Prime Minister Julia Gillard joined the ABC’s Q&A program Monday night to answer the questions and concerns of everyday ordinary Australians.

Robyn Tracey from the audience asked the Prime Minister a couple of questions on tax reform including this one on negative gearing:

Why hasn’t negative gearing been abolished despite recommendations from the Ken Henry tax review and leading economists in the country?

It’s a great question.

In April last year under the headlines, Talks test the water on negative gearing change, The Age reported, “THE Gillard government has sounded out unions over steps to cool Australia’s housing market, with measures that range from a new sales tax for investors sitting on large property portfolios, to curbing the popular strategy of using negative gearing for multiple properties.”

The Ken Henry Tax Review prepared in 2008/09 had warned elements of our tax system could affect macroeconomic stability. The report stated “The existing tax system is also likely to encourage excessive leveraging in pursuit of tax-preferred income. Where capital inflow is used to finance less productive assets [residential housing], this can also affect long term macroeconomic stability. In this regard, recommendations to provide a more neutral tax treatment of savings, to reduce the benefits from negative gearing and eventually abolish stamp duties on housing would also help improve macroeconomic stability.”

The report recommended a more uniform savings income discount be applied across most asset classes to prevent tax distortions created from negative gearing.

In a two day tax forum held in Canberra last October, Saul Eslake, an economist with the Grattan Institute said “There is no country in the world that allows negative gearing as generously as the Australian tax system does.”

Debate was reignited in April this year by NSW Opposition Leader John Robertson. A day later, Treasurer Wayne Swan indicated “The government has committed to the current arrangements and is not contemplating any changes.”

Reaffirming Treasurer Wayne Swan’s statement on negative gearing earlier this year, Ms Gillard told the Q&A audience:

“For negative gearing we didn’t agree with the Henry Tax review, we ruled that out. We think an abolition of negative gearing would cause distortions to the property market we didn’t want to see.”

It is an interesting comment, considering many economists and tax experts actually believe negative gearing causes the distortions, encouraging property “investors” to leverage up into, what is now, low yielding, unproductive investments in the pursuit of a favourable tax treatment.

Others believe abolishing negative gearing will cause all the rental accommodation to simply evaporate overnight. On Q&A’s facebook page, one viewer wrote “If you abolish negative gearing millions more will need public housing which the government now relies on investors for. Those on rental assistance won’t have anywhere to live.”

You have to wonder how other countries address this very issue, considering only very small few in the world have adopted negative gearing, including Canada, New Zealand, and of course Australia. Perhaps non-owners in all the countries without negative gearing sleep on park benches at night?

But there could be some substance to what Gillard is saying in the short term. Unfortunately, negative gearing is a legal tax rort in Australia and an immensely popular one at that. According to figures from the Australian Tax Office for the 2009-10 financial year, there are 1,110,922 negatively geared property investors with total losses on investment properties totalling $4.8 billion. (In 2007-08 losses totalled $8.6 billion.)

As Reserve Bank of Australia governor Glenn Stevens said on Friday, the decade up to 2007 was quite “unusual”. Household debt grew at astronomical levels and asset prices such as residential property surged. The likelihood on seeing a similar phenomenon anytime soon is close to zero.

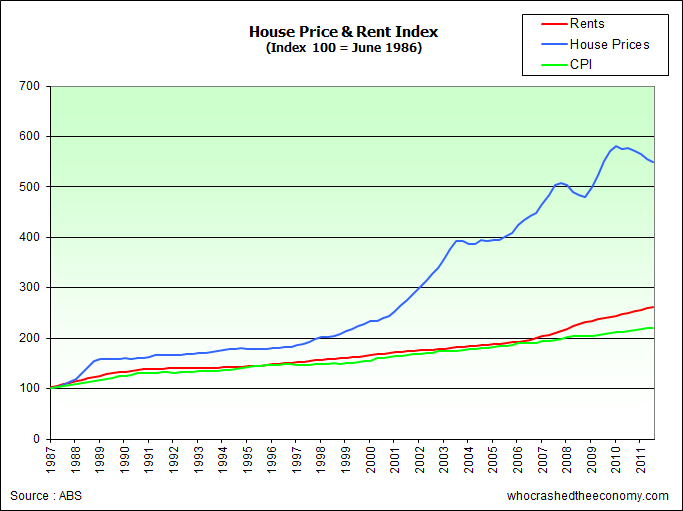

But as house asset prices surged, rents barely grew faster than inflation. This has created a reasonable deterioration in rental yields. At first, this didn’t faze the property investor as what they lost in yield, they made up for in capital gains. Well that was, until recently. House prices have now been falling for almost a year and a half and there is no end in sight.

The warm and fuzzy feeling of avoiding tax blinds many to the low yields property is currently returning and acts like a slow decaying force field, holding them into the market. Slowly the investor will wake and cut their liabilities, but they won’t all leave at once, on mass.

This is important in the political blame game. Just like the carbon tax is the cause of anything and everything remotely negative happening now, the Gillard government doesn’t want the abolition of negative gearing to be the public cause of the property correction.

In May last year, the Australian reported on a 32 year old couple “selling because they are frightened the government may abandon negative gearing on investment properties.” According to the article, “The house has been on the market for more than 180 days and, although there have been many viewers, there have been no real offers and the agent has already persuaded them to drop the price by $20,000 to $290,000.” I could be mistaken, but I only heard about the negative gearing debate a month earlier, so either they had a tip off five months earlier, or this is some political point scoring. It could be July 1985 all over again.

I believe the Gillard government (subject to still being in power), will abolish negative gearing, but not now. They will do it in a couple of years when the time is right and when negative gearing is no longer effective.

» Australia’s Future Tax System Review (Ken Henry Tax Review) – Australian Government, 2nd May 2010.

» Prime Minister Julia Gillard joins Q&A – ABC TV, Monday 11th June 2012.

» Time to axe negative gearing – Saul Eslake, The Sydney Morning Herald, April 25th, 2011.

As worthless as my opinion on Negative Gearing, yes it should go, it has to go. I agree with AverageBloke on this one, it ain’t going anywhere.

Negative Gearing, or the removing of, has nothing to do with good economic decision. Australians are so feverous when it comes to property, they’ll debt slave themselves to the point of anxiety and depression. Thinking it will lead them to riches.

It remains, and that’s a political descision, so all else will bailout the Negative Geared. The entitled class are not the welfare recipients, it the property (self perceived) owner with their hands out.

Gee! House prices have left CPI for dead. People must be eating Vegemite on toast 3 x day and sleeping on the floor.

What annoys me the most in this debate is that Dillard and Goose won’t even make one small tiny change to NG. The reason I assume is because they know the entire property market hinges on it by a hair trigger. I’m not for the complete removal of NG (that would be as stupid as Labor) as it could be a force for good if it only applied to tax concessions for ** NEW ** housing.

Dillard and Goose are so out of touch with average working Australians that many of us are really pissed off that Labor defends the status quo when they of all political parties should be making changes to make the property market more egalitarian. They truly are gutless and deserve to get smamshed back to the stone-age next election.

Leave it alone ! If investors want to negative gear good luck to them !!!!! Just because house prices are too high and are now falling we have to change the law??? WTF

We should be allowed to fail in life and hence we learn not to repeat our mistakes.

The notion that politicians can fix something is completely f**ked.

Wake up punters, government destroys wealth, despite their front happy talkfest (talk it up crap) and the trick is to avoid them and their destructive policies.

Still reckon the banks are crashing the economy as so many are debt slaves leaving the people with no say or power!

How about limited government and some liberty in life, instead of the Nanny state !!!!!

I have saved and saved for years, worked bloody hard and built up enough money for a very healthy deposit on a house (50%).

Yet as a self-employed person, having just arrived from the UK, looking for a 50% mortgage to buy a house in Sydney, not only are the monthly repayments MORE than renting the same property, no bank will lend me the money anyway!

So now I’m spending all my savings on renting house where I can’t put up bookshelves. (Don’t property investors/professional landlords read?) I can’t put my money anywhere else – as interest rates are so low and stocks are going down, so unless the situation changes, I will have no money left to buy a house when the time is right.

Why are the frivolous rewarded and the prudent punished? It’s all so unjust, and goes against every principle of frugality, hard-work and the ethical lending practices that have been around for most, if not all, of the 20th century.

Bring on the crash. Abolish negative-gearing, raise interest rates and let’s get back to some semblance of normality. I fear that won’t happen however until all the vested interests (bankers, bureaucrats, politicians, real-estate agents) have had the comeuppance. We could be waiting a while.

Have to agree with Botrot here, NG will stay until multiple property acquisitions are no longer supportable through the availability of cheap credit to the masses.

Rupert, landlords are not in the business of providing homes for people to live in but to make capital gains. They do not create any value for renters and in fact do the opposite. Property investing is unethical yet they are rewarded with tax breaks while people like you and I have to suffer from their actions.

The sooner the crash comes the better.

NG does not need Govt to repeal it. We are at the point where NG will ultimately repeal itself. NG is now its own hostage. It’s the classic case of an en-mass (1.1 million participant) prisoners dillema. Unless NG’s collectively continue to create exponential increasing debt to replace exponential declining Owner debt, the entire scheme will collapse taking NG with it Note… NG have a taxpayer subsidised interest rate whereas Owners do not, so from a buying power perspective NG must eventually capture the entire market as ultimately almost no Owner will be able to compete as a buyer… End result… Impossible to liquidate the asset & monetize… Asset = 100% debt + 0% equity… game over!

Interesting Peter but I think it’s alot more complicated than that. If only it was that simple.

I’m always sceptical when one of the leaders of the banking cartel speaks, but this is a pretty big call from Gail Kelly.

http://www.news.com.au/money/money-matters/westpac-managing-director-gail-kelly-says-years-of-compound-growth-in-house-prices-are-over-for-good/story-e6frfmd9-1226395093277?sv=ea255c1e73e15f966b5e727f5ad09deb

I’d agree with Peter_W. If Kelly’s call is correct, looking at my neck of the woods where a 3.5% gross yield is as good as it gets, the average 30% taxpayer buying the average property still forks out about $9K per annum after tax in pursuit of capital gains…….PER PROPERTY! You can negative gear till the cows come home, but that’s completely suicidal. I think the cultists have something to be concerned about here.

Random question: if house prices drop a lot will constructing a new house get cheaper. eg it would cost about $400K to knock down and build a suitable 5br house for us. If house prices halved and we could move and buy a decent house in the same suburb for approx 300K who would build a new house? Would they have to get cheaper?

Wow! Arthur P. What an article! I wonder if, “…Australians were rejecting the high levels of debt that allowed them to borrow vast sums against the equity in their house.”, means many people are running for the payoff all debts finish line before they pass on to the next world? I ask cause still to this day all forms of debt, private, public, credit card, personal finance, re-financing,… is still on the up.

Here are the interesting times.

There are 193 members of the United Nations. 3 of them allow negative gearing. I’m sure we can do without the PM’s preferred distortion if 190 other countries can manage just fine without it. All that is required is political will and a transitional plan.

@ Bobby Fisher

The transitional plan is presently manifesting itself… a price collapse

@ AverageBloke

You have 2 years of maths to catch up on

On a National basis this is what has transpired during the past 2 years

5% p.a. asset price decline & 5% p.a. mortgage debt growth

This is what has happened to National LVR ratios for those with mortgage debt (in aggregate)

Year 0. 50% LVR

Year 1. 55.26% LVR

Year 2. 61% LVR

We are at year 3. If this continues at the same 5% p.a. asset price decline and 5% p.a. mortgage debt growth

Year 3. 67.42% LVR

Year 4. 74.52 LVR

Year 5. 82.36 LVR

Year 6. 91% LVR

Year 7. 100.5% LVR

In aggregate at the banking system level

APRA will have a hand in how this all plays out very soon.

http://www.apra.gov.au/adi/PrudentialFramework/Documents/APS-112-12-12-07-Final.pdf

For banks to continue lending at 5% p.a. mortgage growth with asset prices falling at 5% p.a. the banks will need to raise $120 billion of risk capital (spread over 5 years) just to keep lending at 5% p.a. mortgage debt growth into a 5% p.a. asset price decline.

Credit creates deposits…

IT IS the 5% p.a. mortgage credit growth that is causing the 5% p.a. price decline

THE NG’s are not keeping up their end of the prisoners dillema bargin… CREATE MORE DEBT than 5% p.a. or you will get wiped out,

This is how all ponzi schemes end!

If mortgage debt does not continue to grow…. the equity for the debtors = 0

@ AverageBloke

For asset prices to just stablise at the present level, the NG’s need to double (actually slightly more) the quantity of mortgage debt they are presently creating… So as far as I am concerned… NG’s are a hopeless cause, they have totlly abdicated their monetary responsibility for propping up the credit driven ponzi bubble… So they will get what they deserve.

@ AverageBloke

NG will be repealed roughly 5 – 7 years from now. At that point 1.1 million NG’s will have lost 100% equity in aggregate. NG’s will be villified by politicians for being the CAUSE and the damage THEY HAVE CREATED to 2.6 million other INOCENT households (voters). My brief lessson in politics TO YOU is… Politicians of all flavous will wait until they can blame a minority for their OWN political omissions (rather than being associated with the cause of the problem). Politicians will always position themselvels in-frount of the (damaged) majority (of voters) to repeal SOMEONE ELSE’S past mistakes, that was not of THEIR immediate doing.

Banal but true

Totally agree with you Peter and I hope you are right about the repeal. Shame we have to wait that long.

AverageBloke

FWIW… There is no such thing as ‘equity’ in housing in a money sense of the word

Housing is a physical asset with a title

There are banks

Banks are simultaneous double entry record keepers of loans = deposits

There is the potential to create a loan = deposit at banks

Banks prefer title over physical assets as security for loans

The creation of a loan is the only way to monetise equity

Therefore a loan ($M) = a liability ($M) = deposit ($M)

If a Loan = (0$M) then Equity = (0$M) it follows therefore that a clear title with 100% equity = (0$M)

How can anyone spend money which is the circulation of ($M) their equity in a house?