In RP Data’s April update on the Australian housing market, it believes the market is stabilising on the back of interest rate cuts late last year. You can watch the full update here.

The update features a graph showing Monthly Transaction Volumes and gives the following commentary, “Our estimate of transaction volumes have been updated to January, however with the seasonally slowdown in market conditions over both January and December, it’s difficult to gauge how market demand has changed this year.”

While RD Data is correct in suggesting the months of December and January are historically slow due to Christmas, it is interesting to note January 2012 transaction volumes are down significantly from January 2011. It will be interesting to watch this space to see what volumes do in the coming months. RP data said leading up to December it was clear buyer activity had stabilised, and “we would expect the number of sales to increase on the back of lower interest rates.”

The Housing Industry Association (HIA) and RP Data yesterday jointly released its April update to the HIA-RP Data Residential Land Report. Over the year to December 2011, the number of residential land transactions have fallen 27 percent, and according to the report has hit a fresh low. HIA Chief Economist, Harley Dale was quoted in the report saying “The volume of residential land sales has been below the previous trough set during the GFC for five consecutive quarters now.”

“Over the five quarters to December last year land sales ran at a volume 40 per cent lower than their long term average.”

Tim Lawless added his belief that the vacant land market conditions are the weakest in more than decade.

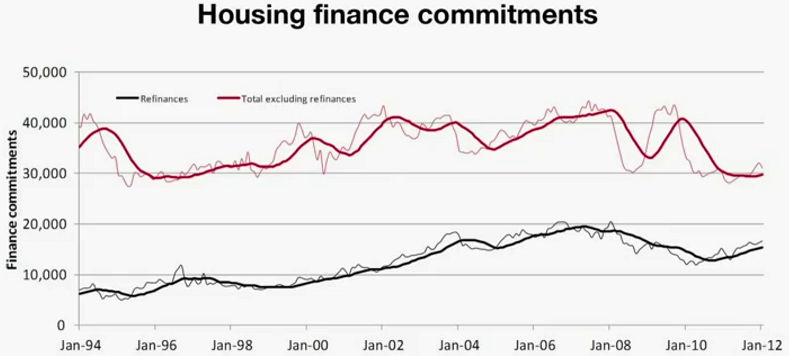

Switching back to the RP Data’s April update, Tim Lawless flicks up the following chart on Housing Finance Commitments, but I fail to hear any mention on it in his commentary.

It is the same graph we presented in our last post and shows mortgage approvals are at levels similar to the mid 1990’s. As the majority of buyers need to get a loan for their property purchases, the downwards trend correlates with transactions.

The expansion of credit contributed to stellar house price growth throughout much of the last decade and quickly ground to a halt during the GFC as consumers became more debt and risk adverse. The peak in January 2010 was due to Rudd’s First Home Buyers’ Boost, a short-term stimulus according to Treasury that was designed to encourage people who had already been saving for a home to bring forward their purchase and prevent the collapse of the housing market.

This federal stimulus ended in December 2009. Some state based stamp duty exemptions ended in December last year. House prices have been falling for over a year and it’s hard to see any driver outside of more stimulus or potentially a significant cut in lending rates that would contribute to a recovery. Near zero interest rates in many other countries have failed to halt the decline in house prices as the burden of high household debt scars potential borrowers.

Based on data from housing corrections in other countries, falling transaction volumes is the canary in a coal mine and leads a decline in prices.

» Australian Housing Market Update – April 2012 – RP Data, 12th April 2012.

» Vacant land market weakest in more than a decade – RP research blog, 20th April 2012.

It is a big drop in sales. With the NSW first home plus scheme finishing in the biggest property market in this country, I would have expected a small fall, but not this much. The first home plus scheme was only for first time buyers and not everyone.

How many times do you count the word stabilising in Lawless’s video?

At best ‘stabilising down trend’ I guess. January 2012 looks particularly horrible. Funny how the number of companies going into administration are at records 1500 per month around the same time. Looks like the shit is hitting the fan.

The game is up for the property speculators. Good luck selling into this weak market. Wealth destruction on a grand scale. Negative cashflow investors will be pissed off with no Capital Gains on the horizon.

But, volumes will increase again when the value of the asset is reflected. It would seem the level of private debt is what is holding up prices at present. Where have all the greater fools gone? Are they in?