Emergency low interest rates are starting to kindle a fire under Australia’s lethargic housing market prompting vested interests’ to warn we are at the bottom of the housing cycle and on the cusp of a new housing boom, encouraging punters to get in early.

Official data from the Australian Bureau of Statistics (ABS) show house prices in Australia’s eight capital cities rose 1.6 per cent in the December 2012 quarter following a downwards revision of the September 2012 quarter to -0.14 per cent. Last quarter, preliminary data released suggested prices actually rose 0.3% in the September 2012 quarter.

Perth lead the country notching up a 2.9 per cent increase for the three months. Darwin tailed behind at 2.6 per cent, Sydney at 2.3 per cent, and Canberra at 2.1 per cent. Lagging well behind was Adelaide at 0.8 per cent, and Melbourne and Brisbane both recording 0.7 per cent increases. Hobart failed to get out of reverse gear, falling 1.4 per cent for the quarter.

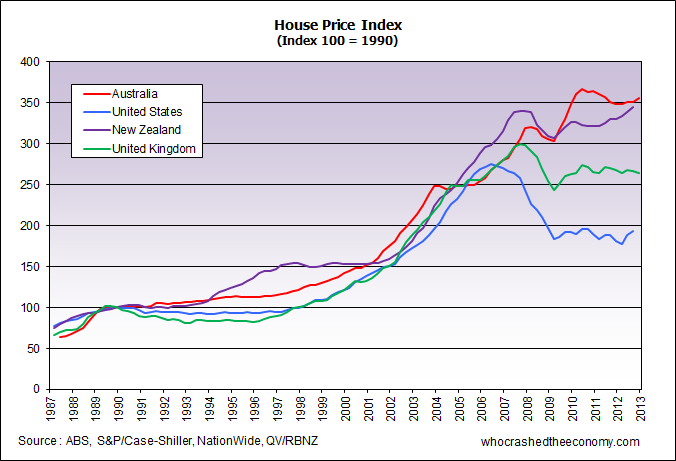

But unless you turn the following graph upside down, it is hard to see a bottom in the market.

In the middle of last year, RBA governor Glenn Stevens said the central bank should not “engineer a return to a housing price boom.”

“As it happens, our judgement is that the risk of re-igniting a boom in borrowing and prices is not very high, and this was a key consideration in decisions to lower interest rates over the past eight months” Mr Stevens said.

Former RBA board member Professor Warwick McKibbin told the AFR today, “I would not personally have cut rates in October or December.”

“It will become increasingly important for the RBA to normalise what are extraordinarily stimulatory interest rates given the striking asset price inflation we are now seeing coupled with the economy’s nominal growth. I would not rule out two hikes before the year is out,” he further explained.

As expected, the RBA decided to leave the cash rate unchanged today citing “During 2012, there was a significant easing in monetary policy. Though the full impact of this will still take further time to become apparent, there are signs that the easier conditions are having some of the expected effects: the demand for some categories of consumer durables has picked up; housing prices have moved higher; there are early indications of a pick-up in dwelling construction; and savers are starting to shift portfolios towards assets offering higher expected returns.”

But the housing market is far from out of the woods yet with many significant risks & challenges remaining. As we reported last week, growth for housing credit in December recorded the worst result ever. This lack of any boom in borrowing should give comfort to Stevens.

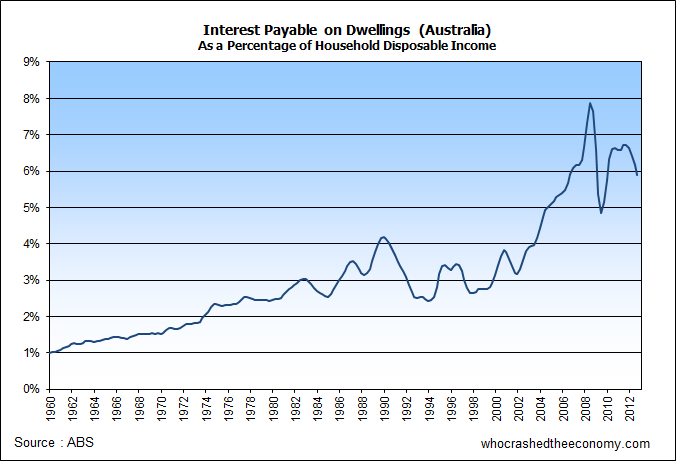

While interest rates might be the cheapest they have been in a long time, elevated dwelling prices has caused household debt levels swell to record highs. The net result can be seen in the following graph showing interest payable on dwellings as a percentage of household disposable income. Interest rates might be extremely cheap, but record levels of debt mean Australian households are still forking our more in interest payments on homes today, than in 1989 when interest rates were at the 17 per cent mark.

What do you forecast house asset prices and interest rates to do this year?

From what I can tell, the market is very heavily regulated and kept in check, plus Australia has been basically stable over the past 2 years which has meant that house prices have just basically stagnated or declined slightly.

It seems as though we’re RIGHT on the cliff… just waiting for some shock (any shock from anywhere) to send the whole system tumbling down. It’d have to be a major shock though, otherwise I’d expect 2013 to be about the same as 2012 if conditions stay stable. Either slight decline or stagnation. People need to either pay down debt, earn a higher income or get a bigger deposit before the majority of people even think about getting back into houses.

RBA will keep lowering interest rate in 2013, maybe the following year as well. the interest rate will hit around 2.0% during these two years.

So in my humble opinion, the house price will be hanging there for a little bit while, then crash like a hell. it will be 2015/16, could be early if the economy of China fall faster.

Just need the official unemployment rate to go up a couple of percentage points from here to signal that the bust is on, I think.

@ John

Asset bubbles burst in spite of employment levels, not because of them.

A fact that many amateur investors fail to recognize.

Falling asset prices cause recessions, not recessions cause falling asset prices.