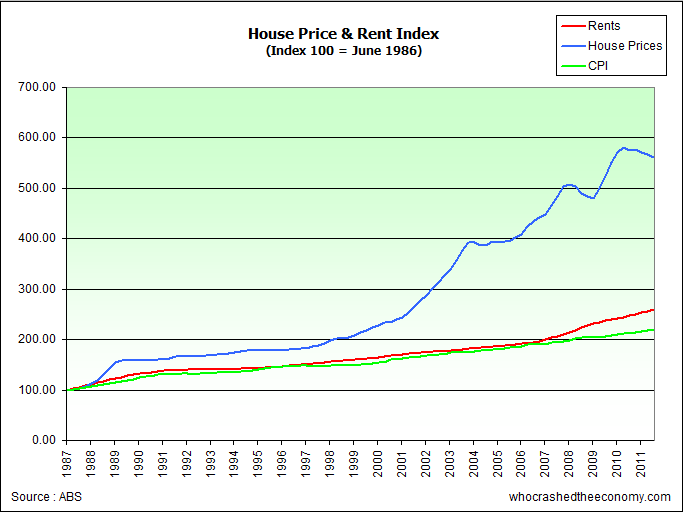

The September update to Australia’s official house price index was released today showing house prices continue to fall in Australia. The weighted average of the eight capital cities fell 1.2 percent in the last quarter according to the Australian Bureau of Statistics. The ABS also revised down the June quarter originally reported as falling 0.1 percent to a revised figure of 0.5 percent.

Meanwhile, the Reserve Bank of Australia has acknowledged the Australian Economy is no longer as robust and has cut interest rates by 0.25 basis points today. The official cash rate effective tomorrow is 4.5 percent.

While this is expected to bring some relief, figures show the Australian households are still paying close to record interest payments due to large increases in household debt over the past 30 years. Interest payments on dwellings as a percentage of household disposable income has surged since 2001, far exceeding levels in 1989 when the bank standard mortgage rate hit 17 percent.

» 6416.0 – House Price Indexes: Eight Capital Cities, Sep 2011 – The Australian Bureau of Statistics, 1st November 2011.

» Statement by Glenn Stevens, Governor: Monetary Policy Decision – The Reserve Bank of Australia, 1st November 2011.

It will be interesting to see how far down The Fed is prepared to go considering the current trend.

Support for the housing market is a major priority. What ever it takes I guess.

The RBA has confirmed yesterday the economy is stuffed. The QLD building boost isn’t working, lowering interest rates isn’t going to work, debt is killing the economy which is what the UN government (Australian) wants.

House prices are falling and there is nothing nobody can do about it except get out of the way.

There is more to life than getting chained to a 30 year mortgage sentence, and especially a negatively geared investment which has no hope of acheiving capital gains.

2012 will be a shocker, accelerating unemployment will put pressure on the UN government (Australian) to do more, and they will make it worse.

Wait for the $50.000 national building boost to come when the shit hits the fan.

GET OUT OF DEBT is the best advice for anyone!!!!!!

@lifeafterdebt, near-zero or even just about zero percent interest rates hasn’t helped anywhere else in the world. I think we’re on a downward slide from here on.

Since the GFC debt and credit issuance, and stimulus packages (go-broke-ulus packages more like) gave many Aussies the impression (well Government and Media-Finance Commentators did too) that, to quote from many people I know, “we missed the recession” (unrecoverable depression more like it), “we have China”, “we have a strong banking system with sound economic fundamentals”, etc, etc. When in reality, since the tide of credit and debt issuance is receding, well, look what is on the sea bed.

I think (emphasise think as I’m usually wrong), there is a downward trend in interest rates a head of us. It won’t help the debt ridden much. On a side note, just before the GFC Australia’s total debt (all Private + Public) was under 1.2 Trillion, it is now over 2.2 Trillion, and busness credit issuance is slowing and slowing.

But anyway, wanna buy a property anyone?

No, but there are many Property Investors who do.

> and especially a negatively geared investment which has no hope of acheiving capital gains.

The goal of negative gearing is to maximise your losses – so negative gearers are currently doing very well 🙂

^ exactly

If you think maximising losses each year with no gain at disposal is a good way to invest we are all doomed. You might as well not work for the first 10 months of the year. Good One Bud

Enjoy your investment? mortgage! and the negative cashflow each week that property demands!

And remember its different here…….

Remember with regard to negative gearing the tax benefit is only proportional to your marginal tax rate.

For example: $20 000 loss X marginal tax rate ( 38.5 % for those earning under 180K inc med levy)

=7700 tax benefit or out of pocket expense $12300 + rates/water/insurance/repairs/agent fees

There is a lot of misinformation about negative gearing around the place with people usually only finding out once they have purchased and consequently having to stump up the costs each month with the tax return spent before it comes in.

Average bloke, get it through your brain that negative gearing is ONLY worth doing while capital appreciation occurs.

Other wise, spend the money on a Ferrari and enjoy using an asset that looses money.

Matty get it through your brain.

Smart Investors use NG to ‘hold’ onto properties until the Capital Gains return and to partially offset their income tax.

It’s all about timing. If you bought a NG Investment Property before the boom you are sitting pretty – after the boom not so much.

Needless to say NG helps you hold onto the property longer than you otherwise would be able to because it’s middle-class welfare.

Also it allows prospective Propety Investors to borrow more from the bank which usually winds up allowing Property Investors to outbid hard working First Home Buyers who just want somewhere to live.

Matty dont waste your time AverageBloke has proven he is without a brain, and if he invests the way he thinks he will be with out any money as well.

Negative gearing only works for the investor in boom and bust cycles, therefore without a bust there cannot be a boom for negative gearing to have any impact on the housing market. In other words negative gearing is useless in a bust cycle, good at the low points and climb back, but bad near the summit and on the way down. Without the bust = ponzi scheme.

^ yep that’s right.