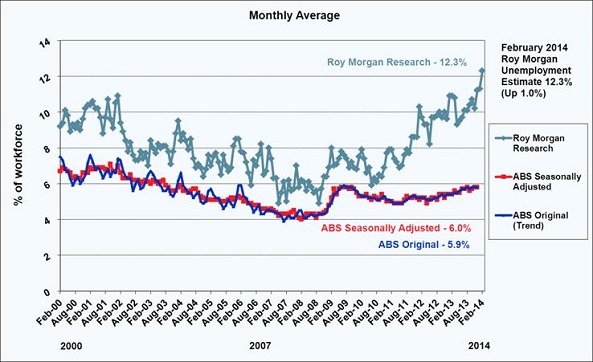

Roy Morgan unemployment figures released yesterday show an estimated 1.561 million Australians are now unemployed. This represents 12.3 per cent of the workforce and is now the highest figure since February 1994, some 20 years ago. An additional 1.08 million Australians are classified as underemployed, working part time while looking for more work.

Australia’s deteriorating jobs market was cited by the Reserve Bank of Australia (RBA) as one reason the bank left the official cash rate at an emergency 2.5 per cent yesterday.

“The demand for labour has remained weak and, as a result, the rate of unemployment has continued to edge higher. Growth in wages has declined noticeably,” the RBA media release noted after the Banks’ monthly meeting. “Looking ahead, the Bank expects unemployment to rise further before it peaks.”

Rising unemployment is expected to put pressure on Australia’s housing bubble, but the market exhibited little stress in the December 2013 quarter according to analysis by ratings agency Fitch. A study of Australian Residential Mortgage Backed Securities (RMBS) show the rate of arrears for the December 2013 quarter was 1.21 per cent, the lowest figure since 2009 according to Fitch.

But Fitch warns lenders not to be complacent and drop lending standards warning “Higher levels of unemployment, a slowdown in the housing market, and rising interest rates, could lead to servicing pressure, and in turn, higher delinquencies.”

» Roy Morgan Unemployment jumps in February (up 1% to 12.3%) – highest for 20 years since February 1994 (also 12.3%). Unemployment amongst 18-24yr olds rises to 28.0% (up 6.8%) – Roy Morgan, 5th March 2014.

» Statement by Glenn Stevens, Governor: Monetary Policy Decision – Reserve Bank of Australia, 4th March 2014.

» Mortgage arrears at lowest December level in four years – The ABC, 5th March 2014.

» Roy Morgan unemployment hits 11.3% – highest in 19 years – Who Crashed the Economy, 4th February 2014.

The ABS employs some very skilled employees I see. Can’t be easy.

Don’t they keep mortgage arrears low by lending more money to mortgaged stressed borrowers so they can avoid default?

Well if the push comes to shove people could always use up their superannuation stash to pay for their mortgages as a last resort, might as well, before the government gets hold of that billions worth Super savings and they will eventually take it bit by bit(because that’s what governments do)and not a damn thing you can do about it then.

Glenn Stevens gives a warning. He’s worried.

http://www.smh.com.au/business/the-economy/rba-warning-for-homebuyers-20140307-34b2e.html

Also a good article.

http://www.smh.com.au/business/rba-playing-a-dangerous-game-with-housing-20140305-347h8.html

Thanks Jj

To quote- “The Reserve Bank of Australia has warned home owners to be wary of taking on too much debt to buy a property.”

With first home buyers on the sidelines, who is the RBA referring to as the home owners? Are they warning the Chinese investors? (Maybe the should print the article in Mandarin like some auctions are), or are they warning the Australian Specufestor that is leveraging their retirement funds in their SMSF’s and going all in on the Ponzi?

I suppose what I am trying to say is that there are fewer and fewer “home owners” because of govt and RBA policy and those numbers are still dwindling.

Stevens is turning out to be an ineffectual joke who has now exceeded his use by date. He did this a few years ago and any specufestor who took his advice has probably lost 20% of subsequent gains. What we need from Stevens is some action such as rate rises off the historic low, advocating macroprudential policy and foreign investment restrictions because of the distortions its causing. We simply need him to do his job, whilst keeping his public trap shut. He’s slowly becoming a contrarian indicator (house prices, aussie dollar etc).