A fortnight ago, we heard from the Prime Minister Ms Gillard taking about how “many Australians miss those days when they could spend all of their income, see wealth increase through ever-rising house prices, and through easy credit, borrow against the house again to spend more.”

Last Friday, it was the newly appointed Minister for Housing and Homelessness, the honourable Mark Butler’s turn to expand some more on the housing position here in Australia. Barely 5 days with the new portfolio, Mr Butler was invited to talk at the opening of the UNO Apartments Social Housing Initiative in Adelaide about the challenges of affordable housing.

This is some of what he said:

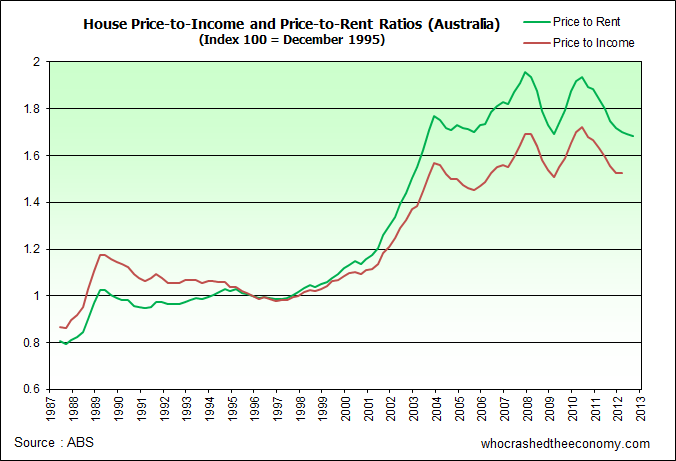

But the challenge of providing affordable housing, if anything has intensified in recent times, particularly over the last 10-15 years. We saw across western countries, particularly after the dot com bust when cheap money was looking for a place to go, an extraordinary rise in housing prices across the west, including here in Australia. Across the world, the asset increase amounted to around $30 trillion, US dollars, the largest asset bubble in human history.

We saw housing price/rent ratio, a measure of true housing value, and the ratio of prices to average incomes soar across the western world, including here in Australia. In the mid part of the last decade, Australian house prices had a rent ratio about 70 per cent higher than their long-term, or their 25-year average. What that did, was to price many Australians out of the market, price many Australians out of being able to get in to housing for the first time as purchasers, particularly younger Australians, but also older Australians who might be experiencing late in life separations, having to divide one house into two.

The Global Financial Crisis had one benefit and that was to start to moderate the housing asset bubble across the west; indeed in some countries it saw housing prices collapse. Here in Australia, we have seen a moderation in housing prices, partly because of economic conditions, but also because of some government policies, which I want to talk about.

He indicated “Government policy has been an important contributor to that moderation in the housing affordability crisis here in Australia,” choosing not to dwell on past disastrous “affordability” policies such as Rudd’s First Home Owner’s Boost, but to talk about the Social Housing Initiatives and National Rental Affordability Scheme (NRAS).

In summing up, Mr Butler said “This is a very important thing that the Australian Government has done, particularly to take advantage of those moderating economic conditions to start to puncture that extraordinary housing affordability crisis that confronted Australia over the last 10 or 15 years. I’m very pleased to be in this Ministry. I see it as an incredibly important contributor to social justice in Australia, but also to economic productivity and prosperity.”

» Launch of UNO Apartments Social Housing Initiative, delivered in Adelaide, 8 February 2013 – The Hon Mark Butler MP, 8th February 2013.

“I’m very pleased to be in this Ministry. I see it as an incredibly important contributor to social justice in Australia, but also to economic productivity and prosperity”

What economic productivity and prosperity is he talking about?

Big business is still making profits, by pushing down their purchasing prices.

Small business is in dire trouble. Many of which are funded by this ‘cheap money’ via the house ATM.

“The Global Financial Crisis had one benefit and that was to start to moderate the housing asset bubble across the west” WTF? That’s like saying lucky a hangover kicked in or I would have kept drinking alcohol all night. If there wasn’t the alcohol, then there wouldn’t be a hangover……If there wasn’t an asset bubble, there wouldn’t have been a GFC…..Jeepers, to think I am paying for this clown.

And another thing…..Did an Australian politician just admit that housing is in a bubble…….

So is he going to push for changes to Negative Gearing or is he just going to piss in our pockets?

It’s possible we now have two politicians admitting a housing bubble. Our own Prime Minister says it was a phase that could not last or be it unsustainable – see wealth increase through ever-rising house prices, and through easy credit, borrow against the house again to spend more.

Our budget position continues to deteriorate day by day so I suspect they are looking for a financial management scape goat. In saying that the Australian economy is strong and the envy of the world makes it harder to explain why government revenue is in free fall. Saying we are in the grips of a housing bubble, one that has engulfed the world (largest asset bubble in human history) helps shift the blame away from the government.

They have probably had their treasury briefings by now. Last year there was very limited hope a residential construction boom could save Australia, as the mining investment boom dies. But with Stockland reporting massive write-downs yesterday and Mirvac the week before, and residential construction falling lower and lower, this is no longer an option.

In my opinion, They are now preparing us for the inevitable. It has to come sooner or later.

Hmmm, good take on the situation Peter, I think you might be right. Could it all part of the usual ‘softening up’ process, like the little leaks that occur months before a tax hike, or before they make a serious budget cut? Have the Treasury boffins clued them up to something the rest of the country doesn’t want to hear? So the name of the game then becomes rampant buck-passing if you pardon the pun. Finger pointing in February, election in September, full-blown housing market slide underway by July? Place your bets

Admitting there’s a problem is the first stage of a cure, so good on Gillard and Butler for finally admitting what most people with an ounce of intelligence already knew. We could call it ‘Positive’ gearing I suppose.

My money is on a 30% drop in current property values by January 2015.

“Hmmm, good take on the situation Peter, I think you might be right. Could it all part of the usual ‘softening up’ process”

“It’s possible we now have two politicians admitting a housing bubble.”

Yes im on board with this hypothesis. I think the public’s being juiced up for more disappointment to come with regard to expectations of house price ‘gains’.

Politics is marketing, they dont say this stuff because they’re ‘nice guys’. Its no coincidence the Housing minister is now out saying things like “..when cheap money was looking for a place to go, an extraordinary rise in housing prices across the west, including here in Australia.”

If you listen to politicians in damage control when being interviewed, the technique is to constantly steer their replies to repetition (think Wayne Swan and ‘strong economic fundamentals’) So for the housing minister of all people to be speaking such heresy hints at a new marketing campaign for the ‘disappointing’ new circumstances.

A good way to reduce housing costs is to abolish negative gearing. It would reduce the numbers of investors & reduce prices for needy first home buyers. It would also help to reduce the govt black hole in their budget. Who knows the govt might leave our super off their hit list with their increased tax. Please everyone email your local federal member. I HAVE.

http://mobile.news.com.au/national/under-employed-numbers-on-the-rise/story-fncynjr2-1226556124515

Statistics. Science? Art?

Good article about the gen rent and the house price vampire.

http://www.thepunch.com.au/articles/dont-worry-mums-and-dads-generation-rent-are-ok/

This is the same government, under Rudd, that loosened the FIRB laws, and we have since seen around a 20% rise in house prices, even though Rudd sympathised with housing affordability, practically promising to do something about it, then did the complete opposite?

Why yes it is. Labor have ZERO credibility in this area.

i dont think its convincing when you telling people to buy, while at the mean time you are selling your own house.

http://www.couriermail.com.au/realestate/selling/pm-gillard-sells-canberra-unit/story-fndbofvw-1226573177580

Well, maybe things aren’t so bad down here after all??

LOL!

http://www.bloomberg.com/news/2013-02-19/china-housing-slaves-helping-property-rebound-mortgages.html

another EXPERT……

http://www.news.com.au/realestate/investing/when-will-prices-recover/story-fndbarft-1226582758279

Can’t help themselves, can they DX?

“Australian property prices (and economy) improved after major catastrophes such as The Great Depression, Word War I, World War II and the recent recession of 1990s. The GFC hit our shores more than four years ago and the initial negative impact of this is slowly disappearing.”

It took 20 years for US house prices to recover after the 1929 crash, and that was with a huge double-bottom and the stimulus of World War 2 along the way.

http://www.ritholtz.com/blog/wp-content/uploads/2011/03/RealHousingPrices_1890_2010_log.png

Negative Gearing Myths busted

http://www.macrobusiness.com.au/2013/02/busting-negative-gearings-myths/