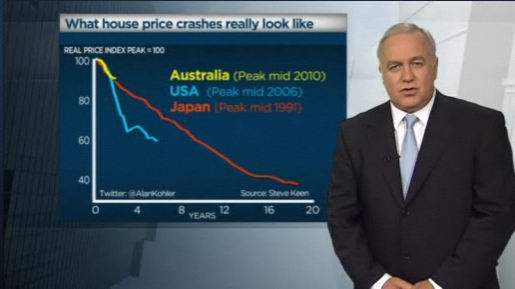

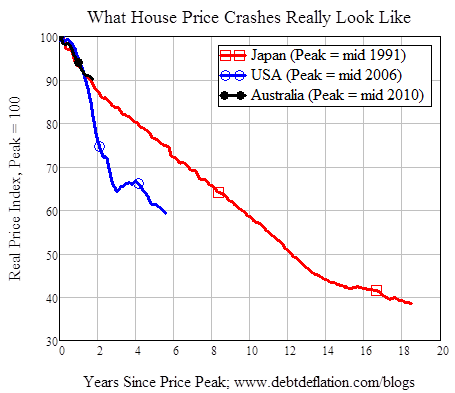

A graph prepared by Steve Keen has featured on the Kohler Report (ABC News) last night showing how Australia’s house price correction is tracking with the Japan and USA housing bubbles.

Kohler told viewers around the country, “disturbingly, according to this chart it’s the same decline from peak at the same point of the big Japanese and American housing crashes of the early 1990’s in Japan, and 2006 to now, in the US.”

» Kohler Report – ABC News, 2nd May 2012.

» Australian House Prices down 10% from Peak – Steve Keen’s Debtwatch, 1st May 2012.

I bet that got Cristopher Joyes blood pressure going.

We will have have a slow melt Japanese style because of Negative Gearing.

And I bet Rory Robertson is putting a lot of time in at the gym on the treadmill. Guess he is getting ready for Mount Kosciuszko.

“We will have have a slow melt Japanese style because of Negative Gearing.”

Won’t make a difference if there aren’t enough new entrants to the market.

So I’ve got to wait 18 years to afford a house? Or, buy one now as the worst investment possible. The world’s going to hell in a handcart!

The Australian house bubble has popped, now we just watch as people run for the exit. Every 1% on $500,000 is $5,000 so with housing so leveraged this is going to hurt people. Sell now if you plan to, price are not going anywhere but down for a long time it seems.

I don’t think that the Japanese spent like drunken sailors like aussies have. The aussie mortgage (ATM), the wealth effect, baby boomers trying to cash out before losing so much, and just the sheer size of the bubble we have blow will destroy house prices in OZ.

Agreed the bubble pop is well underway. As soon as the media starts printing articles quoting real estates saying we have already hit rock bottom, you know things are heading South. Not to mention all the recent articles about how we have never been better off and to spend spend spend.

So Australia is not different all

So there is a bubble

So houses prices do go down

If only people will wake up!

Just been made redundant. Very unexpected. That leaves me out of the credit bubble.

Sceptic, sorry to hear. However that isn’t an excuse for spamming this site over the past week with comments containing multiple swear words. Naturally, none were fit for publication.

@Sceptic

I’m NOT sorry to hear that… really hope it’s true… but I don’t

I have just bought a house 30% down from it peak in North West Victoria. I hope prices drop fast. But I think the government will try and soften the crash. How long will people wait to buy 5, 10 or 20 years? of decline.

Admin, very sorry but I was frustrated. Just made redundant after 15 years, and it’s very confusing as to what direction to take from here. Lots of conflicting information.

@ Macca. If your happy that my whole department got outsourced to an off shore company then good on you. I don’t know who you are, but you better hope that it does not happen to you. It’s the worst feeling imaginable. I have been working with these people for years and one day your whole life changes just like that. Some of the people that I worked with had huge mortgages and if they do not find work soon, they will get caught out, especially the ones where both partners were working in the same dept.

Soon they will outsource their brains to an offshore company. It cheaper.

The point is if your happy that we lose our jobs in OZ to overseas companies who pay their workers $2.00 an hour, then maybe you will be blessed with this opportunity in the future.

Don’t take on too much debt.

Been there Sceptic, about 10 years ago, both wife and I working for the same company that went bust. Tough times indeed, but in hindsight opened our eyes and we’ve exceeded our expectations since through further education and good budgeting.

Your last line is the key and it will bring the economy to its knees if we are in fact slowing. In days where I had debt, my question wasn’t just can we cope with interest rates rising to X%, but can we cope if one of us loses a job. Later it became can we survive if we both lost our jobs! That should be the new analytical baseline. That said, it was far easier 10 years ago where the price/income ratio was still relatively healthy. Still, if that sort of conservative approach had been reflected across the market we wouldn’t be in this bubbling mess.

So, I don’t pity any adult that decides to leverage to the absolute limit of their family income with the expectation of housing based riches. Ignoring the risks is paying little respect to history.

Not really living up to your name Sceptic. Over ten years ago, we had an economy that (we were told) was great by the Government, low interest rates, banks that gave you a (huge) loan, an economy that gave you a job, mortgages that were much greater than 3.5 times one’s salary, and you *sceptic* (by name), like many others did not even think, “there is something wrong with this picture”? Nothing smart sceptic, it really is that basic, its’ arithmetic not mathematical, in determining ones financial position. No sympathy. Whether such decisions were emotional, calculated, mis-calculated, perceived status based, or feeling of moving ahead, your work-mates didn’t come out too well. No sympathy nor empathy. OK, what person doesn’t take risks thinking that they will come out the winner? Only few people win, that is what has happened here in this environment. This economy has crashed, now badly for many people. For some, things are great and couldn’t be any better. The new debt-slave-servitude class for most is their own doing by simply not thinking, not doing their arithmetic. Cannot even blame mis-calculation cause they didn’t calculate.

Now to blow my own trumpet Mr. (Mr by assumption) skeptic. From 15-16 years ago I was in I.T. Software development. Never had what was (once) known as a permanent position. I contracted via a Pty. Ltd. company. I did very well out of it. Earned much better income than those I knew with high powered professional incomes. They bought really expensive houses, no! that’s incorrect. They bought into very big mortgages, the expensive car, and seven credit cards. I was always at the brunt of their humour for renting. It never one part of an electron bit bothered me. Ever meet a person on just under $400K pa and now broke skeptic? Broke from years back, just wasn’t surfaced back then. How would that be? No! It wouldn’t be causes house prices always go up, would it? Skeptical back then? No?

2009 was the last I saw of highly paid, relatively large I.T. projects. But that was OK, I didn’t need to panic. I can afford to look into other business ventures, many that didn’t take off (that’s the risk I mentioned above), some that look promising, and I am now in a postion where I do need to act, but not panic. Like my very humbled, stressed, heavily in debt friends that no longer are able to pull in that 320K salary.

You sceptic, come here with such moniker, adversarial to what is posted here, and not once in the past 15 years being sceptical on what was going on around you? If you are concerned for your work-mates and even yourself, I’ll leave you with this adage based on Spartan Fatalism, its not the first striking blow that matters, its the bounce back that counts.

Best of British luck Squire.

Hi guys,

I’m looking into the Australian housing crisis and found statistics on repossessions (“Civil Property Possession Applications”) in Western Australia here:

http://www.supremecourt.wa.gov.au/content/about/statistics.aspx

Does anyone know where to find the same statistics for the other states?

They are out there somewhere. These people have access to the latest figures too:

http://au.news.yahoo.com/today-tonight/latest/article/-/12486561/mansion-repossessions/

Thanks

Jeff

Jeffrey, you have me on the hunt with that post of yours. So far I found this, I know, I know, maybe not significant but, I’m looking.

House repossessions up in Broken Hill

http://www.abc.net.au/local/stories/2012/01/09/3404348.htm?site=brokenhill

They give some stats.

My last IP sold at auction yesterday! One bidder which luckily negotiated and paid just under our original reserve. We are very relieved. Have paid off our principal place of residence and are waiting to ride out the crash.

I have been following this website for over year now and really wanted to thank you for the information. I agree with everything you have said and am glad to have had the alternative to the often rubbish printed in the general media.

I was lucky enough to be in the United States during 2008 and 2009. I saw their housing crash first hand and then tried my best to hold back my good friends and their partners all leveraging themselves with a “whatever it takes” attitude to get into the West Australian property market.

“Oh but we’re different”, “It’ll never happen here”, “it’s a long term investment”, “I don’t want to pay someone else’s mortgage” These were all the typical replies I got..

I’ve been following this site for 6months plus and also work in the building industry. Best thing I ever did was Rent save up what most would use as their first home deposit and then invested this into a start up company.

Time will tell… But I’ll be renting for quite some time and I’m happy about it! I’m used to the judging faces when I say I’m renting. Lumped straight into the lower social class who ‘can’t afford to buy a home’.

Keep the good articles coming!

The only thing causing this slide is the media and critics..before cruising a wave you must first slide DOWN the face until you gain momentum, you can ride the wave till you want to exit, just don’t crash.

BotRot, thanks for looking. All the media have these figures, yet not one of them say where they actually got these figures from. For example, by googling “nsw 2466 writs”, I can find 55 results, mostly saying that there were 2466 writs of possession in NSW in the 10 months to November last year. But where did they get these figures from? None of them say! What is their source?

“New data reveals 80 houses are seized a month, while up to a third of people in the worst-hit suburbs are struggling to pay rent.” New data from whom?

Some of them even break the figures down. For example your abc link has figures for Broken Hill.

But I think your link gives some leads that all the other links I’ve found don’t:

“State Government statistics show…”

“Attorney General and Justice Department figures show…”

Let’s try googling “State Government statistics” and “Attorney General and Justice Department”…

Thanks

It appears I am not the only one having trouble finding repossession data for states other than Western Australia.

http://www.macrobusiness.com.au/2011/07/repossessions-rising/

“I am unable to find any more recent data for most of the states as their supreme courts do not make their data directly publicly available. The only state data I can find is Western Australia, and in that case the data clearly shows the same trend:”

The funny thing is I believe that Mr Alan Kohler was a skeptic of Steve Keen’s warnings in the past.

I’ve also read that a bunch of morons who borrowed more than they could afford…. and then were foreclosed on, are setting up a political party to try and win seats to force regulation of the banking sector and order lower interest rates.

House prices don’t always go up,the first home buyers have been suckered with a bribe.

We can already see prices dropping in most areas and houses sitting on the market for extended periods.

Blood Sucking Real Estate parasites have had it too good for far too long, wont be long before they are convincing sellers to take less while they still can. What sales pitch are the Spruikers going to come up with next ?

Well, looks like the so-called budget is just another round of welfare for all those “Little Aussie Battlers” out there…. my they must be a great investment……

Things like a sovereign wealth fund or business investment must really be bad choices over this class with the entitlement mentality. Lets just hope China does not fall over too soon, else the cheque may bounce.

I noticed one ratings agency (S&P) has already come out and stated that this welfare budget is just plain dumb and risky.

In the USA and elsewhere they are going to drop business tax to try and get manufacturing going again, what do we do? rev up centrelink instead…..

Look… Keen’s great. He’s definitely onto something. There IS a housing/land bubble. People ARE too indebted. There will be blood. All agreed.

But overlaying one (or two, or more) chart/s over one an other is just intellectual chicanery.

Yes, it indicates how the other countries’ crashes tracked. And, so far, ours is tracking the same way.

Yet, overlaying our data on their data just because the curves just so happen to correlate isn’t some kind of prediction of the future. The “Australia Line” could go up from here. It might go down from here; tracking Japan down, or America down… or even sharper. I saw this same chartist trick back in 2008… but do you remember what happened then? Therefore, the 100 value at the top of the Y axis is an abstract value and an assumption.

If the chart helps average people to reconsider the reality of the current economic situation, great. If it frightens The Gov. to bail out the market again, bad.

@ Chief Squirrel

Keen’s research is much more than that graph. The graph is just an attempt to visualise somethings for the masses.

Anyone looking for another example of a crash as a result of inflated prices, a false economy (due to the nearby celtic tiger) and household debt should look at what happened here in Northern Ireland. Watching Oz is like watching what happened here, just 5 years later.

My property is now worth 65% less than it was in 2007. And back then, we all thought the only way was up. ireland’s Celtic tiger would keep roaring.

Ireland doesnt have the billions of tonnes of mineral wealth that Australia does.

@Belfast Dad, I and others have spoken about the Celtic Tiger phenomenon, and similarities to Australia. It was impossible to tell Aussies this. I don’t know what response others had, but the response I received from Aussies was, “…I don’t think so…”. And the most classic slam down I received for having the audacity and bad taste to compare us to Ireland was, and I’ll never forget it, “…don’t you know? We have China Ireland doesn’t!…”. Well, OK….! I ponder.

Many Aussies deserve what they get, I do consider those who will be caught up in this due to the stupidity of others.

Well the “knock-on” effect to the local economy in the South Coast areas of NSW is becoming very obvious – in the shape of closed retail establishments. The first to go are the “very discretionary” trendy eateries, followed by boutique fashion / retail.

Just hope no-one in Australia is expecting assistance or sympathy from the EU / USA – they’ve been there whilst our “World’s Best” Wayne Swan seems to have ignored all the lessons they learned the hard way, and been very happy to wag the finger at everyone else since “Australia was showing them all the right way to run the Economy” – into the ground.

So much for being a “one trick pony” – no industry (except for mining), and with just as good iron ore in Africa for far less money, even that’s over. Maybe the “Carbon Tax” will accellerate the demise, but in reality it’s not the straw that will break the Camel’s back, just an added impost on all Australian society, for doubtful (and possibly nil) benefit short or long term.

ok Ireland doesnt have mining (we are well aware of that), but the comparison i was making was about property prices and household debt. My Australian friends still talk about “pushing yourself”…. get that bigger house, release that equity, remortgage…. all because “property can only go up”.

People in Ireland thought they were invoncible, it was incomprehensible that anything could change. That is also an attitude that seems to be prevalanet in Oz.

i’m not saying its the same place, i’m saying many of the attitudes and patterns are the same. And look where ireland is now. Europe’s shining example of wealth, property boom, inward investment, skilled employees…. now on its knees, and mostly because of ridiculously overpriced property, and household debt.

People “pushed themselves” just that little too far.

@Belfast Dad, to clarify a little better there is more delusion amongst Australians when it comes to Mining *BOOM*, and “…but we have China…” hand slaming argument finisher. If Australians (the people) were the true beneficiaries of resources here, we would not be at this cliff edge, or slanted hill (for the soft landing folk).

Property here, just as everywhere else was not shot to the high heavens in price by Mining *BOOM*, it was debt fuelled, like many (if not all, I don’t know) other asset classes here. Countries that don’t have resources were also fuelled by debt and credit issuance. The profits of Mining *BOOM*, are predominantly in private hands, that’s the direction all wealth seems to be going these days. The minions can own the debt.

The debt level in this asset class (property) here is just about 100%. Either Australians are heading for a huge salary increase, or a huge increase in GDP to bring down that debt level, I doubt that 120%, or we’re heading for the bucket of very cold water on our sleeping faces.

Australians were “gifted” a few short years from the housing bubble burst in the US and UK to get their affairs in order. How could anyone sit by and watch annual housing price increases of 10%, 15% and even more year on year in the early 2000’s and think it was going to continue?

Looking at the long term house price growth is the same as looking at a 100 year history of the Dow or any other market – huge short term spikes will always get dragged back to the long term trend.

I understand that in the middle of it you think you have to get on board, or you’ll get left behind. As always, this outcome will favour the patient and younger home owners will just have to grit their teeth and ride it out.

Where this will really hurt us as a country is that those high mortgages will prevent individuals starting their own businesses which would drive growth through innovation and increase employment – ie: all this home debt is keeping valuable capital away from more productive activities – home debt doesn’t drive GDP

should check out these latest reports from where i live…. scary

http://www.nisra.gov.uk/HousePriceIndex/hpi.html