After 21 years of economic expansion, Treasury is pinning its hopes on a bigger housing bubble to stave of recession after the mining boom.

David Gruen, executive director of Treasury’s macroeconomic group told a Senate budget estimates committee, “In a couple of years, when mining investment does not contribute to growth any more, we will need other things to contribute to growth,”

“One of the most obvious things [to contribute to growth] is the housing market, given that we think there is under-supply. That is a natural and desirable development and we are seeing early signs of it.”

David Gruen believes there is no sign of an housing asset bubble in Australia.

» Housing to the rescue as boom ends – The Australian Financial Review, 18th October 2012.

David Gruen is an idiot. Just a basic NPV or ROI equation will show that there’s an assets bubble in Australia with most asset purchases returning a net rental yield of 0-1%, in other words you would make more interest in a basic high interest savings account for the same level of capital invested. There’s just one problem……….. Banks will loan a young couple a ridiculous amount of money with LVR’s of around 90% to make purchases. The only real way for prices to decrease sharply, as seen in the other developed economies is through unemployment increasing in the short to medium term which is starting to begin in Australia. Interesting to see that Singapore have moved to tighten lending with LVR’s of around 60%, they obviously see the emerging risk that high personal levels of debt can bring.

Housing isn’t even a productive asset. Fancy wishing housing will give you growth following a large mining boom caused by huge Chinese stimulus.

Clearly sustainable growth is no longer an consideration.

I’m 42 years old, earn relatively well, and pay my fair share of tax. Will someone please tell me when the house price crash will happen so I can build a house for my family? I refuse to pay more than 4 times my income to buy a house, so I’ve been renting for 5 years. But I am now getting a little tired of greedy landlords, useless real estate agents, increasing rents and the scary thought that this bubble we’re all so sure about will never actually burst. How the truly poor cope in this vicious world, I shudder to think.

I find it really disturbing that a Treasury spokesman thinks there is no housing bubble.

He probably thinks that Negative Gearing has been successfull in stimulating new housing even though over 90% of all Negative Geared PI’s are for exisiting homes.

Hi Rupert, I am in the same position as you, 37years old been renting for too long now and need a house without having to deal with landlords, estate agents etc.

I am beginning to think this bubble will never burst though due to Labor government intervention in the market.

I spoke to my Irish mate the other day who has lost 4 houses, has a GBP400k mortgage on his house which has decreased 70% in value and has now moved to Australia to work.

I am extremely weary to buy my first house and and very concerned that all my hard earned savings will be squandered if the bubble does burst in Australia.

Does anyone know if there is Insurance you can take out against the banks for overvaluing a property?

ie. If they value the property now and it decreases by 40% over next 10 to 20 years, can I get Insurance for my loss in Equity?

Hi Rupert and FHB Dreamer,

I too am in the same boat as the both of you. I have been renting with my ever growing family and I can tell you, it is extremely frustrating.

I used to laugh when Average Bloke would go on about the negative geared IP’s and how prices wont come down till that is changed… Im not laughing now! I too am beginning to think this bubble wont burst due the Government.

“If you rent, the landlord gets the deduction.” …… Something is not right!

The Housing bubble here in Australia is well and truly going to burst…and I strongly, encourage Rupert and other fellow Australian renters….hold tight! The day is coming, and when it does, you and your family will be glad that you waited. Buying a neighbours or a family members house for 50-70% less than what they bought it for is going to be hell for them, but heavenly for you. Like the saying goes…”all good things take time”.

The problem in society today is that we live in a “disposable” world where everyone wants things instantly! The “keep up with the Jones’s” mentality is the reason why so many people have negative equity on their properties or have purchased homes way beyond their affordability.

Don’t be fooled by recent falling interest rates…as we all know, what goes down, must eventually come back up. At the end of the day, you can purchase a home, but with increasing unemployment rates, what do you intend to pay your mortgage with, when you have no job?

Linguistically speaking…in latin the word mortgage means “death pledge”

Fellow renters…there are “many ways to skin a cat”. One can still attain their dream of owning a home, but it doesn’t have to be by route of a 30 year debt with compounding interest.

Think “free-hold”, think “precious metals”, think “commodities”, think “outside the square”… and don’t follow what the sheep are doing!

Right now though, I strongly suggest investing in FOOD…inflation is going to push food prices through the roof.

Owning a home isn’t too much good if you can’t feed your family!

Ohhhh and I forgot..

Prime Ministers lie, Governments lie, Presidents lie, Real Estate agents lie, Bankers REALLY lie….But NUMBERS do not lie.

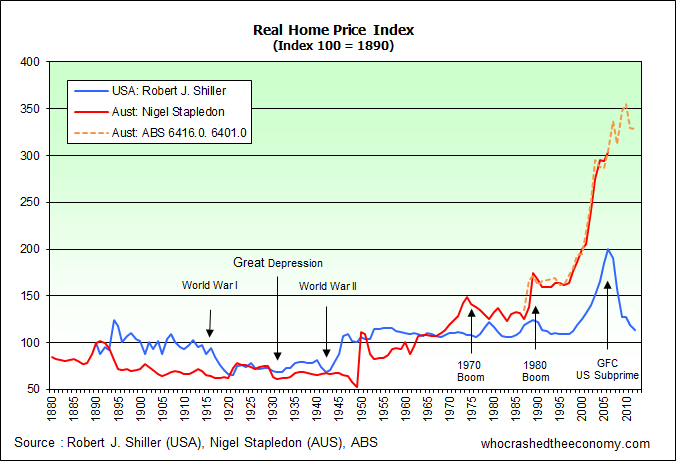

The graph says it all!

Rupert, FHB Dreamer, and Gavaroo. I’m 46 years old and renting. Been doing so since I can remember. Personally, it doesn’t bother me, and I have an A-1 landlord. We both say, “…yes, yes, ok, of course, why not?…” to the real estate agent whenever they feel as though they should appear important.

From about 1998-9, I stayed away from purchasing purchasing due to the way a very large number of people where behaving, and the very bad gut feeling this was giving me. Now I feel much at ease (financially) cause of this. I can afford to think of businesses, attempt them, and move on when I see they will not eventuate. Or put more time, effort, and money into them if I feel good about it.

I was in I.T, contractual programmer. Programmed from Visual Basic, to C#, to web pages, to active server pages, to PHP, etc. Earned well from this. I always knew things coming for the worse (and man! didn’t they ever for I.T), and I wanted to be in a better situation when this downturn came. Renting did this for me.

Boy! Was I at the brunt of everyone’s humour and sly remarks cause I never purchased. I knew people similar to me who purchased 4 investment units, plus the house they were (yes! WERE) living in. That’s financial advisors for ya’. I don’t see some of these people anymore, despite knowing them for a long time, its’ hard looking at people in pain, inflicted on themselves.

Gavaroo, I never laughed at AverageBloke, didn’t know why people threw such vile at him at times. As bad as negative gearing is, the combination of Government, Australian’s property fervour, and Australian’s willingness to starve their families and themselves to purchase another investment unit, ensures its’ immortality. You couldn’t see this? It was another major reason that stopped me purchasing.

@ Botrot,

I have been following this site for a number of years now and I have learnt a lot from everyone’s comments. I meant no disrespect to AverageBloke….. I was (still am) just green under the collar and was hoping the bubble popped much earlier! AverageBlokes comments just didnt fit my timeline or understanding.

Credit given where credit is due, he has stuck to his guns and now I agree with what he has said, in regards to negative gearing.

@Botrot “the combination of Government, Australian’s property fervour, and Australian’s willingness to starve their families and themselves to purchase another investment unit”.

I agree totally, but the trouble is, I don’t see that changing. The Abbott/Gillard popularity contest is making a mockery of democracy (I wish they’d both disappear in a puff of their own excrement gas), and most politicians I see on TV look like and sound like real estate agents or high-street lawyers. Every day I get pamphlets from real estate agents in my letter box bragging about selling this property last week or renting that property this week. They are glossy and cost a fortune to print. They are SCUM! Australians treat property like pornography and are addicted. Those magazines with all the pretty pictures of houses in are not called ‘property porn’ for nothing. And as for your last comment, I constantly see mothers in their designer clothes, driving in their $60k SUVs, yet feeding their kids crap! What is wrong with everyone here? Has no-one got any sense? This ‘keeping up with the Joneses’ mentality will kill this country.

So @Watchman – WHEN is this going to happen? I’m with you and Steve Keen all the way, but I’m running out of patience with the government and the sheeple that vote these cretins in to power.

@FHBDreamer – Great idea about the insurance. I wonder if anyone would take a punt and underwrite that…

@Gavaroo – there are many more like us out there, but I’m inclined to agree with @Watchman. Stick it out a but more if you can.

Peace and integrity to you all.

I’m living and working in Ireland ATM. Left Brisbane and came back home in 2008, just in time for the recession. Australians haven’t a clue whats coming. I’m 43 now, never bought during the boom times and boy i’m glad now i never did. Many of my friends who bought houses back in 2003-2007 are now f*cked. Most are in negative equity to the tune of 300k euro with very little job security. House prices have dropped 60-70% since 2006 which has wiped a lot of people out. I on the other hand have a few 100k in the bank which i saved over the past 10 years, a good job and no debts. I’m very happy renting a nice apartment near work with no stress.

I was thinking about heading back to Oz next year but I think your economy is going south over the next few years. If Australian mining tanks i’m not sure where jobs are going to come from. The word on the street this side of the world is that Australia is heading for a fall…….lets hope that doesn’t happen.

I emigrated to Sydney from the USA about 10 years ago. After 4 years, bought a house. Sold it 3 years later because the 90 minute commute was ruining my life. Wanted to live closer to work but couldn’t afford it. So, 4 years later again I bought another house. Turns out it was another 90 minute commute (two hours some days). Add to that, went from a dual income to single income household. Two years later, sold that house partly because of the commute and partly because we couldn’t afford the $5000/mo mortgage. I have since left the country in disgust and returned to the USA. So far, it’s best decision I could have made. Housing is 50% less expensive and I’m still earning the same money. Net effect: a 40% tax-free lift in my purchasing power.

The Aussie property market won’t crash. There is too much vested interest and wealth consolidation to allow it to run its course. At best it will stagnate over the next decade (or two) until prices normalize. The bust will never come. You will wait in vain (if you don’t die first). So, you have four basic choices:

1) Change your mindset and accept reality; buy the house you want but can’t afford

2) Buy a house you loathe and can barely afford

3) Keep renting until you die

4) Leave the goddamn country

You know, Aussies bang on about “a fair go” and equality. Politically and socially this is fairly true. But economically, it’s very much a feudal system. New entrants to the game are at a huge disadvantage and are – fundamentally – screwed. It’s a great country but it isn’t THAT bloody great.

Correct me if I’m wrong, I don’t believe there is ever a case of a bubble not bursting. Certainly, we have the government propping it up wherever and whenever it can. As the bubble gets larger, it will become more volatile and the government will find it harder to control, especially when state and federal income starts tanking and unemployment starts to surge. Sooner or later the government will lose control of the bubble.

The question about remaining in Australia or moving overseas is, I believe is about living in Australia after the crash. It’s becoming quite evident that another boom will mean we will skip a deep recession and move straight into depression. David Murray’s comments last week that Australia will start looking like Europe is, in my opinion, spot on.

@Tom – Bubbles do end but they don’t all end the same. Some explode violently, most do burst and some deflate slowly. I expect the Aussie housing bubble to deflate slowly (very, very slowly) because of the feudal nature of the Australian property landscape. Between the gov’t, Big 4 banks and a small cadre of land barons the Aussie property market is under very tight control. These guys can’t stop the wave from crashing but they can certainly shore up the banks (literally & figuratively). You can plainly see it in action since 2008. They won’t give up without a fight and they have a lot of weapons at their disposal.

I’m 40 – I can’t wait 20 years for the property bubble to slowly deflate. This is why I have left the country. There is nothing in Oz that I want anymore. Screw the sunshine, I want a place to live.

I rent, 415 dollars a week, i have a family, my wife has never worked, i am part time, i work 2 -3 days a week, i invest my savings in currency devaluation assets every time they crash, every on else around me is working full time and say im crazy

Im up 150k in 6 years, they are in debt over 300k to 400k for 25 to 30yrs

we will find out who wins when unsteralized qe3 seeps through the system in 2013

at least most of us here take the time to read the facts most housing investors i know are too busy weeding their garden, not that i don’t like weeding my garden, its just that my gardener will weed the gardens for me

Jimmy – This housing bubble in this country by world comparisons has reached a monumental peak – we have gone so high that it will simply not be possible for a very very slow deflation of house prices, they will crash and hard.

Australian ignorance and blind stupidity eventually will have a light bulb moment but by then it will be too late. Our private debt levels will not allow us to get out of the forthcoming mess scott free.

The prudent will have their day while the profligate will have the devils work to do !

@ Tin Boat Bob

I agree! While government meddling and Negative gearing, buyer boost’s etc.. All provide short term ‘stabilizations’ in prices, they ultimately push the bubble beyond predictable and controlable collapse. When it collapses, it will be so big, so fast that those hurt by it will blame EVERYONE except themselves.

I bet an iced coffee (thats all I ever bet 🙂 ) that we will even see headlines such as “House price collapse caused by cold capitalists, who refuse to enter market”.

Can anybody tell me if this graph is adjusted for inflation ?

@Urban Hermit – Yes, the above graph is corrected for inflation (Real).

@ Tin Boat Bob: I would like to agree with really – truly. But there are many factors at work in the Australian property landscape. Some immune to the free market. A few come to mind:

1) Land rationing (as identified by Demographia…always a good read)

2) Negative gearing (which leads to the next point)

3) Property hoarding (both private & government feudal lords)

4) Heritage listing (ramshackled brick boxes)

5) Money printing (via low interest rates)

6) Poor infrastructure (keep ’em boxed in)

7) A quasi debtor’s prison (i.e. the banks can seize everything you own)

8) Draconian land usage laws (good luck cutting down a gum tree)

9) Even more draconian environmental laws (and if you do cut one down you will replace it with 10)

10) Even MORE draconian development approval laws (those 10 trees must be precisely pi meters apart)

Aussie real estate experts bang on about how “different” the Australian market is to the US market. Well, it’s true. It IS different. The US market is mostly open and subject to the “invisible hand”. The Aussie market is very much a closed feudal system that is heavily protected. I loathe it.