Brent crude plunged 6.7 per cent last night after the OPEC oil cartel decided against intervening in the market to quell steady price declines. The cartel agreed to keep their output ceiling at 30 million barrels a day, sending the futures price to a four year low of $71.12.

Brent crude has now fallen 35 per cent in the past five months – 15.8 per cent of that fall this month. West Texas Intermediate is down 31 per cent since July.

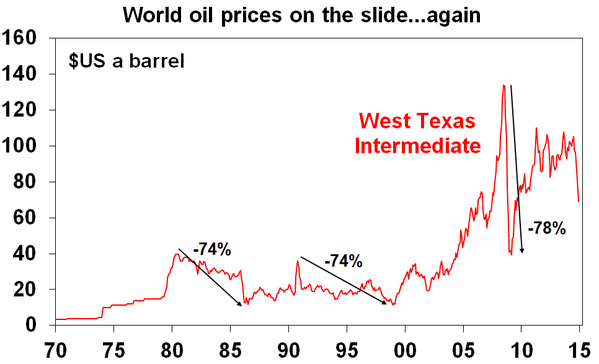

This is a chart, Shane Oliver tweeted today:

Some of the fall is believed to be attributable to the United States gaining oil independence through local shale oil production. But this production is extremely expensive and could be one of the reasons why the cartel decided to do nothing, hoping to price U.S. shale oil out of the market.

Another cause is thought to be falling global demand for oil, especially from regions such as China and Europe. Two months ago, the International Energy Agency (IEA) said a sudden drop in oil demand for the second quarter of 2014 was “nothing short of remarkable.”

It has some wondering if the fall in oil prices is a leading indicator of falling world demand and the onset of the GEC – The Global Economic Crisis? (Note the 78% decline during the heights of the GFC)

The lack of intervention is said to be an indicator that world oil prices will continue to decline for now.

» Oil price collapses after OPEC nations decide against cutting production – The ABC, 28th November 2014.

» Oil rout threatens to spoil Australia’s gas bonanza – The Age, 28th November 2014.

» Drop in global oil demand ‘nothing short of remarkable’ – Who crashed the economy, 14th September 2014.

So I can keep my quick ute and will be able to buy a cheap home one day sweet!

How much of the commodity price collapse is due to simple USD strength, caused by the FED unwinding of QE? (Albeit most likely temporarily).

The chart of oil in AUD might well look a bit less exciting.

How can anything anywhere be correctly priced, when the value of the global “reserve currency” has no measurable independent value, but is simply priced according to the whim of the FEDERAL RESEVE central planners?

A monetary cancer, is in control of trade.

Many producing nations like Nigeria will get desperate if prices continue to fall. It will also expose how badly the real economy is doing as opposed to the enchanted world of stocks and shares that have no link to reality.

Oil price down, iron ore down, tax revenue down. There go’s Negative Gearing – can’t afford that anymore.

Very, very interesting times. Oil, gold, interest rates all plunging.

Yet most countries are printing, and increasing (even the RBA is in on it now).

USA supposedly has tapered: We will see how long for.

Japan back in recession, with crazy monetary policy trying to increase inflation against a falling yen.

China house prices all over the place depending on who you believe.

Annnnnnd, then there is Australia. Don’t think I’m trivializing it, but we are more concerned about the state of cricket than anything else ATM.

Oh, and the FIRB review, found: Money entering Australia is good.

Interesting, interesting.

Well imagine that the possibility of world oil price hovering around $20. That’s just a sort of thing to bring out a full blown war…

and this

https://www.bullionstar.com/blog/koos-jansen/citibank-releases-anti-gold-report-just-before-swiss-gold-referendum/

@ Michael Francis

Sorry mate, but you are dreaming if you think Sloppy and Wingnut are going to make changes to Negative Gearing when their polls are in the toilet.

No, the government will drive this economy into the ground(if they haven’t already) before the voters’ sacred-cow is to be slaughtered or even roughed-up a little bit.

@ Average bloke

I think you’re right, but not for the reason you sprout.

I think when the collapse happens, bail outs/bail ins will occur.

When the housing appears to have bottomed/flatlined, then they will remove negative gearing so they can get back that $XBillions they hand back every year.

Once I learned how currency is produced, it become clear that deficit spending is the norm: How far they push remains to be seen.

If oil hits $20, then all hell will break loose: No western/developed economy will have a manufacturing base when pantec container ships carrying 12,000 containers will move around the world for hundreds of dollars each.

I’ve long said oil was too cheap: If it was expensive shipping cars from Japan, UK, France, Korea would be a hell of a lot dearer, allowing us a bit better chance to compete, but meh, Aussies are too worried about spend a couple of red notes per week at the servo.

Some nasty, nasty s%#t is brewing: No one has the answers, but the old rules of drop interest, print currency are not working.

Treat your personal finances as if you were the president of your own country: Build it strong, build it safe and build it so it can be shaken, but not collapse (physically, the price of assets will be very unstable).

Make sure you have a skill that can earn you $$$$ even if things get as bad as possible: Learn to fix a bike, a roof, a leaking tap: Any skill that can’t be off shored.

I know too many accountants that though they would be rich: Kinda hard when you can’t find a job because India/Manila/Philippines/Malaysia etc etc will do it faster (not limited to 8 hr days) cheaper and more accurately (they care about jobs not AFL, golf, $15K bicycles etc).

Fun times

Some history,

http://www.collective-evolution.com/2014/11/28/10-things-about-gaddafi-they-dont-want-you-to-know/

prepper

We’ll get deposit holder bail-ins before negative gearing is even remotely touched.

@ Arthur It wont matter about NG, IO loans won’t look too attractive as prices go backwards as these investors use IO because they the property will never go into the red and always into the black. Imagine paying interest on something falling quickly, no thanks.

The perfect storm is brewing…

Revenues on ore and oil are plummeting along with the tax receipts. From your Centrelink bogan to the middle class have NO idea what is barreling towards them. Too many of us are maxed out on debt and need money to keep pouring out of the ATM.

They’re about to find out where it comes or DOESN’T come from.

It’s clear now the government is shitting itself, when will the affluent population catch up?

@ Patrick The general public have no real concern from what I have witnessed people don’t really grasp any of this. Even with hard facts in front of them and news coming out. Latest being Chevron laying off many. Many people believe that they will somehow protected or battle out the hard times and manage to repay mortgages. The problem is though if they think of renting their own homes out there will be even more rental stock and growing unemployment.

@Paul

Gaddafi was supposed to be the “tyrant”!

Kinda looks more like the schmucks running this country.

The sheeple will believe anything..

Look around people…Aust is fast becoming the not so lucky country!

AUD is at its lowest level since July 2010, going as low as 83.97

@Patrick

http://www.9news.com.au/national/2014/12/03/11/39/australian-economy-slow-growth-lower-than-expected

http://www.theage.com.au/business/the-economy/gdp-australia-enters-income-recession-dollar-dives-as-economy-stalls-20141203-11z2bk.html

And so the manipulations continue. As with all the commodities, interest rates, libor rates & energy, the financial petroleum ( 20 to 1 derivatives ) is controlled by the western central planners. It has nothing to do with supply and demand. It is ludicrous to think we have an oversupply of oil when so many of the producers are troubled states with uncertain supplies. Think in terms of the financial war already declared on the Russian economy and the ruble, with added advantage of cheaper gas in the US prior to an election.

My prediction, and disclaimer

I have no licence

Less than 3 years,

Gold to the moon silver to Jupiter.

This doesn’t mean they gain in value.

It means currency’s lose value

The wizard of oz:

An oz of metal will be an oz of metal as an oz of metal has been for almost 6000 years.

These metal will still be the same oz of metal in another 6000 years..

prepper

In 2017 I will buy my first house…with cash

Ah Australia.

Everyones bitch.

You know… Speaking of cheap US oil. I now know more people living in the US and overseas than I do living in Australia haha.

Under 30

Everyone has seriously left… I feel like the tool that got left behind in a sinking ship haha.

When you get taxed 40% then a 10% gst then stamp, duties and host of others. Then paying 10x your wage for a house… and getting told oh btw, you gotta retire at 70. Because the generation before you went on a debt spree that you have to pay for with insane house prices.

Fk Australia right off.

We only spend about $50 a week on petrol anyway so its not like cheaper petrol will make a massive difference to our savings/spending.

BHP and Rio have upped production to kill off the smaller players. Once they are out of the picture in 2-3 years they will do what Qld coal did and ‘shut down’ over Christmas and let prices recover again but not until the knowledge that the other miners has gained has vanished.

Good ole capitalism

@Bubby

Sources online are saying to expect the AUD below 70c..

I don’t think we’ve seen anything yet yolks!

@HueBart

Unfortunately what we are experiencing in Oz is not capitalism. What we now have is Corporatism with the large banks and oligopolies directing government at the expense of the people. What BHP & Rio are doing to mining Coles and Woolworths are doing to retail. Anybody who thinks voting in elections will change anything is delusional. If you want change to bring Australia back to what it was, boycott the current party system and the corporates and shop local. It’s easy so why leave?

@Realist

Yeah its certainly dropping. So much for the days of $1.10 a few years ago when the govt claimed it was high due to our strong economy.

There is now talk of RBA to cut rates further 🙁 Of course all the neg gear clowns will see another red flag and go all out nuts.

@Paul

So before gold and silver goes to the moon and Jupiter whats a good price to start hoarding those metals?? AU$300.00/oz for gold, $5.00 for silver??

I know gold is not an investment but I see great opportunities. Plus they make an excellent doorstop.

http://www.macrotrends.net/1333/gold-and-silver-prices-100-year-historical-chart

Woo hoo second GFC here. We. COMEEEEEE.

Lol

@HueBart,

we haven’t had capitalism for decades.

we live in a crony capitalism state….

prepper

@ Max D. Leverage,

if you vote in an election for Australian Government (register business in washington) you are committing fraud.

our constitution has the lion and unicorn as the seal and is called commonwealth of australia. all votes in an election for our representatives under another name is fraud

https://www.youtube.com/watch?v=umVj5XQYAi8

@Seashellscurrency,

There will be no right time to get in…

because if you decide to exchange your fiat for real tangible assets. you will have already come to the realisation that you are exchanging unbacked valueless paper to the only two currencies that have been in use and lasted almost 6000 years. as opposed to the over 500 paper currencies that have become worthless in the same time frame.

Doorstop: nothing better

you are right it is not an investment… it is insurance against the privately owned central banking unbacked fiat confetti currency system

prepper

The property prices in Sydney are still going ballistic, I was reading the Sydney Morning Herald, and here are some of the insane prices people are paying: $4.16 million for a run down house in Clovelly, $1.2 million for a mechanics garage in Paddington, and $1.5 million for a 4 bedroom home in Ashfield.

All I can say is that the next generation of Aussies will be renting, because buying a home is definitely for rich people only, or when peoples parents die and they get an inheritance. The government is hell bent on keeping this bubble going inspite of the tremendous damage its doing to the economy

I liken Australia’s current economy to a ship that has lost its rudder, and is now sailing aimlessly at sea not knowing where it’s going, or where it will end up.

Our so called “elected leaders” ie. politicians have well and truly lost the plot, and none of them have any solutions to the economic train wreck Australia is rapidly heading for.

You don’t need an economics degree to work out that the reason the unemployment rate is going through the roof (the Australian Bureau of Statistics are the masters of distorting the figures), and that is, we don’t make things any more. Manufacturing products whether it’s a car or a pair of shoes is the basis of a truly sound economy, that creates well paid jobs for people to live on, and make a career out of. What’s Australia’s economy based on that the moment?, the mining boom is over, our manufacturing is virtually dead, so all we are doing now is selling overpriced houses to each other, one big government sanctioned Ponzi scheme. So in a nutshell, Australia’s economy is based on debt (lots of personal debt), and property speculation, I can’t see that creating any real jobs.

@Seashellscurrency

keep your money in the bank account then. No chance of being bailed in when the housing market collapses, if that was going to happen then bail ins would have been ratified in the recent G20 at Brisbane.. oh wait.

and when you’re looking at that silver chart, remember that 90% of mined silver was lost over that period, & that the number of uses for silver is only increasing.

Talking of the RBA does anyone know why the treasurer gave them $A8.8 billion in the last budget when they really didn’t ask for it. In the past they paid dividends to the government. Now Joe Hockey borrows the money and just hands it over while cutting back on services and reducing bulk billing. Surely they can offer some plausible explanation or do they think “We can’t handle the truth”.

@ max

I don’t know about the purpose of the RBA payment unless it is merely a cynical bit of financial engineering to make some future pre election budget look a bit better.

Changing subjects slightly…

Consider how the moneychangers embrace high immigration, how easy then for them to show us that Australias “debt per person” is not as bad as previously thought. ( notice they never refer to debt per non government, tax paying worker) ?!

@Seashellscurrency

http://www.tribuneindia.com/news/nation/29-himachal-temples-have-gold-silver-worth-rs-178-crore/15143.html

Himachal is just a very small state if India. Got any idea?

@nsw2206

Well I’m not saying don’t hold/buy precious metals,go for your life! I WILL definitely be buying more gold/silver, I sold all of my tiny stash in 2012(thank you Cashconverters,ebay & Cashworldgold).Besides how would you go about purchasing things like cigarettes,fuel for the V8 ute,Balinese furniture,lawnmower,beer etc with a solid chunk of silver? Ahh but there will be people like me who’s more than happy to swap your metals for plastic cash. Haven’t it occurred to you that the perceived price of those precious doorstop is being rigged anyway(but don’t tell those Youtube spruikers that or they’ll get upset).

$80 to make and install,front entry jamb,fit door and house and fit lock.Can you hear me.OZ back is broken.

Welcome to the cottonfields of Alabama.This is OZ into 2015.The new workers are no longer Asian or Indian but African.Do you know where this is heading.In Indonesia people work for $5 per day.One world government(NWO)is slavery for all real workers(the 99%).The elitists are crashing the economy.

Time for the next post on the Murray Inquiry recommendations?

… and then perhaps another one on which of the recommendations will be ignored by the Laberals 😉

@ 56andoverit,

There is some hope.

https://www.youtube.com/watch?v=zl3kaBSl2p8

prepper

@ Seashellscurrency’

the rigging is no longer conspiracy theory its conspiracy fact

http://www.zerohedge.com/news/2014-11-09/another-conspiracy-theory-bites-dust-ubs-settles-over-gold-rigging-many-more-banks-f

consider signing

http://www.petitionbuzz.com/petitions/aussiegold

prepper

… Lets hope the government will implement more recommendations than the Ken Henry Tax Review.