The latest installment of the official House Price Index from the Australian Bureau of Statistics (ABS) was released today showing Australian house prices continued to fall in the December 2011 quarter. The weighted average of the eight capital cities fell 1.0 percent in December, ending a year where house prices fell in every quarter. For the year, 4.8 percent was wiped of the value of Australian homes.

Brisbane led the falls, slashing 6.7 percent from values. Adelaide, considered one of the more affordable capital cities racked up second place at 6.4 percent.

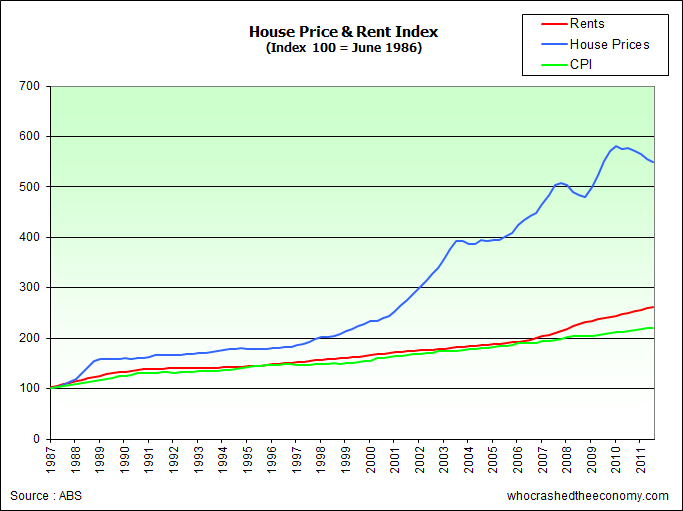

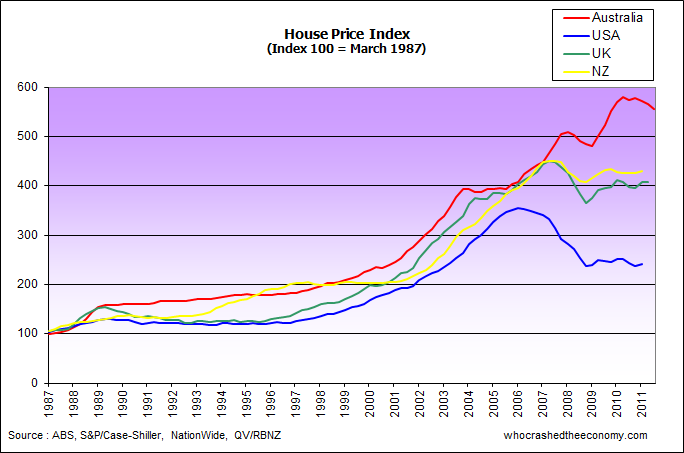

Assuming there is no further government interference in Australia’s housing market, this years falls is considered to be the start of many in a long period of painful deleveraging. The Economist Magazine reports Australia has one of the largest property bubbles in the world and is overvalued by 53 percent on a rent to price metric. It also believes Australia, Belgium, Canada and France have property markets that are more overvalued today than at the peak of the American housing bubble.

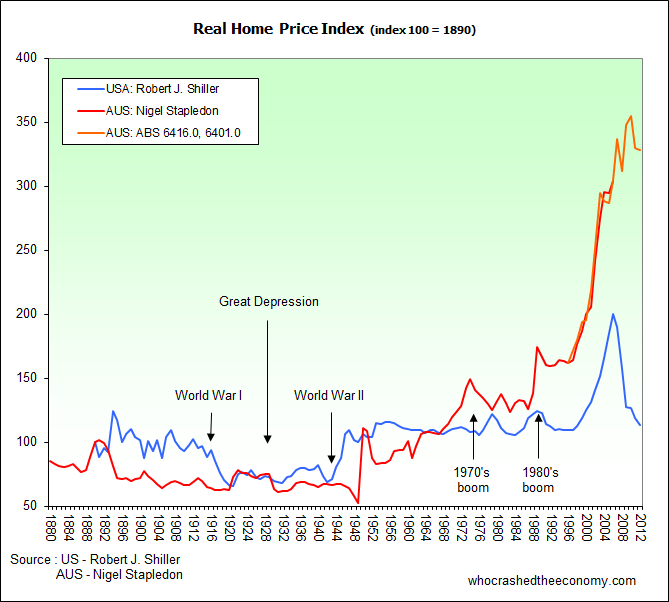

While housing lobby groups in the USA cried a chronic shortage of houses, and central bankers said not to worry – there is no bubble, thus there can’t be a crash, Yale Professor Robert Shiller was raising concern about America’s housing bubble. His real house price index is shown above in blue.

After 5 years and 5 months, the S&P/Case-Shiller Home Price Index for 10 composite cities show house prices have fallen 32.8%.

In Australia (red/orange line), some analysts believe house prices may have bottomed out. On a more serious note, Henry Blodget asked the same question to Robert Shiller about the United States property market while in Davos on the weekend.

Shiller answered, “When people phrase it that way, they say ‘we’ve reached the bottom.’ That suggests that we have the expectation of a major turning point right now. But I don’t see that. I don’t see any reason to think that prices are going to start heading up dramatically now. We do have some good news. Permits are up. Notably, the National Association of Homebuilders Housing Market Index is up and that’s a forward-looking index. But it’s not up very much. If you look at the rate of change it looks dramatic but it’s still at a low level. ”

Blodget suggested property prices in the United States was starting to look like ‘fair’ value relative to long term historic trends (i.e. graph above of real house prices), but Shiller argues what does ‘fair’ value actually mean in an economy like this. Shiller is questioning if America will overshoot. “Now the question is whether we’ll overshoot, which is a common thing that happens after bubble burst.”

As Shiller has looked at bubbles going back hundreds of years, Blodget naturally asked if Shiller has ever seen a bubble where there wasn’t a major overshoot. His reply “Well, the problem is we’ve never had, in the United States, a bubble like this, of this magnitude before. That’s the problem. That’s the fundamental problem of economics.”

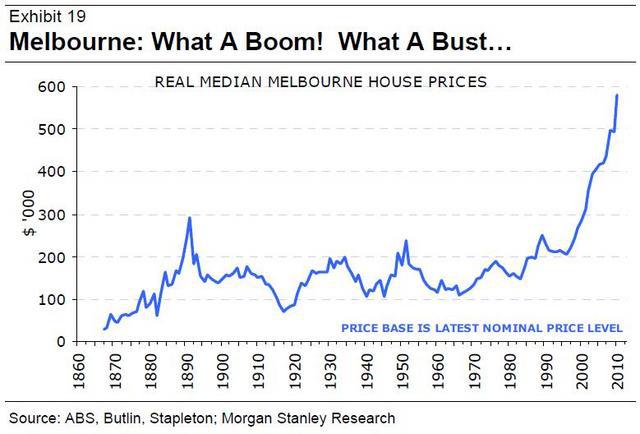

But this isn’t a problem limited to America. In Australia, Dr Nigel Stapledon from the University of NSW and former Westpac Bank Chief Economist has compiled real home prices for Australia. In a Morgan Stanley research paper written by Gerald Minack titled “Australian Strategy and Economics : Living in a bubble”, Minack provides the following graph of real median Melbourne house prices dating back further than our graph above.

As you can see, today’s prices are unprecedented in Australia, eclipsing the speculative land boom in Melbourne after the gold rush era (we were digging up stuff then, too) and leading to the Australian Banking Crisis in 1893.

» 6416.0 – House Price Indexes: Eight Capital Cities, Dec 2011 – Australian Bureau of Statistics, 1st February 2012.

» Can’t happen! – cause it’s never happened before! – Who Crashed The Economy, 14th July 2010.

» Housing Bottom? What Are They Thinking? – Business Insider, 29th January 2012.

A pretty sorry state of affairs indeed.

House prices are sacred stuff for the property investor (bull), so it will take another year of losses before people become despondent and start selling their crap investment properties.

Add some job losses, defaulting tennants and resulting vacancy rates, to add some new listings into the mix.

Plus the HIA want more fresh stimulus to bail out the over extended average builder that needs to pay for their shiny new Triton / powerboat.

The RBA cutting rates will have no effect to support house prices, only more principal will be repaid and les interest to the banks to feed off.

The game is up, the bubble has popped and many are left holding illiquid properties that have huge holding costs.

I vote the government and banks as tied winners who can be blamed for crashing the economy.

Yoda has spoken.

Agreed Yoda.

We should see broad based job loses this year. Cuts to the official cash rate can’t fix this. We are stuffed.

I think it’s hysterical and shameful that the Australian government and banking institutions didn’t see this coming.

Then again, I’ve watched the news in Australia and you would think the rest of the world didn’t exist. My in-laws in Queensland haven’t got the faintest clue what’s going on in Wall Street or the City of London – and they don’t even care.

WAKE UP AUSTRALIA! You are a stakeholder in this world like everyone else and no-one is immune.

Every time i talk to a real estate agent they keep saying the same thing……..we’ve finally hit the bottom.

Sorry , have to go now and bust some spruikers……………………………………………………………………..

Dunno I wouldn’t call it a crash yet. Just a slow deflation. You can’t have a crash when there is still ponzi stimulus (QLD) and me old mate Negative Gearing.

Insteed of the government staying out of it and letting the crash happen It might only last 10 years. With all this propping it up by the government and if it continues it be more like 30 years. A lost decade is here.

Average Bloke, not sure if your old mate Negative Gearing is working all that well in this climate. I sure would hate to be subsiding my tentant’s housing costs, making a loss each year and then have a capital loss when I sell my IP.

Einstein once famously quipped about the two infinite things: Universe and Human stupidity and how he was unsure of the former. Well, the latter is due to run out soon and the Ponzi scheme is up. Ahoy the ship of Greater Fools!

Roy Morgan unemployment just out – a 1.7 percent spike in December to 10.3%. Check out the scary graphs at

http://www.roymorgan.com/news/polls/2012/4742/

Hard to see this bubble reflate.

A bank needs to default before there is a crash. One of the banks must be struggling out there. Like northern rock in uk or lehmans in us. I don’t believe the crash will start until this happens.

fhb dreamdog, interesting suggestion. Their funding costs are very high but I’d reckon we’d see some other signs before it happens e.g. calling in loans? Any ideas whether some of the foreign banks did this prior to their demise?

Interesting that a number of people have said “the government” in their posts. It is both political parties that over time when in power have got us in this mess.

True Philip, but only governments can really legislate. The ‘government’ is a catch-all term for all of them. Maybe ‘Parliament’ would be a better term, but it doesn’t quite have the same ring to it.

Interestingly enough, your comment has proved that they all have the same policies and are all career politicians with the same agenda . The only way to get out of this mess is to stop voting for them and revolt. Global anarchy anyone?

Rupert, I heard this few times over the last three or so years about stop voting some are saying we would need about 25% not to vote for a change. If this happend what would they do? Clamp down on the people like in the Arab spring. They are addicted to power so I don’t think that they would just roll over and take it without a fight. THEY NEED TOTAL CONTROL!!

Let’s be honest. The governments majority of votes come from the baby boomers or anyone who actual has a property. They fuel their votes using whatever laws they can to keep themselves and their fellow baby boomers in power whilst our generation have nothing else to save for except the latest iPad. Which keeps retail plodding along. My friend got his New build valued by the bank who ensured they valued it higher than the equity he has for a 20% deposit so that he was forced into paying for mortgage insurance. That tells me that the banks know property is going to go down and they don’t care as long as the vendor forks out the insurance. My mom and dad gave up investing in stocks in the 80’s and put their money into property. I think it is terrible what is happening to our economy. A huge social generation gap is occurring. Not one of my friends are able to buy a house or put down a deposit due to high price of living and low wages. My partner is on $5/hr less than she was 10yrs ago ! Good luck to the boomers selling their 5bedroom houses and finding a place in a retirement home.

Voting is not compulsory in the UK and at the last election there was a 40% turnout. If just over half voted for the winners (the Conservative and Lib Dem coalition we have at the moment) that means that the government has a mandate and was elected by 20% of the electorate.

At least voting is compulsory in Australia – the trick is to pass legislation allowing for spoiled ballots and ‘none of the above’ votes to be counted, instead of disregarded as they are at present.

It’s crazy that our world leaders are elected by a minority, put in charge of the majority and then left to grease the palms of the tiniest minority of the super-rich in order to stay in power. It’s all nuts. It is time for a revolution. Whether it will come though is another matter. Most of us can’t be bothered. Enjoy Foxtel sheeple!

It all comes down to the China boom when we crash. The reason we didn’t tank in 09 was the 1 trillion USD in Chinese stimulus. Now China has put on the brakes, the vibrations are being felt in Australia, Canada, and Brazil. It’s only just beginning. If China lands hard, we will land harder. Want to know why Melbourne has done so well?? Who has their head offices in Melbourne? BHP and Rio, fat cat mining executives who have never set foot near a mine. And all the hangers on; lawyers, accountants etc… Go to a carpark in the city and see “Reserved Rio Tinto” for about four floors. Everyone gets a park, everyone gets a bonus, couple of Christmas parties for each division. What makes me sad is that everyone in power is making policy decisions on this lasting for another 20 years…….we probably have closer to 20 weeks.

@Rupert

I won’t say to much about your post as this is not the website for such a topic, just that compulsory voting can no more generate a credible result than a free vote if you want system. The real issue is that 80% of your population are basically stating there is no one standing for election in the UK they approve of and hence don’t care or bother to vote. Australia’s system is a big joke and is proven so by the cretins who now occupy all areas of parliament. Self interest & greed are the two qualities of all elected individuals.

Bob Katter announcing he would force down interest rates to around 2% by law only shows how much these people really understand the economic system and damage they can do to the nation. Only an quick sharp hard crash & correction to this mess can clear the air.

Modern democracy is designed to transfer decision making from the people to a small group of mostly narcistic politicians who make decisions in the best interests of those who can influence them (banks, large business). This is why people like you and I have no say in law and policy changes. Modern democracy is likened to going to a super market and finding that you can only choose between to trollys of groceries, both exactly the same except for differences in a handful of items like toilet paper, batteries and soap. All political parties are influenced by the same players so it makes no difference who is in government to them, this is why nothing changes. This is why I do not vote. I want to make decisions on policy issues, legislation changes etc. This is how the banks manipulate the housing market.