|

In a sign that the state of the economy is far worse than initially expected, the RBA has once again surprised the market with a 75 basis point cut to official interest rates. Market consensus today was for a cut of only 50 basis points.

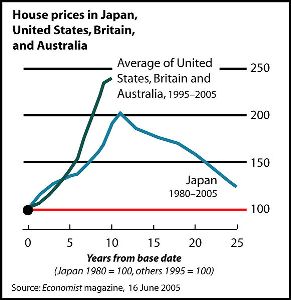

This follows the RBA’s surprise 100 basis cut last month. The official cash rate from tomorrow is now 5.25%. Full marks to Steve Keen who earlier predicted the 0.75% cut. Steve Keen’s view is official cash rates will fall to 2% by the end of 2009 and to 0% in 2010. Following Japan’s Housing Asset Bubble which peaked in 1990, the Bank of Japan cut rates to zero percent. While this sounds like great news, at the time it was still not enough to stimulate the economy as banks were too afraid to lend and just as many consumers were too afraid to borrow. Futures Markets suggest the cash rate would fall to 3.5% within a year. |

The Aussie is trading at $0.6651 at 5pm AEDT, down 2.5% from yesterday’s close and is likely to be further sold down overnight.

» Monetary Policy – RBA Media Release – 4th November 2008

» Australia slashes cash rate to 5.25% – Market Watch, 4th November 2008.

» UWS professor tips Reserve will cut rates to 5.25pc – The Australian, 4th November 2008.

» Australian dollar falls after big rate cut – AAP, 4th November 2008.