:

I suggest the drop in LVR is purely a test: If CBA were serious about it, they would have done it across all their brands, but no, it’s just on bankwest ATM.

So will this change of LVR affect the market much? Not at present, there’s still waaaaay too many predatory lenders out there.

The link below is dedicated to those who are naïve and gullible who do not believe in conspiracy theories but prefer to listen and trust politicians who are professional liars and the government generally which is the most corrupt institution in any society.

http://www.theguardian.com/business/live/2015/may/20/greece-june-repayment-ecb-support-live-updates#block-555c93b0e4b0920abfc30edb

@ theo,

Yes your right regarding Government especially ours. They are puppets and there is no democracy. One thing absolutely estounds me is that at every election most people believe that with their vote they have a chance deciding our nations future as if Jesus was being voted in. They all lie, they are all full of shit.

I see a bad moon rising

I see trouble on the way…

No bubble. I repeat. No bubble

http://news.domain.com.au/domain/real-estate-news/skinny-surry-hills-house-sells-for-965000-at-auction-20150523-gh7lv9.html

Mark Twain quote,

If voting made any difference they wouldn’t let us do it.

prepper

Good point Jj.Overseas investors buying real estate by phone.Nevermind that locals can not bid unless they are involved in criminal activities.The inequality here is like an expodential graph going through the charts.When you compare the average workers,on single income,purchasing power for residential property in Sydney in the seventies to the present tragedy.Our children do not deserve this slavery.Pawns in a game are not victims of chance.Does not matter who is in power same lie different face.

Hey guys, my dog is moving out, I’m selling his dog house on his behalf. My dog is a non smoker and it is a one bedroom dog house but it does have potential. It will be up for auction starting at around 260k. If your keen get back to me. Thanks.

Getting back to you on that dog house. It recently sold for 620k to a Beverly Hills chihuahua.

@Me,

i have cash

will fit it out myself and out bid anybody…………

prepper

As the banks worldwide get closer to insolvency again it is interesting to note the global move towards to a cashless society. The idea being no cash, no bank runs. It will of course fail as individuals will always transact amongst each other.

https://www.youtube.com/watch?v=6t4wIz_-kNE

Time is money. Delaying the information so that the spriukers withdrawing with max profits… Dirty politics!

Max D Leverage

The law of unintended consequences says that if cash is removed from society, people will replace it with something else. In such a situation you would expect that gold would shoot the moon.

Norther beaches,Sydney.

One of those beachside suburbs that are littered with 1960-70’s unit blocks row to row is now littered with for lease signs.

I grew up in this suburb, live close by still. I decided to beat the traffic and do the rat-run through the streets. I knew the for lease sign had disappeared for a while and was coming back,

But Jesus. 3-4 different signs in each one. Few have none. The tend to be the nicer modern builds, which I reckon are the downsizer’s. The guy doing the signs is making good coin in my book.

Really people, I saw that many. OMFG.

Two thoughts were: there’s the rush for the door and second was gotta tell you guys.

And just when you thought the multinationals (including banks) could not possibly take even more control of governments, out come the details of the TPP “trade” agreement. This document which is being ratified in our name in total secrecy, has only 5 chapters out of 29 which refer to trade, the rest are about the rights of corporations over governments. It gives them the power to sue governments over perceived loss of income should they compete with them or restrict them in any way. It will affect every aspect of our lives and finish the job of hollowing out economy started by globalism.

http://www.zerohedge.com/news/2015-05-27/julian-assange-tpp-deal-isnt-about-trade-its-about-corporate-control

While I agree with the sentiments most people on this site express … prices are still rising. Anyone hazard a guess as to when we will start to see them falling?

@ 28

Yeah I can’t see it happening in Sydney and Melbourne, the demand factors are still there i.e record low interest rates, rabid foreign investment, wet lettuce-leaf FIRB, high pop growth, un molested negative gearing, SMSF’s, FHB grants, property porn tv shows, corrupt state and federal govts (both sides).

Some states have/will flatline and mining towns will fall as the mining boom comes off the boil.

So unless we stop foreign property investment, interest rates rise significantly, have a full blown recession or get politicians to grow a pair and make changes to negative gearing(lol!) we will putter along as is.

Sorry to pee in your lemonade.

Recession within 12-18 months according to the smart guys over at MacroBusiness. It would seem that they know what they’re talking about, given their prediction of the collapse in IO prices well before it happened.

@ 26 Patrick,

Mate you need to video that and chuck it up on you tube.

Remember how they say no one saw it coming….. Prove them wrong

millions of Australians aren’t that smart, prices will come down. Sit back and watch.

I see all these predictions of a correction and they sound alright. I wish prices would correct.

But lately I am wondering if all the economic analysis makes any sense at all. Although the reasoning seems true, perhaps the premises are not.

I think that if the economy was based in real wealth, the analysis would make perfect sense. But since certain institutions can create money (debt) whenever they want, then nothing is real. There is no mathematics.

Some of us work, some produce stuff, create wealth. But others simply don’t need to because they have the right to print it. Probably not quite fair.

The private sector wakes up every day wondering how to make money. The Public sector wonders how to spend it (for the good of all the people including themselves). The banks just print it and charge rent on it to whoever they give it to.

In this sense, I suppose, in a simplistic way, that the economy readings are secondary. Somewhat important, but we really don’t need exports, or profits, or anything. We simply need someone to print more money, and a crowd to go and speculate with it. The rest is irrelevant.

I think that while they are in printing-lots-of-money-mode, there would be this “prosperity” and boom, regardless of anything else include debts bigger than profits. The debts will never be paid, but perhaps rather be served with our taxes.

Like average_bloke says @ 28, while people believe in the property porn tv shows, they will still speculate. This would happen regardless of reality, regardless if their investment actually loses money.

I suppose it is like an MLM scheme. As long as you can manage to have people going through the roller door, or bums on seats, you can make money. What you sell (and if it works) does not really matter, as long as you can have people turning over. Things that promise hope like healing or being rich in the very distant future are the better.

In a very abstract way, wealth, even if it was real (like gold), does not matter either. What matters is what we believe. For example, if people didn’t put value in gold, then it will be worth nothing. You wouldn’t work a day for gold.

However today Australian’s are working their day to get what they think is money. So again, as long as they believe in the property porn TV shows, everything will keep going.

The problem that I have is that despite not agreeing with the way money (debt) works in our civilization, despite not agreeing with people speculating with houses (food and everything else they can of course), I still need to live somewhere, and eat, etc. So I find myself simply trying to participate as little as possible in this system, but wondering how to change it, how to make a difference. I might be a minority though.

@33

You’ve got it. The central banks, and some of the banks, create cash from nothing. You’re completely right regarding the mathematics. For every dollar in existence (it’s actually debt..money is borrowed, hence printed) there needs to be more printed to be the interest repayment…so debt must have more debt to pay it back, which needs more debt, so 1 does not equal 1: It’s a system that will fail.

6000 times in history fiat currencies have failed, but here we are using it again………. But in a world first, we all trade in US$, which is also fiat…. Crazy.

I think the thing you miss, is that the rich declare that fiat currency is the best thing there is and that gold, silver etc are unnecessary….

Yet why are the rich pouring money into real tangible assets at a rate never seen before: Gold, silver, art, cars, antiques, critical CBD business properties, key stocks etc. etc.

Because they also know that fiat will fail.

Now when you learn that the USA took over 200 years to get a base money supply of $1trillion….but since 2009 through QE1, QE2 and QE3 (with QE4 in the pipeline:- don’t believe the hype about USA raising rates) they have QUADRUPLED their base currency you come to realize the whole show is collapsing under it’s own weight. We did nearly lose the whole lot in 2009, but the taxpayer was there to bail everyone out and keep the system going.

So while we do work for printed money, don’t allow yourself to become to complacent, as it will fail. It has to fail. When, I don’t know.

All I know, is there is no way I’m going to have a noose of $X00,000 around my neck when it goes pear shaped, and regular run of the mill houses and properties are shown for what they are: An investment that should return a fair rate, and for that to happen their prices must plummet: It’s mathematically impossible for wages to rise to meet them, it just can’t. We’ve set the world up for a massive disaster, but almost no one is preparing.

Hell, I hear on the radio today they say Aussies are now only two pay checks from homelessness…WTF? Are you serious.

If after 23 years without a recession you don’t have a financial buffer, I have no sympathy for you (extreme circumstances excluded).

Average Australian’s can want same sex marriage, but guys, let’s get things in perspective here.

@ 42

There is nothing wrong with the way you think so if I were you I would continue thinking the same way. Just my opinion , all the best.

FortyTwo – spot on mate!

@33 “wondering how to change it, how to make a difference.”

They say the best way to send a message to the government is to stop spending. Simply cease any discretionary spending.

I read this little gem the other day stating “What’s wrong with the global consumer? In the immortal words of Howard Davidowitz, a leading expert on retail, consumers “don’t have any f’ing money.”

And this is in part true, or they have money and are simply no longer willing to give it away. Yep ANDREW (37) choose not to spend! That would be my clan. Wee little roof over head, money in pocket, no debt, almost zip overheads, no salary, multiple income streams, fix everything, grow most, stop caring what folk think, enjoy more free time to learn and share.

Folks we are already over the edge (economy, energy, environment) and picking up speed. Collapse now and beat the crowd.

I read once that the IMF had given up trying to work out the rationale behind the Aussie housing market. Well I’ve seen why.

One of our neighbours sold their house for $200,000 more than they wanted to Chinese (no surprise there) and then our other idiot neighbour went in next door and they all started discussing why the woman next door wouldn’t sell her house because she wanted a backyard and what they would do with her property blah blah. But what happened next was amazing, I noticed they had wide eyes like all staring at each other in a frenzy and almost babbling incoherently. Three nutters stood before me and I realised our housing market has reached what seems to be a cult-like pitch. I’ve only ever seen this behaviour from nutty religious cults.

That’s why it doesn’t make sense as they’re all believers of what seems to be a real-estate/government/media driven property cult.

It’s to the point where you pass anyone talking in the hallways at work and all you hear is the words “property” and “investment”. Along with it comes arrogance, stories of ripping off renters and other subjects that make my blood boil.

Ultimately, “Mum and Dad” investors will get the bankruptcy they deserve but unfortunately for those who used their brains and didn’t get sucked into this cult, the government will rape our bank accounts to help the idiots out.

Estupidos ,

Well said, pretty accurate too as I hear the same rubbish at the lunch table at work. I actually giggle to myself , I think how stupid do you have to be. These same people who think a walk around the block will save your life and live by the food pyramid and microwave dinners. And yes the idiots deserve to go bankrupt. We all will be talking about this for many years after and I am interested to see what they eat for lunch then. Until then folks.

http://www.abc.net.au/radionational/programs/backgroundbriefing/2015-05-31/6500468

Ouch ! Five investment properties underwater.

@Skichaser. Great link. Love it how she is blaming everyone else but herself.

“Diane says if the miners were allowed to stay in town rather than at mining camps, the bust would not have happened.”

Ironic that she was probably pumping up rents each month. Coal prices have crashed, and now her homes are too expensive to rent. She has priced herself out of the market. The mine operators have no choice but to implement 100% FIFO policies to stay solvent.

Should be a wake up call for all investors – they are all pricing Australia out of the market – we are now the highest cost economy in the OECD. When all the jobs go, they will too be screaming like Diane – From Sydney & Melbourne to auto towns like Adelaide.

‘So I’m working seven days a week in my consultancy business just to pay the interest on those mortgages. I’m not paying the principal, just the interest, to stop the bank coming after me. It’s a pretty awful situation to be in.’

She should just declare bankruptcy. She must be delusional and waiting for the recovery.

@ Pete – And after thinking about it, people like the investor mentioned would quite likely have other properties elsewhere out of the mining areas, that could possibly be needing to be placed on the market to help cover losses in the previous mining boom areas. Its is then simple to see how these localised ‘bubble busts’ way out bush, in fact do reach far away into the suburbs in the cities as you quite rightly mentioned. I wonder how ‘Diane’s’ there are out there ?

@estupidos: Thanks for saying it. I totally agree, it looks cult-like, and if so then Australia is brainwashed with this propaganda and in this way the are happy slaves in a huge ponzi scheme totally unaware or perhaps oblivious of their imprisonment and the harm they do to others.

They are so unaware that anyone that dares talk the truth will be bashed or burnt in the fire…

I hear the same chats at work. Its like people’s ego’s, identities, self-worth is based in the investment properties they have, and not in any virtue or good deeds. Some justify themselves saying things like “I took the risk”, “I made it”, “anybody could have made it”, etc.

There is no virtue in speculating, and holding assets, monopolizing, etc. It is immoral and inconsiderate, a sophisticated way of enslaving.

I suppose the propaganda helps make it look like a noble, elite-like, endeavor. But it is just a ponzi scheme, called the propperty “ladder” (Pyramid?), in which you benefit from the suffering or work of others, which in a nutshell I think would be the most basic definition of evil.

Rather than wake up in the morning and think how to make this a better place and help others, you think how to “own” titles (like properties) so that others have to work and pay you while you don’t work or produce anything for this world.

Again like you said, this is nothing new. It is probably the same old greed and evil, dressed in the shape of “i am a property investor”.

The people that invest in mining towns should know they are high risk / high reward. They like to blame it all on the FIFO arrangements but don’t attribute anything to other factors like the downturn in mining that has happened as well as overbuilding in the mining towns that occurred during the boom. They built houses in these mining towns without actually keeping track of all the other new builds that were occurring in the same area at the same time. There are now hundreds of investors who have been burned by Moranbah.

Lol Diane,

There is hard work and gratitude and there is stupidity and speculation.

Hindsight would say to me she’d be swimming in cash today had she just rented a studio unit in Melbourne, worked seven days in what I’m sure is her own successful buisness and not bought any property.

Instead of the problem of “my mattress is stuffed with cash where do I put it?”, she’s just tipping a fortune down the drain. Just to end up a bankrupt in the end anyway. Pure comedy.

Lemmings I tells ya, Lemmings!

http://m.news.domain.com.au/domain/real-estate-news/rare-riverside-toorak-estate-soars-13-million-over-reserve-at-auction-20150530-ghd6iw.html

“It was two local buyers in the end, and obviously there has been a big surge especially by off-shore money for land in Toorak, but it was local buyers that really fought it out tooth and nail,” Mr Armstrong said.

Nothing quite like cash up foreigners forcing up the price of our own land, eh! Sure, we need ‘investment’ for Australia…

@ Skichaser

……and this is why I own bank shares and not “investment” properties. (and she’s a consultant? people are paying her for her opinion… well..there ya go)

A religion is the best way I’ve heard it described actually. I love how it’s publicly acceptable to bash my share investments…but never talk bad about property. Never!

Prices across the nation down in May. Although the article tries to put up excuses… Lets see how things go in the next few months.

http://www.theaustralian.com.au/business/property/house-prices-slip-in-natural-correction/story-fn9656lz-1227377708363

Today marks the day we are “unequivocally a bubble” according to Treasury Secretary John Fraser.

Now lets watch who lies and denies. Hope someone is keeping track of these quotes because the vested interests are going to seem awfully silly in retrospect.

btw: Must be nearing time for the annual Real house Price Index update?

soon will be the time to short everything

prepper