As Australia progressed through the stages of the housing bubble, all range of excuses were invented to support the unsustainable credit binge on property. We were told if we look back over 100 years, houses double every 7 years. Then there was a shortage of houses, high immigration and the fact that Australia is different – What happens in the rest of the world, can’t possibly happen here in Australia.

Now as mortgage approvals plunge and auction clearance rates fall like dominoes, attitudes are starting to change. Focus has moved from the fact that property only every goes up, to that it can’t crash – at worst it will plateau. We have entered the denial phase of the bubble clock. The objective of speculator’s cheer leaders is to limit the damage.

According to Smart Company, President of the Real Estate Institute of Australia, David Airey said that there has never been a major price collapse in residential property history, and even though the market may cool he is confident the market will sustain at least a flat growth rate through the rest of the year.

Looking back at history and at Australian house prices in real terms (corrected for inflation), we can see the more recent boom and busts of the 1970 and 1980’s. In real terms, house prices fell 9% between 1989 and 1992. The 70’s boom saw prices correct by 17% between 1974 and 1979. A 27% fall was the result of a bubble in 1950.

But the most interesting speculative bubble occurred in Australian in the late 1880’s. According to the data above prices fell 32% from 1891 to 1898.

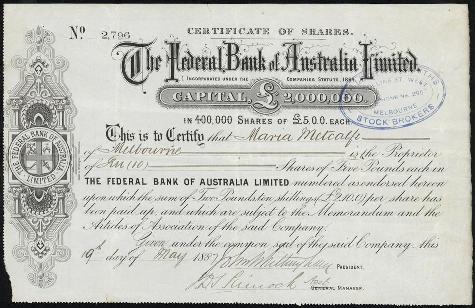

In 1880 there was a speculative land boom in Melbourne fuelled by wealth that had been created during earlier gold rushes. There was strong population growth, with the population of Greater Melbourne rising by more than 70 per cent over 10 years from 1881. The land speculation engulfed most members of society and was helped by large increases in lending. The Federal Bank was founded in 1882 by James Munro and the funds used to speculate on suburban real estate.

A certificate of shares in the Federal Bank of Australia, Ltd. Issued in Victoria in 1887. Source : Museum Victoria

The crash began in 1891 with land prices falling to around half of their perceived value at the peak of the boom. For example, average property prices peaked at around £950 in Brighton in 1888 and then fell to around £400 in 1893 and £300 in 1898. Property in Collins Street which was selling for £2000 a foot at the top of the bubble had an asking price of £600 and still was unable to attract buyers.

While the trigger is not 100% clear, its believed the crash started when banks started restricting their lending for land at the end of 1887. Another observation was the large amounts of land brought onto the market resulted in poor rental yields. Coupled with high levels of leverage, more and more speculators experienced cash flow issues. (I guess they didn’t have negative gearing then!)

Mortgage defaults and bank runs started a period in history known as the Australian Banking Crisis. The peak of the crisis was signalled by the Federal Bank failing on the 30th January 1893. Five months later, 11 commercial banks had suspended trading.

But while history is all well and good, what comes apparent when looking at historical data is that we have never had a speculative property bubble this big. It’s probably short sighted to say it can’t happen based on history. I’m sure if someone predicted 10 years ago that property prices would hit these current levels in 2010, someone would have said – it can’t happen, cause it’s never happened before!

» Backlog of property listings will put pressure on price growth, experts say – Smart Company, Tuesday 13th July 2010.

» Australian banking crisis of 1893 – Wikipedia.

» Three Australian Asset-price Bubbles – John Simon.

Interesting that 130 years on, Spectulatorville (Melbourne) is the epicenter of the bubble.

http://www.theage.com.au/victoria/rental-houses-pushing-boom-20100713-109eh.html

The Age says of the money lent for housing, almost 50% of it’s for investors. Melbourne is the only state where bank lending for housing increased in the 12 months to May.

Is that saying something?

Great post – financial history is probably the most valuable investment education available

It’s saying that Melbourne is full of the most fools??

1 in 10 taxpayers are negatively gearing? Surely the tax office will close this loophole (or at least restrict it) in the coming years also..

Great series of posts recently. Full marks.

The evidence is starting to appear all over the main stream. The tide has turned. The government has only, at most, 3 months to prop it up again before the fundamentals rule supreme.

Totally agree. The Government has a few months before this goes Bang!

The only intervention would be to relax international investor laws again or bring in a new First Home Buyers Grant or RBA drops interest rates !! Lets see what they do? But don’t think they will go as far as giving people $85k for a deposit!

Everyone was so focused on low supply of housing that they got totally blinded by decreasing demand.

The conflicting information in the media is a true sign that things are about to go downhill.

It is better that the market evens itself out as it is creating huge social issues and a class system.

Nah it still won’t happen people. Plateau, yes! Crash, no!

Why I hear you ask?

We still have high immigration to our already crowded capital cities, low unemployment and of course the ‘goose that laid the golden egg’ (for some ppl) our old friend Negative Gearing. These things haven’t changed therefore there will be no crash.

Im still on the fence here.

I agree houses are very overpriced and way above what they should be.

However, Im not sure they are going to go down anytime soon.

The thing is, without giant leaps in interest rates or a surge of unemployment, I don’t really see why there would be a drop in prices…

-Because why would people sell at a lower price than they purchased for unless they had to?

Agree, a crash is unlikely when unemployment is very low and economic forecasts are robust.

However, if the economy continues to strengthen, then inflation will rise and the RBA will be forced to raise interest rates.

Then highly leveraged investors or first home buyers could struggle to make their debt repayments, and ta-da you have the equivilent of America’s sub-prime mortgage crisis.

I love the blog, but I would find a log scale rather than a linear scale on the vertical axes of the various graphs much more informative for comparing different events. For example, 30% drop from 300 looks much bigger than a 30% drop from 100 on a linear scale but looks the same on a log scale. Critics could argue that using a linear scale artificially makes the problem look worse than it really is, blunting the force of your argument.

A crash will occur, when it will occur, only time will tell. It is more likely to occur as a result of either an international shock which will create a liquidity crisis which will affect our banks as 60% of their funding comes from overseas or it will come from the implementation of Basel III, which will reduce the profitability of mortgage lending on a risk adjusted basis, which will result in the banks diverting lending to other sectors.

I once again have to argue with those who continue to argue that a crash will not occur and prices will only plateau. The argument that immigration will prop up our property prices is a lie at best, the supply argument is no better.

Firstly the supply argument was used by the building lobby in California in 2006 and look how right they got that. So I have no faith in the people gathering the data to use in this argument as they work for the industry that has a vested interest.

Secondly the immigration argument also does not stack up. Kris Sayce of Morning Money put forward the following argument in May:

“But if you look at the Australian Immigration Update for 2008-2009, you’ll see the spruikers have left out a few key facts when they talk about immigrants flooding the country and creating a massive demand for housing.

For instance, look at the tables on page 8. You’ll notice that a whopping 56,477 people were added to the Australian population under the Family category.

But when you strip back the numbers, it doesn’t mean that there’s a requirement for 56,477 houses, and it doesn’t even mean there’s a need for 22,590 houses if you assume an average occupancy of 2.5 people per home.

For a start, 42,425 of those permanent additions were spouses or fianc

Adam,

You are spot on mate except I dont think we have reached the point yet that cutting rates will not stop a crash but if the price of housing keeps going up we will soon reach the point that people are so highly geared that cutting rates will no stop the crash. Debt will have its way at some point.

EL G: “Because why would people sell at a lower price than they purchased for unless they had to?”

Any number of reasons. You are assuming that people only buy a house to sell it again. They may be moving interstate. Anyone buying and selling back into the same/similar market would be happy to take a haircut as long as the house they buy is similarly discounted.

People inherit property and sell it. People get divorced. People retire and downgrade.

I will hazard a guess and say that MOST property sales are made up of people selling for these reasons. Very few sales would be people selling to rent so they could make a bit of cash.

I’d be more inclined to ask another question: if prices are not going to boom, why would anyone keep one as any investment? So many investors lose money on their investment just to get capital gains. With no capital gains, you’re losing money on an asset for no gain.

Timbo it’s called Negative Gearing and it’s awesome if you got into it say 8-9 yrs ago.

Why do people keep talking about micro economic variables?!?

People need to start doing themselves a financial favour and start reading into monetary economics.

Demand will only meet supply if those who are willing to buy can access the finance.

So when international liquidity crisis round two hits, Australian banks will be forced to up rates and cut back lending regardless of the RBA’s by then ZIRP, buyers will be unable to demand property because they can’t obtain finance, falling home prices will send the economy into recession as everyone realises there’s no “equity mate” for retirement and that they need to start saving more.

Then the penny will drop that money doesn’t go on trees, and and house is a house is a house, which is at best a store of wealth, not a means to wealth.

“house is a house is a house, which is at best a store of wealth, not a means to wealth.”

EXACTLY! Property should be used to store wealth, not to create it. Any wealth created through property is done purely by speculation.

Speculative bubbles ALWAYS end the same way.

If you want a close to guaranteed means to wealth, perhaps you need to look at shorting the Aussie dollar and it’s banks.

^ try telling that to the australian government. You guys are crazy if you think the governemnt won’t pull their economic levers to keep the bubble going.

AverageBloke Says: “Timbo it

Dude, calm down. Property Investors know that over time that Property always goes up. We are currently in a plateau at the moment. Negative Gearing helps in holding onto the property during flat times such as these, whilst waiting for the next boom which will be a few yrs away.

There is simply too much demand in this country for housing.

Average Bloke, what do you think the government will do to keep the bubble afloat?

We now have a caretaker government until the end of August, so that rules out anything before then. Banks now want a 20% deposit with demostrated savings. Both parties have said they want to return the budget to surplus, so a $75,000 – $100,000 first home buyers grant is probably out of the question. Even if they did, the banks no longer use grants as demostration of savings.

Everyone can carry on about low unemployment and immigration as a reason for high demand, but the simple fact is that the banks have to lend those people the money to make it a real demand.

I seriously do not know how many first time home buyers have $85k and which investors have this disposable cash of min20% to put down as a deposit.

The banks have changed their lending requirements following the GFC. The only house sales will be people with existing houses at the moment. They are the real demand.

So no new entries into the market and people who bought during 2009 trying to sell their homes as they cannot afford the repayments, together with the baby boomers down grading / selling their investments to release the equity should mean a high supply. Is that is not what is happening now?

‘Property Investors know that over time that Property always goes up’

I would imagine quite a few these ‘property investors’ who have recently jumped on the bandwagon recently would not be prepared for little or no growth and perhaps even the possibility of negative equity. This particular group have got into property with mindset of the above quote but have ignored the ‘over time’ part of the quote and expect instant gains and equity to leverage on the next purchase to expand their sure thing means of untold prosperity.

Yeah you guys say all this stuff, yet there ius no real evidence of it. Sure there are a few spots here and there but overall the market isnt dropping … just flat.

The immigration flood is REAL. The lack of afforable land in Capital Cities is REAL. Government Supported Negative Gearing is REAL.

AverageBloke Says: “Dude, calm down.”

Huh? Am I foaming at the mouth or something? I’m not over-leveraged in an asset that is looking shaky… I’m quite calm.

And then says” Property Investors know that over time that Property always goes up.

There is simply too much demand in this country for housing.”

Heh. Yes, I remember having this conversation with a work colleague in 2007 when I worked in the UK. He had 3 or 4 “investment” properties in Manchester, which were going to make him rich because “property always goes up over time” and there was “too much demand for price falls”. He lost them all in 2009.

Dude, Australia isn’t the same as the UK, USA or any other country we have a unique ‘perfect storm’ that makes our property market so strong.

The U.K doesnt have 1. As generous a Negative Gearing scheme if at all. 2. They don’t billions of dollars in minerals to sell to a resource hungry giant like China.

That’s just for starters.

AverageBloke: I’d not be betting on China coming to save us from our stupidity anytime soon – notice their 2nd largest Steelmakerwill be cutting capacity by 38% between now and 2012; you may be sure that the other steel producers will be thinking along the same lines. I note also that this “news” has resulted in a 25% drop in iron ore spot market values, so relying on the “Resources Boom” to provide sustenance will not happen anytime soon.

As to the UK being in a worse situation than Aus – may be in fact the opposite: The UK has an extremely strong infrastructure, and a truly World-Class R&D reputation, being home to some of the World’s best Universities. Innovation provides added value – that’s how China and Japan made their millions – not by digging it out of the ground (an almost Third-World economic strategy), but by innovating, designing, and manufacturing higher-value finished goods. Instead of real investment in productive, or at least strategic, infrastructure, Aus. has frittered the resources boom away on pushing up the prices of a non-productive, high maintenance cost consumer durable, and created an army of individuals tied to servicing this market and no other. This money cannot be “re-spent”, so any future infrastructure spending will either be financed from internal revenue (taxes) or through external sales (in a Market where GFC2 – The Double Dip” is being increasingly touted as a high probability by some VERY credible economic forecasters!).

– Then there’s the never talked about elephant in the room – UNDERemployment – OK “Employment” figures are still looking (fairly) rosy, but ask those in Retail if their hours have been cut – “in respoinse to low customer numbers” – and you’ll find things are a lot less hunky dory than the “headline Employment figures” would have you believe. Less hours = less money, but the same expenses (travel, etc). Less hours also mean less likelihood of finding extra work to “make up” the lost hours, and so the pressure on discretionary (i.e. Retail) spending increases – and so the cycle, once started, becomes self-sustaining. With forecast (unavoidable) increases in most infrastructure and services costs (water, electricity, gas), it doesn’t really need any “exogenous event” to start the slide, just a realisation that the tipping point has either been reached, or is about to be reached.

Looks like we are all in for some “Interesting Times” ahead!

We had the same credit binge as the US and UK. I’d say this played a greater role than the two factors you quoted above in the perfect storm scenario. With first time home buyers being asked for up to 20% deposit and therefore being priced out the market I can’t see how investors can keep picking up the slack in an environment of rising wholesale debt costs.

Negative gearing will help refund some costs and the end of FY, but can create cash flow issues throughout. It’ll be interesting to see how investors respond to a few flat years of growth and having to outlay vast sums of money along the way.

I’m constantly surprised by investors lack knowledge of how negative gearing actually works. I’ve directed a few to the following website and they have been quite shocked as it is not quite the ‘White Knight’ they thought it was. A few had already bought on IP’s on a false understanding.

http://www.propertyinvesting.com/strategies/negativegearing.html

Cheers

AverageBloke,

You are going to look real stupid when unemployment starts to go up!

We will all get a rude shock.

Well, the impossible appears to be happening, I remember reading not so long ago that TAS was running hot with rising realestate costs…… land costs on the rise like never before….. that was yesterday of course, the truth today is very different, particularly if you were an investor foolish enough to go with the hype. Stories coming out of TAS now are not so rosey, even the HIA has admitted so :

>”Land prices in Hobart have plummeted in the March quarter.

>

>The Housing Industry Association’s latest report shows median residential land values fell nearly 14 per cent to >$125,000 per block.

>

>Compared to the March quarter last year, the volume of land sales has dropped 40 per cent.

>

>Stuart Clues from the Housing Industry Association says while it represents an excellent opportunity for land buyers, >investors have lost significant capital value.”

Bet things will worsen when all those “investors” attempt an exit from TAS.

Roll that dice guys & best of luck.

and when will that happen? When China stops making everything in the entire world? Yeah that might happen in 100 yrs or so.

AverageBloke, Its going to happen soon because the people that live in China are getting richer buy the day and this will lead to you ending up the poor worker on cheap rates working your ass off to sell crap to them!

Now you are being silly.

You may think I am silly but I am pointing out that if we keep going into debt and China keeps lending us the money to buy the cheap crap they keep making for us, and incase you dont know it China is where a lot of the Western Worlds borrowed money is coming from, we will all end up with a lower standard of living than what the people of China will enjoy (good luck too them). We have to earn what we have instead of just runnnig up alot of big debts buying over valued houses form each other as we look for an easy way to make money. Trading house’s will not earn any money for our nation. The future generations of Australia will pay for our stupid addiction debt. Short term thinking is going to cost us big time in the long run, but then it seems most people in OZ have become too selfish to look out for the future generations.

Well long term you may find that China becomes prosperous.. and they start to rely on Africa and other poorer Asian countries (like Indonesia) to make cheap goods for them..

Guys,

I am Irish (who migrated to this beautiful country 4 years ago)

I have read that people don’t think that there will be a crash in the Australian Housing market

however I see parallels to Ireland before the now accepted ‘Irish Depression’.

During the Celtic Tiger

[1] We had high immigration from eastern europe (namely poland) and

there were many Kiwis, Aussie and Yanks that came to Irish shores looking for the wealth from the Celtic Tiger

[2] We had a Low unemployment rate (I think it was 4%)

[3] We had a fantastic highly skilled work force – which lead us to be the 2nd biggest exporter of software in the world.

[4] We had a housing bubble which was / is very similar to what is going on here in Australia.

[5] Taking two cities together – Dublin at its height is now what Melbourne is experiencing.

[6] The Irish People – namely the public were is denial that there was going to be a housing crash.

WHY – because people believe in greed – that is, that property will increase significantly in a few years.

Everybody wants to earn a quick buck in a short amount of time.

[7] The Irish keep going into debt and Germany kept lending us the money to buy the cheap stuff

[8] In Ireland during the Celtic Tiger the immigration flood was REAL.

The lack of afforable land in Capital Cities was REAL.

Government Supported proeprty developments was REAL.

[9] During the Celtic Tiger Irish economists and Government stated that no crash

would occur as Ireland had low unemployment

and economic forecasts were robust.

As a result:

The bubble burst – housing market prices have fallen 50-60%.

Unemployment has grown to 14% (mainly builders – tradies and property developers were sucked into the void)

Our talented youth have fled to overseas – namely to Australia.

So what happens next…..

Well all I can say is

“be afraid VERY afraid”

Saw that Channel 9 is bringing back that TV program “Hot Property”, why?

Could it be that those who have a vested interest in continuing the property frenzy realize that things are on slide now and they need to try and boost things back up again? With another interest rate rise just around the corner now they better be quick.

Just read James link to negative geared property. Interesting stuff. Thanks James.

As this can be the only thing that is still propping up property prices up it basically means that people are going to have to work longer and harder to make their ends meet. This is not sustainable and a few more interest rate increases will prove this.

I think RBA knows that these next interest rate increases will push the market over the edge. Remember we were warned by the RBA not too long ago that property investment is not necessarily a risk free path to prosperity. They also warned people to start saving and not take on too much debt.

Basically we have learnt absolutely nothing from the GFC and have not listened to the RBA. People have not changed their minds and taken on mountains of property debt. Hence, people can’t afford to save as they are ploughing all their money into their houses, their cars, their living expenses.

Was in Wollongong today. Street upon street of empty houses / properties for rent / sale. Where has the “demand” gone???

Think the newspapers, estate agents, property jouranlists & banks are brilliant at their “low supply” marketing strategy for buyers to all jump in like a bunch of sheep and get emotional at an auction and buy a 50% overvalued asset. Well done guys it worked! I suspect their will be a new campaign soon to help avoid this crash. Don’t be surprised to see a news headline in the next few weeks “Property to increase 50% over the next 5 years !!!!!”.

I will never be able to afford a 2 bedroom house as long as house prices remain as they are. At the age of 35 after significant years of saving and trying to start a family this is really worrying.

Hi Murray, just 2 points:

1. Did you have as generous a Negative Gearing scheme in Ireland as we do here in Australia?

2. As I’ve mentioned before China/India still has a demand for Mineral Resources, albeit a lower demand after the GFC but a demand nonetheless. Our country is basically a giant mining site now and this demand is propping up our economy and looks as though it will in the future. Did you take this into account whilst comparing the Irish Property Boom/Crash and the Australian Property Boom?

Negative Gearing is a wank if your house is not going up in value or starts falling in price as interest rates keep heading north. People always try to claim that Negative Gearing means that house values will never fall but smart investers know full well that as soon as the market stalls its time to sell because there is no point in holding onto a home thats keeps costing you money, remember you have to claim a loss on the house to get a tax advantage from neg gearing.

The worst time to gear is:

* when the economy is going well after several years of recovery,

* asset valuations are high, and

* the government is looking to raise interest rates to rein in growth and inflation!!!!

Get the picture!!!

So now is time to buy, before the next soul crushing boom?

Those smart investors are buying up the cheaper properties that have sat on the market for 3 months or more. These guys are keeping a floor under prices. The NG means they might suffer a bit of discomfort they might have to sell 1 property to keep the other 7 or 8 that they have. No downside being a Property Investor in this country.

Just give up, like I did 2bob. I could have been a Property Investor as well but I didn’t do it and I only have myself to blame for that. But I must admit the punishment doesn’t really fit the crime.

AverageBloke.

To answer your question

[1] Yes, we did – I think it was called ‘Section 42’ under Irish Taxation.

And it was the death of my wee Nation.

[2] Yes, I did take this into consider this. That is, the mining bloom.

There is parallels with Ireland – We had / have a large tech sector ready for exporting.

It was very successful, and lead Ireland to its inital boom years,

Just like the mining boom here – the economy started to overheat – increase prices in food, housing etc.

The common worker started to ask for wage increases (which is happening here )

so on and so forth (the spiral of insantity continued – just like in Australia)

So all in all, Looking at Australia.

It best to fasten your seat belt before take off!

@ AverageBloke: why do you think negative gearing will help people in Australia? Did you know In the USA, all interest expense charged on owner occupied dwellings (so not just investment properties) are tax deductable? Despite the attraction to property in the US, the housing market crash as we all well know.

Everyone talks about China and India. India uses such a small amount of resources as a percentage of total world consumption. They have massive growth atm, but from a very, very small base, so please do not put them in the same sentence as China. Moreover, if China continues to pump along, why does that mean house prices will continue to rise? If China continues to pay the same price for resources, how are we going to afford even more debt to fuel the rise in property prices? How can the average Australian afford more debt with higher interest rates as the rest of the economy picks up (the market is factoring 3-4 rises in the next 12 months)? Look at Japan, they have experienced house deflation with low unemployment for many years; low unemployment does not equal stable house prices.

Well I give up. But the house price just keep going up or are staying put. So what now?

Yes house prices may be increasing atm, but so what? I know it is difficult to sit on the side lines and watch all the property morons go into an increasingly amount of debt…I have a wife who reminds me of this everyday 😉 I don’t know when the housing crash will come, but they are unsustainable. Worst case scenario for those who don’t own a house is that house prices remain flat for many years (negative real growth), but I believe that housing will slowly begin to fall within months if they have not already started. Watch the CPI figures that come out today, my bet is that they will force the RBA’s hand to increase rates in August!

Looks like RBA are not going to raise interest rates this month. Trying to delay the inevitable. Hoping people are going to start spending again.

Check out this article from – sums it all up.

http://blogs.forbes.com/greatspeculations/2010/07/26/aussie-housing-bubble-gets-popped-with-chinese-credit-crash/

Dont expect the RBA to raise rates any time soon, the man in the street is starting to run out of money after taking on so much debt to buy over priced houses, this has sucked too much spending power out of the econ. This data is just starting to show up in the inflation fig’s for retail and if it keeps going the way i think then the RBA could be forced to cut by Xmass. The Banks may have to put the rates up independent of the RBA to cover borrowing costs from overseas. If this happens then even as the RBA cuts it will not stop OZ slowing so the end result will be unemployment going up and house prices falling, not a good outlook!

I’ve just heard on the news that house prices here in Melbourne are continuing to rise, looks like Australia is set to become the “PosterBoy” of all time for realestate bubbles. At least we will get a mention in the economic history books which will be nice, no point building up the big bust for nothing.

Picked this up off a diff blog, its a good quote to explain what happens when prices stall for too long!

I’d just like to add that property ‘investors’ are also in major peril in Australia. The majority are on average incomes and own only one property. Many have ‘interest only’ loans. These are usually for a period of 5 years – the plan being to either sell within that time frame or else ‘just’ roll the loan over in to a new one.

But if the capital gains disappear – this group is haemorrhaging money on their investment. If there is no capital gains, negative gearing means that you are losing (lots) of money. It doesn’t matter either if there is a reduction on capital gains tax of 50% if you don’t make any capital gain.

There is no plan B – rents are not sufficiently flexible to convert losses to gains. Once distressed sellers flood the market, prices drop again and the cycle continues.

As an immigrant, I will not be buying an Aus house until I can flog my negative equity house in Ireland. I expect this to take 10 years. I know other immigrants with exactly the same problem with their houses in UK, America and UAE.

The two biggest house buyers in Aus are

Aus Firsttime buyers – who can’t source 20% deposit.

Immigrants – who don’t have the money they used to have.

Add in lower immigration due to Aus Gov policies during GFC

Increased rates

and international investors pulling out …

its not difficult to see where this housing market is going.