Since the GFC, Australia has literally bet the house on China. We have put all our eggs in one basket. And like Australian housing, you shouldn’t become complacent on the China miracle either.

Throughout much of last decade, many western households around the world spent more than they earned. China’s low cost emerging manufacturing sector was the primary benefactor of this unsustainable global spending spree.

This quickly changed during the GFC when debt bubbles started bursting, and global consumption rapidly declined. Demand for Chinese manufactured goods dried up and inventories soon started to pile up.

To prevent collapse, Beijing embarked on a massive 4 trillion yuan economic stimulus program. But, additionally, it told local governments to spend like mad and they did this off balance sheet, though SOEs (State Owned Enterprises) and LGFV (Local Government Finance Vehicles). This set the foundations for a large fixed asset investment boom to follow. The beneficiary this time was us, via the Mining boom.

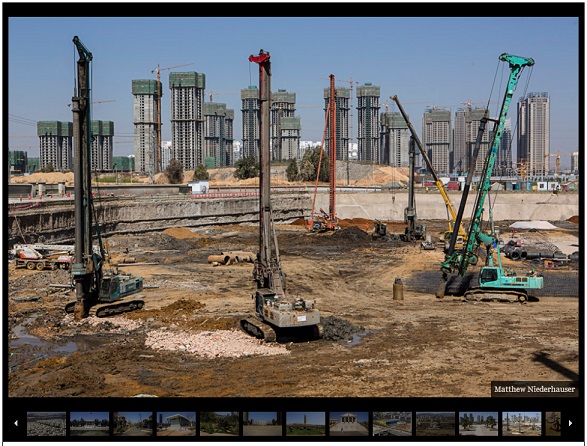

One of many photos published by Foreign Policy on June 21st 2013.

China built apartments, office towers, shopping centres, roads, transport infrastructure etc. Most were superfluous, would sit empty and with no cash flow, and create future issues when the debt comes due for refinancing.

Like other significant credit bubbles, the trick is to quickly move on the debt to the unsuspecting to reduce your risk before it blows up. China’s lenders created Wealth Management Products (WMPs). I love the name – it simply sells itself. Zero Hedge explains:

“The so-called ‘Wealth Management Products’ that are discussed widely and yet little understood are basically higher yielding vehicles pitched to a greater-fool retail audience with the goal of reducing banks’ risk at the behest of the PBOC. Of course that is not how these stuffed-to-the-gills-with-risky-development-projects deals are pitched to the investing public but they have allowed banks (and implicitly local governments) via the infinitely virtuous loop below to fund any and all things construction-based… until now.”

This has now been going on for a decade, but at an rapidly accelerated place in the five years since the GFC. About twice a year, pictures emerge of a new ghost city similar to the much publicised city of Ordos in Inner Mongolia.

Last week it was Foreign Policy’s turn to publish photos of the district of Chenggong, a 41 square mile city built 11 miles South of Kunming in China’s Yunnan province. The new city designed to house 1 million by 2020 includes 15 university campuses.

Two weeks ago, Ratings agency Fitch warned China’s credit bubble is now unprecedented in modern world history. The Sydney Morning Herald reported, “China’s shadow banking system is out of control and under mounting stress as borrowers struggle to roll over short-term debts, Fitch Ratings has warned.”

Prior to the Fitch warning a fortnight ago, the China central bank – The People’s Bank of China (PBOC) had always stepped up to provide extra liquidity when the banks and shadow banking system was under pressure allowing the problem to continuously snowball. But what happens when one day, the PBOC decides not to step up to the plate?

We came close to this last Wednesday week (19th) when the Shanghai Interbank Offered Rate, or Shibor surged and credit markets in China began to freeze over. At first the PBOC was nowhere to been seen, spooking financial markets around the world. Commentators started talking of a Lehman style collapse. The cause was believed to be a massive withdrawal of deposits in early June, including maturing wealth-management products (WMPs). Could investors be getting cold feet? Why would you not want to reinvest?

The PBOC was forced to intervene a couple of days later, once again saving the banking sector – for now. But it warned the days of easy money are over. Credit markets in China has loosened a little but still remain tight, and this is expected to have the intended impact of curbing growth going forward.

The question remains, not if, but when will the big credit crunch come.

The consequence for Australia is likely to be more severe this time. Australia has depended on mining to keep household incomes elevated and mask the effects of high household debt, caused from a significant housing bubble. As mining and the domestic economy slows, jobs are being lost.

Albert Edwards from Societe Generale says “Australia is a leveraged time bomb waiting to blow” and makes comparisons to the US subprime crisis caused in part from (CDOs) collateralised debt obligations blowing up.

“It is not a CDO, but a CDO squared. All we have in Australia is, at its simplest, a credit bubble [household debt] built upon a commodity boom dependent for its sustenance on an even greater credit bubble in China.”

On Wednesday night after a leadership challenge, Prime Minister-Elect Kevin Rudd delivered the following in his leadership victory speech:

“We have a great future, but that future is not guaranteed. In recent times I’m been thinking a lot about the state of the global economy,”

“There are bad things happen out there. The global economy is still experiencing the slowest of recoveries.”

“The china resource boom is over. China, itself, domestically is showing signs of recovery.”

“And when China represents such a large slice of Australia own economy, our jobs and opportunities for raising our living standards, the time has come for us to adjust to the new challenges.”

“New challenges in productivity. New challenges also in the diversification of our economy.”

Channel 9’s 60 Minutes will tonight air a segment on Chinese ghost cities. It will claim “vast new megacities bigger than London or New York are shooting up all over the country at a rate of 20 a year.” Tune in at 7:30pm.

» Presenting Chinese Wealth Management Product’s Infinite ‘Risk’ Loop – Zero Hedge, 24th June 2013.

» Haunting photos of China’s latest ghost city – Macrobusiness, 24th June 2013.

» The Empty City – Foreign Policy, 21st June 2013.

» China’s credit bubble is unprecedented: Fitch – The Sydney Morning Herald, 18th June 2013.

» Fitch says China credit bubble unprecedented in modern world history – The Telegraph (UK), 16th June 2013.

Well even good old Kevin Rudd mentioned about the the China boom being “over” to the viewing public the day after he got reappointed as a prime minister, what a joke. I mean the labor Party being a joke for having a total disrespect to democracy,why even vote at all,they should just have given the leadership job to a Macaque.

The 60 minutes report showed an entire city where the cranes and work has stopped. Does anyone know what happened? I would have assumed the story was filmed prior to last weeks credit crunch.

With credit availability coming under serious pressure in China, who is going t buy Harry Triguboff’s apartments?

How will this affect credit here? If at all?

China in fear of revolution if the music stopped after the GFC has inflated their housing market to the tune of 63 million empty apartments with an average purchase price of $100,000. The people requiring accommodation in the areas surrounding earn $2 per day. It makes almost as much sense as the inflated housing sector in Oz. So if our eggs are all in the China basket are we going to end up with an almighty debt omelette?

Get a spruik up ya!

http://www.couriermail.com.au/realestate/news/brisbane8217s-median-house-price-tipped-to-leap-17pc-by-2015-to-about-515k/story-fnihpu6h-1226672415235

How long will the resources / land grabs be able to continue?

AND more importantly what will it mean to the world, if/when it is no longer possible?

At home, while the Chinese population continues to grow, their carrying capacity is marginal. What will happen when the Himalayas snow melt dries up?

A mate of mine was telling me the other day Brazil is in the process of buying up Australian farming land at an alarming rate. How dumb are we.

Winner Take All: China’s Race for Resources and What it Means for the World

http://5x15stories.com/presenter/dambisa-moyo/

Woot!

http://smh.domain.com.au/real-estate-news/its-unanimous-sydney-property-on-the-rise-20130701-2p61k.html

AverageBloke, they must have a spruik template.

Im happy reading all these spruik articles re ‘real estate on the rise’, be it bris, syd, melb..

MSM is saturated with spruik and BS, so every time you read one of these articles you can be assured that indeed real estate is not booming, it is in fact still stagnant (in the face of multiple rate cuts and easy money/debt, no less).

Hence another article is produced to try and proport the contrary, that all is well. If you’re like me, once again you can read through the BS and rest assured you’re not missing out on anything by holding out.

Id find it stressful having alot of debt in todays economy, people know something is up. Good reasons why confidence is low.

@ Glenn “Brazil is in the process of buying up Australian farming land at an alarming rate. How dumb are we”. Brazil the nation is not buying Australian farm land but individuals and corporations owned by individuals are buying Australian farm land. Question , what difference would it make if James Packer or a Brazilian bought the land? You still don’t OWE IT!

Lets give the jingoism a rest mate. OYI wealth Brits owe large parcels of rural “Australian” land that once belonged to the original people of Australia. But that is another story

@FRED You’re right “a lot of individual and corporations owned by individuals are buying up Australian farm land” AND some happen to be from Brazil. Is that wording ok with you now?

And yes, I would think this could be a problem Fred.

Just as the purchase and lease of lands in northern Africa is also a problem for the locals when the food grown there is shipped away to feed some other country.

@FRED “what difference would it make if James Packer or a Brazilian bought the land? You still don’t OWE IT!”

If you can’t see the difference I can’t help you there fella.

But that might also be a problem as well wouldn’t you say Fred?

JINGOISM defined as extreme patriotism in the form of aggressive foreign policy. Now that’s a bit of a stretch don’t you think?

FRED name calling from behind the key board never really seems to promote any sort of meaningful exchange to me.

Just my 2cents worth:-)

Peace,

Glenn